Newmont Mining Corporation (NYSE:NEM) announced that it has retired $575 million of principal under its 1.625% convertible senior notes due Jul 15. The move is in line with the company’s strategy to deleverage its balance sheet.

According to Newmont, reducing debt will provide the company with financial flexibility to fund high margin projects. It will also enable the company to explore opportunities and ensure that it meets the commitment to return cash to shareholders.

Since 2013, the company has been streamlining its balance sheet and has lowered its net debt by almost 70%, while its gross debt reduced by roughly $2.1 billion. Newmont has also self-funded its nine growth projects and returned around $260 million to shareholders in the form of dividends.

Overall, Newmont has roughly $5.5 billion in cash and revolver capacity. The company plans to assess and optimize the use of free cash flow including returning capital to shareholders, investing in projects to improve margins and repay debt.

The company also announced that its next tranche of debt due is $626 million of 5.125% senior notes due on Oct 1, 2019.

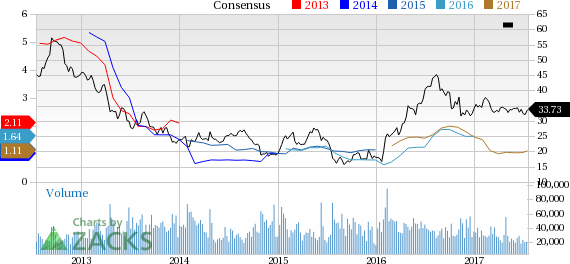

Newmont has outperformed the Zacks categorized Mining–Gold industry in the last three months. The company’s shares have moved up 0.6% over this period against a 7% decline witnessed by the industry.

Newmont remains focused on investing in projects, explorations and transactions which can improve the company’s resources, reserves and margin. Its effort to reduce debt will improve efficiency and cash flows. The company is also making a notable progress with its growth projects.

However, Newmont is exposed to a volatile gold price environment. Higher projected unit costs for 2017 and the company's falling gold reserve base remains a concern. An expected increase in unit costs in 2017 as reflected by the company’s guidance is also a concern.

Newmont currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space are The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Newmont Mining Corporation (NEM): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research