Newell Brand Inc.’s NWL FoodSaver brand is cheering customers with the launch of two new innovative vacuum sealers ahead of the holiday season. The products namely FoodSaver VS2100 Vacuum Sealer and the Multi-Use Handheld Vacuum Sealer will offer a hassle-free experience and help keep food fresh for a long time.

The brand claims that these products are life-savers especially for holiday seasons when families meet up for a meal together, by enabling marination of a meal in no time and storing leftovers for later use. It can also be a great holiday gift for someone interested in upgrading home cooking and food storage.

The VS2100 vacuum sealer comes with built-in roll storage, a cutter bar, Moist and Dry mode options and an airtight seal for different food types, which will keep food fresh up to five times longer than usual. It also prevents freezer burn and features a handheld adapter that supports FoodSaver Zipper Bags, Preserve & Marinate Containers and accessories along with an accessory hose.

The product is also compatible with FoodSaver’s newly launched Microwave Meal Prep bags. The product is available across the United States on FoodSaver.com, Amazon AMZN, Target TGT, Walmart (NYSE:WMT) WMT, etc.

The second product, a multi-use handheld sealer comes in a compact size and serves as an alternative to the FoodSaver device. It also features a Marinate Mode, which enhances flavor in food and is compatible with FoodSaver Zipper Bags, Preserve & Marinate Containers and accessories. This product will be available at Target and Costco (NASDAQ:COST).

What’s More?

Newell has been witnessing a recovery in the Writing Business with core sales growth in the unit in second-quarter 2021. Strength across all regions, school re-openings and the demand for key categories such as pens, presentation markers, permanent markers and highlighters remained upsides. Within the unit, the gel pen category and Boy, do I love that pen also act as key growth drivers.

This marked the second consecutive quarter of strong POS growth in the Writing business. Management remains optimistic about the back-to-school season and is on track for long-term growth on the back of robust merchandising plans.

With the acceleration of the vaccine programs, the resurgence in in-store consumption trends also bodes well. In second-quarter 2021, the company witnessed healthy consumption trends in the United States, as business trends started to normalize. Sales growth in brick-and-mortar stores outpaced digital sales in the reported quarter, as it lapped a period of store closures and lockdowns in the year-ago quarter.

Newell’s solid online show has been strong for some time now due to customers’ persistent shift to the online platform. As a result, e-commerce sales grew in the mid-single digits, accounting for roughly 20% of total sales in the second quarter. The company expects digital penetration to increase despite the potential quarterly fluctuations due to the lapping of the extravagant digital sales witnessed in 2020 following store closures.

Management raised the 2021 sales view and issued upbeat third-quarter guidance on its last reported quarter’s earnings call. The company anticipates sales of $10.1-$10.35 billion for 2021 compared with the earlier mentioned $9.9-$10.1 billion. Core sales growth is likely to be 7-10%, up from the previously stated 5-7%.

Normalized earnings per share are still forecast at $1.63-$1.73 for the year. For third-quarter 2021, net sales are envisioned at $2.7-$2.78 billion, with core sales ranging from flat to up 3% year over year. Normalized earnings are likely to be 46-50 cents a share.

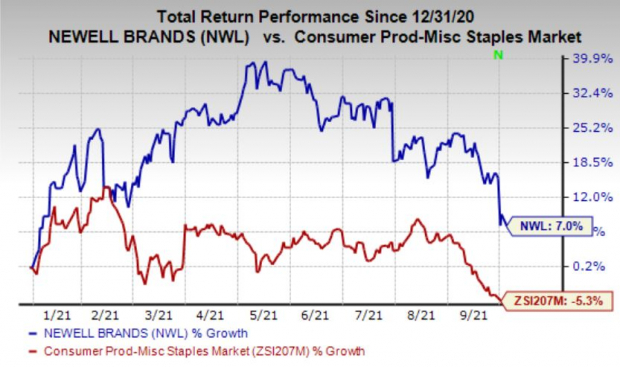

We note that shares of this Zacks Rank #3 (Hold) stock have gained 7% year to date against the industry’s decline of 5.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

However, elevated advertising and promotional expenses related to product launches and omnichannel investments are concerning. Newell also witnessed higher transportation and labor costs in the second quarter.

Management expects inflationary pressures to be at its peak in the third quarter. This is likely to hurt margins. The third-quarter normalized operating margin is forecast at 10.3-10.8%, suggesting a decline from the prior-year quarter’s reported figure of 14.9%.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (NASDAQ:AMZN): Free Stock Analysis Report

Newell Brands Inc. (NWL): Free Stock Analysis Report

Target Corporation (NYSE:TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research