Apart from strategically enhancing its financial results, Newell Brands Inc. (NYSE:NWL) remains keen on strengthening its portfolio by investing in its key segments, reducing activities with marginal profitability, and exiting certain businesses and markets.

Much in line with this strategy, the company concluded the previously announced sale of its Levolor and Kirsch brands to a market leader in window coverings, Hunter Douglas. These window covering brands form part of Newell’s Décor business, which in turn constitutes its Home Solutions segment.

While the Levolor and Kirsch brands will gain from Hunter Douglas’ solid focus on developing and investing in the window coverings space, this sale marks another step in Newell’s strategy of concentrating on areas with strong international growth potential.

In fact, the company has made many such investments in the past, in an attempt to solidify its portfolio. Evidently, the company recently merged with Jarden Corp., which gave rise to a $16 billion entity. Apart from this, Newell has acquired Elmer’s Products, Ignite Holdings LLC and bubba brands inc., bringing the Contigo, Avex and bubba brands under its ambit.

Also, to curtail its non-performing assets and simplify its portfolio structure, the company sold its Endicia online postage business to Stamps.com, and its medical cart business to Caspa Solutions. All these moves are likely to enhance Newell’s brand portfolio and help sharpen its focus on creating a faster growing, higher margin and more profitable company.

Coming back to the Levolor and Kirsch brands' sale, Newell generated nearly $270 million as gross proceeds from this divestiture, including accounts receivable. Management plans to utilize these proceeds toward debt repayments. This reflects the company’s focus on efficient capital allocation and commitment to achieve its targeted leverage ratio of 3.0 to 3.5 times, over a time span of the next two to three years.

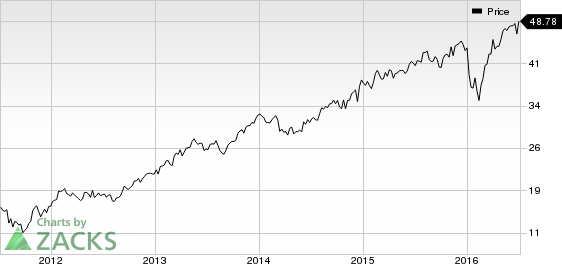

We believe that this Zacks Rank #2 (Buy) company is not very far from achieving the target, given its robust growth initiatives and healthy financial status.

Notably, Newell boasts a strong balance sheet that offers it the financial flexibility to enhance shareholder returns and drive future development through value-added investments aimed at accelerating growth and expanding margins. The company’s commitment toward boosting shareholder value is well evident from its robust dividend payment history and share repurchase programs.

Other Stocks to Consider

Other well-ranked stocks worth considering in the same industry include Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) , with a Zacks Rank #1 (Strong Buy), Blue Buffalo Pet Products, Inc. (NASDAQ:BUFF) and Energizer Holdings, Inc. (NYSE:ENR) , each with a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

NEWELL BRANDS (NWL): Free Stock Analysis Report

ENERGIZER HLDGS (ENR): Get Free Report

OLLIES BGN OUTL (OLLI): Free Stock Analysis Report

BLUE BUFFALO (BUFF): Free Stock Analysis Report

Original post

Zacks Investment Research