The latest retail sales report from New Zealand saw a modestly better print than expected. Quarterly retail sales rose 0.7% beating estimates of a 0.6% increase. But this was comparatively lower to the Q4 retail sales print of 1.7%. On an annualized basis, retail sales in New Zealand is up 3.3%. The NZD was muted to the report.

Euro Stays Muted Despite Weaker US Home Sales

The common currency was trading subdued on Tuesday amid lack of any clear fundamentals. The US existing home sales report saw a decline of 0.4% on the month to 5.19 million units in April. There were also a few Fed speakers lined up during the day but investors remained on the sidelines.

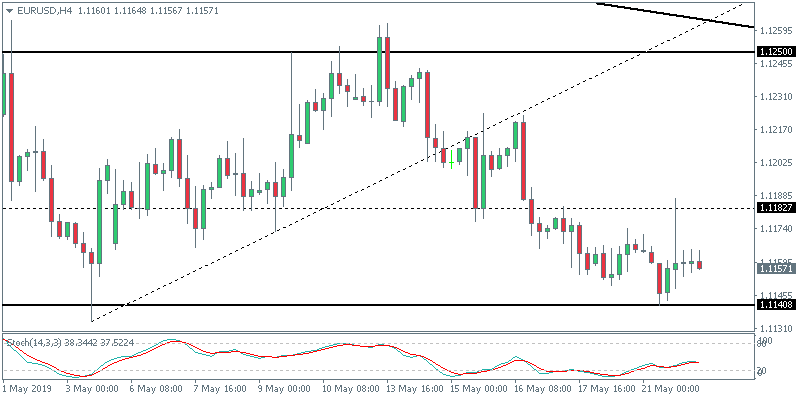

EUR/USD Slips to the Support Level

The currency pair extended declines to briefly test the support area near 1.1140 before pulling back modestly higher. The sideways range within 1.1182 and 1.1140 remains in place for now. The currency pair could remain within this range unless there is a strong breakout in either direction.

Sterling Volatility Rises on Brexit Drama

The British pound rose to the day’s high of 1.2811 before retreating to end near the lows of 1.2716. The volatility shot up as PM May promised the parliament on a vote to call for a second Brexit referendum if they support her deal. The opposition party, however, rejected the proposal. The monthly inflation report will be coming out later today.

GBP/USD Settles Back Near the Support

The currency pair closed the day back near the support area of 1.2716. The consolidation near this level has kept price action subdued so far. There are signs of a bullish divergence building up near the current support which keeps the upside bias intact. GBP/USD could rebound to 1.2895 followed by 1.2975. However, if price breaks below the current support, we could expect to see further declines.

Gold Waits for Fed Meeting Minutes

Gold prices briefly tested the support at 1270 before pulling back from the lows. Price extended gradual declines after breaking down from the 1285 handle. The Fed meeting minutes will be the main highlight of the day. This could potentially see either gold extending the declines or perhaps rebounding off the support level.

XAU/USD Likely to Trade Flat

Price action in the precious metal indicates that the sideways range could build up in the short term. The resistance and support levels of 1285 and 1270 will remain key for the moment. There is scope for gold prices to retest the 1285 level to establish resistance ahead of posting further declines. To the downside, if gold declines below 1270 on a daily basis, we could expect to see a continuation to the downside.