New Zealand dollar surges today after RBNZ hiked interest raise and affirmed the tightening bias. The central bank raised the OCR by the third time this year, by 25 bps to 3.25% as widely expected. It noted that "inflationary pressures are expected to increase" and emphasized that " it is important that inflation expectations remain contained and that interest rates return to a more neutral level". And it reiterated that "the speed and extent to which the OCR will need to rise will depend on future economic and financial data, and its implications for inflationary pressures." Meanwhile, inflation forecasts was revised lower to 1.5% by year end, comparing to prior projection of 1.9%. However, RBNZ governor Wheeler said in the press conference that there are a lot of uncertainty around the forecasts. He noted that RBNZ would prefer a "lower exchange rate and higher long-term interest rate". Overall, the statement suggested that RBNZ would not deviate from the policy path and some economists are seeing over 50% chance of another rate hike in July.

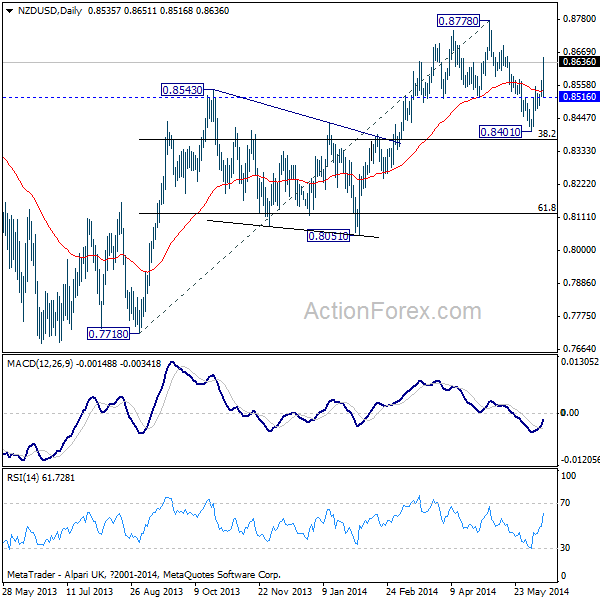

The NZD/USD jumps to as high as 0.8651 after the release. Intraday bias remains on the upside and the rise from 0.8401 would extend towards 0.8778. Based on current momentum, breach of 0.8778 could be seen. But it should noted again that the pair is staying in multi-year range below 0.8842 historical high (made in 2011). We'd still expect strong resistance below there to limit upside and bring near term reversal. Meanwhile, break of 0.8516 will turn bias back to the downside for 0.8401 support.

The Australian dollar dips sharply after disappointment in employment data. The job market contracted -4.8k in May versus expectation of 10k growth. But that was mainly due to reduction in part-time positions, which were down -27k. Full time positions added 22.2k jobs. Unemployment rate was unchanged at 5.8% as participation rate dropped from 64.7% to 64.6%. Overall, trend employment growth at is at 0.9% yoy which is still positive.

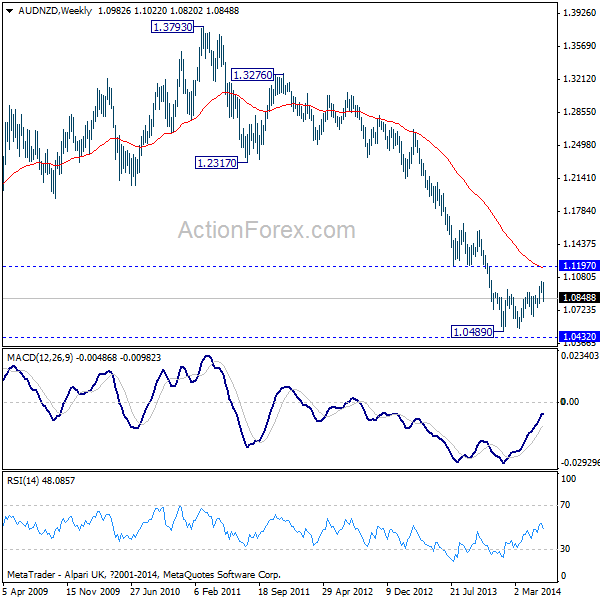

AUD/NZD drops sharply after the released. Overall, the cross is staying in the medium term consolidation pattern from 1.0489 low. With 1.1197 resistance intact, medium term outlook remains bearish and we'd anticipate a downside breakout later. The cross is expected to take out 2005 low of 1.0432 at a later stage.

Elsewhere, UK RICS house price balance improved to 57 in May, Japan machine orders dropped -9.1% mom in April. Main focus today is retail sales and jobless claims from US. Meanwhile, Germany WPI, Eurozone industrial production, ECB monthly bulletin and Canada new housing price index will be released later today.