Pushing back Chinese tariffs brings a bit of a “risk-on-Asia” feel to the market and this almost always means that the Japanese yen is going to get sold.

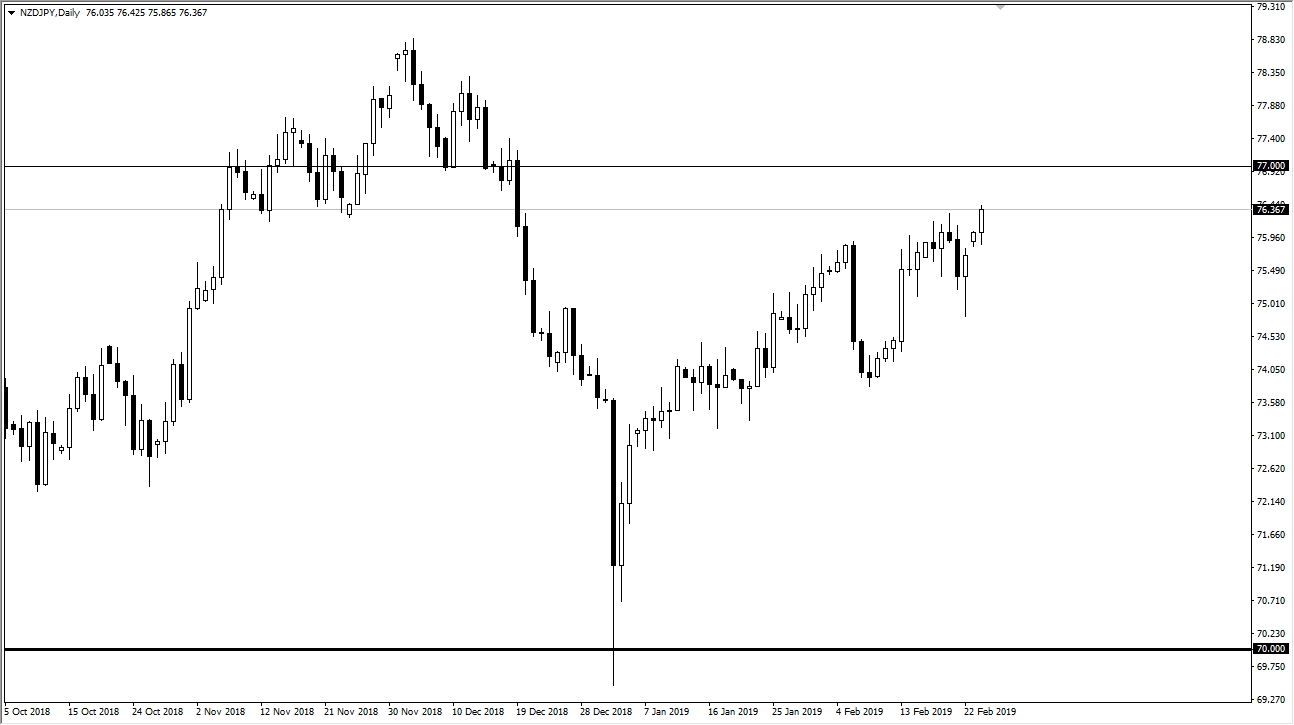

The New Zealand dollar has been enjoying a bit of strength due to strong economic figures as of late, and it now looks as if the Kiwi dollar will continue to drive towards the next major round figure, the ¥77 level. This is an area that has seen a lot of selling pressure, where I would expect any signs of exhaustion will get hammered and perhaps send this market down to lower levels again.

It is because of this that the market is probably going to rally a bit from here, before facing quite a bit of trouble. The next 24 hours should be positive for this market, but the upside might be somewhat limited. Beyond that, you should pay attention to the USD/JPY pair, as it has a significant amount of input when it comes to this market as well, because it is the proxy for Japanese yen strength. It is struggling to continue to go higher against the greenback, and with that in mind it’s going to make a lot of upward progress against the Yen difficult. The ¥111.50 level above is going to be difficult for the greenback to break, but if it does that will probably pull the New Zealand dollar right along with it. It is because of this that you need to pay attention to both markets, as the NZD/JPY pair is simply a triangulation between the NZD/USD pair, and the USD/JPY pair. Short term, it looks as if strength will continue.