The New Zealand dollar is headed for its seventh consecutive losing week. NZD/USD has declined 2.51% this week and the currency is trading at July 2020 lows. The currency plunged 1.01% on Thursday but has steadied on Friday and is trading at 0.6244.

New Zealand’s Manufacturing Index slowed to 51.2 in April, down from 53.8 in March. The reading didn’t have much impact on the New Zealand dollar, which remains under pressure after a sharp drop on Thursday. This marked the lowest level since August 2021, and the index has fallen close to the 50.0 level, which separates contraction from expansion. Manufacturers continue to point to labour shortages and supply chain disruptions as key problems for the sector, along with Covid-19.

The slowdown in manufacturing follows Inflation Expectations for Q2, which accelerated for an eighth straight month. The gain was admittedly small (3.29%, up from 3.27%), but the RBNZ has stated it would act to ensure that soaring CPI does not become embedded into inflation expectations. I expect the RBNZ to continue to raise rates aggressively until inflation expectations show signs of easing, which could take several months. The RBNZ next meets on May 25 and is widely expected to hike rates by 0.50%, which would bring the Official Cash Rate to 2.0%.

Fed’s Powell sticks to 0.50% stance

The Fed has signalled that it plans to deliver 50-bps increases in June and July, but the markets aren’t dismissing the possibility of a massive 0.75% hike, especially after US inflation remained higher than expected in April, at 8.3%. Hopes of an “inflation peak” were dashed, and the Fed’s aggressive stance appears justified in order to wrestle down red-hot inflation. Fed Chair Powell was overwhelmingly nominated for a second term on Thursday by the US Senate. Powell stuck to the 0.50% script yesterday, which has helped soothe market nerves about a 0.75% move.

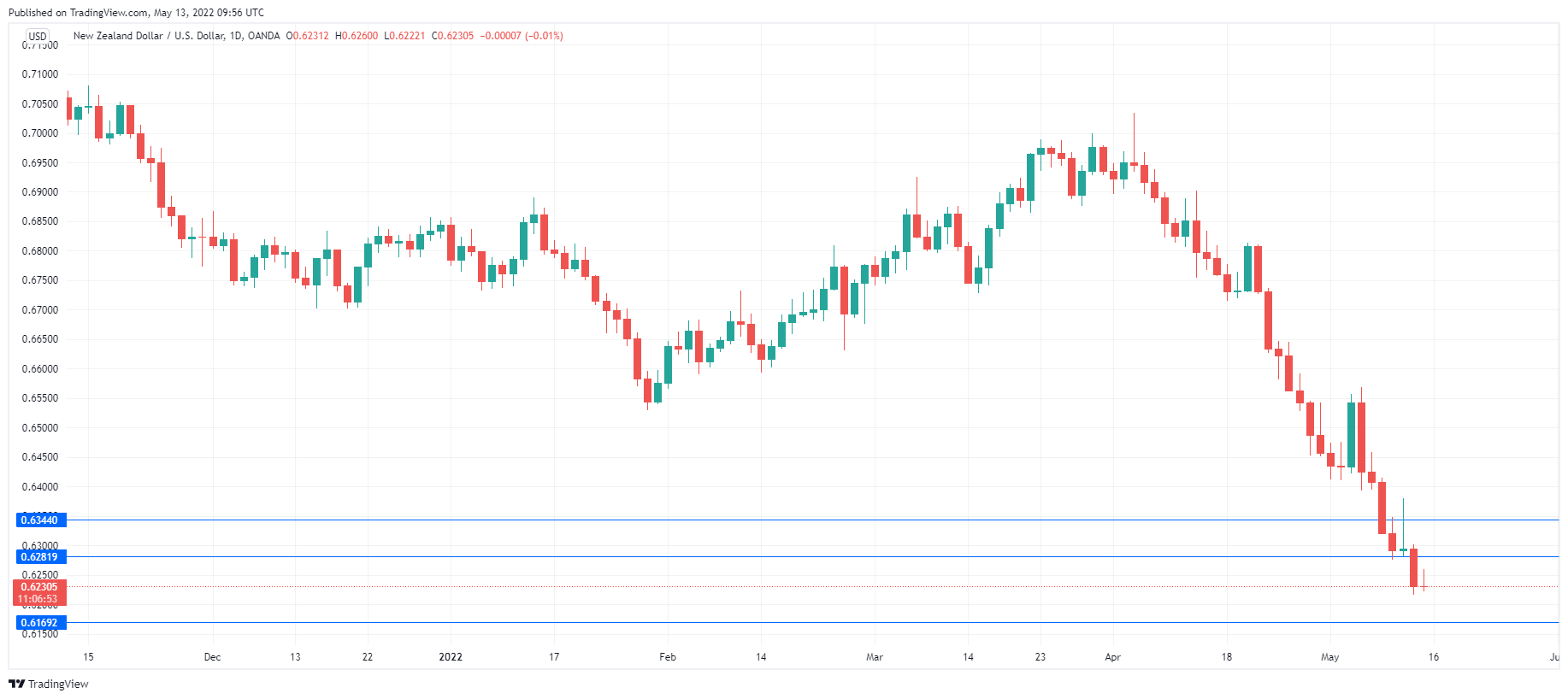

NZD/USD Technical

- NZD/USD continues to break below support levels as it loses ground. There is support at 0.6169 and 0.6066

- There is resistance at 0.6281 and 0.6344