The New Zealand dollar jumped after the Reserve Bank of New Zealand meeting but has pared most of these gains. In the European session, NZD/USD is almost unchanged at 0.6216.

RBNZ hikes by 50 basis points

The RBNZ delivered a 50 bp rate increase today, bringing the cash rate to 4.75%, its highest level since 2009. The move was widely expected, but a hawkish tone from the central bank gave the New Zealand dollar a brief boost. The rate statement noted that while there are signs that inflationary pressures are easing, CPI remains too high. The statement said that the cash rate “still needs to increase” in order to get inflation back to the Bank’s target of 1%-3%.

There is plenty of life left in the RBNZ’s rate-tightening cycle, as the central bank has forecast a peak rate of 5.5% later this year. The next rate meeting is in April, and as things stand, we can expect another 50-bp hike at that time. Inflation is running at a 7.2% clip and a 75-bp hike was a strong possibility at today’s meeting before Cyclone Gabrielle hit and caused damage in the billions of dollars. This is expected to dampen growth in the slow term, although the rebuild should boost inflation.

In the US, Manufacturing PMI was almost unchanged at 47.8, while Services PMI improved to 50.5, an 8-month high. The 50.0 level separates contraction from expansion, and both services and manufacturing have been in decline for months, as high inflation and rising interest rates have dampened activity in these sectors.

The Fed will release the minutes of its February meeting when it delivered a 25-basis point hike. The markets will be interested in the extent of support for a 50-bp hike at the meeting. The blowout employment report and a strong retail sales release have forced the markets to come closer to the Fed’s stance, and there is now talk of more rate hikes this year when only a few weeks ago the markets were confidently projecting rate cuts in late 2023.

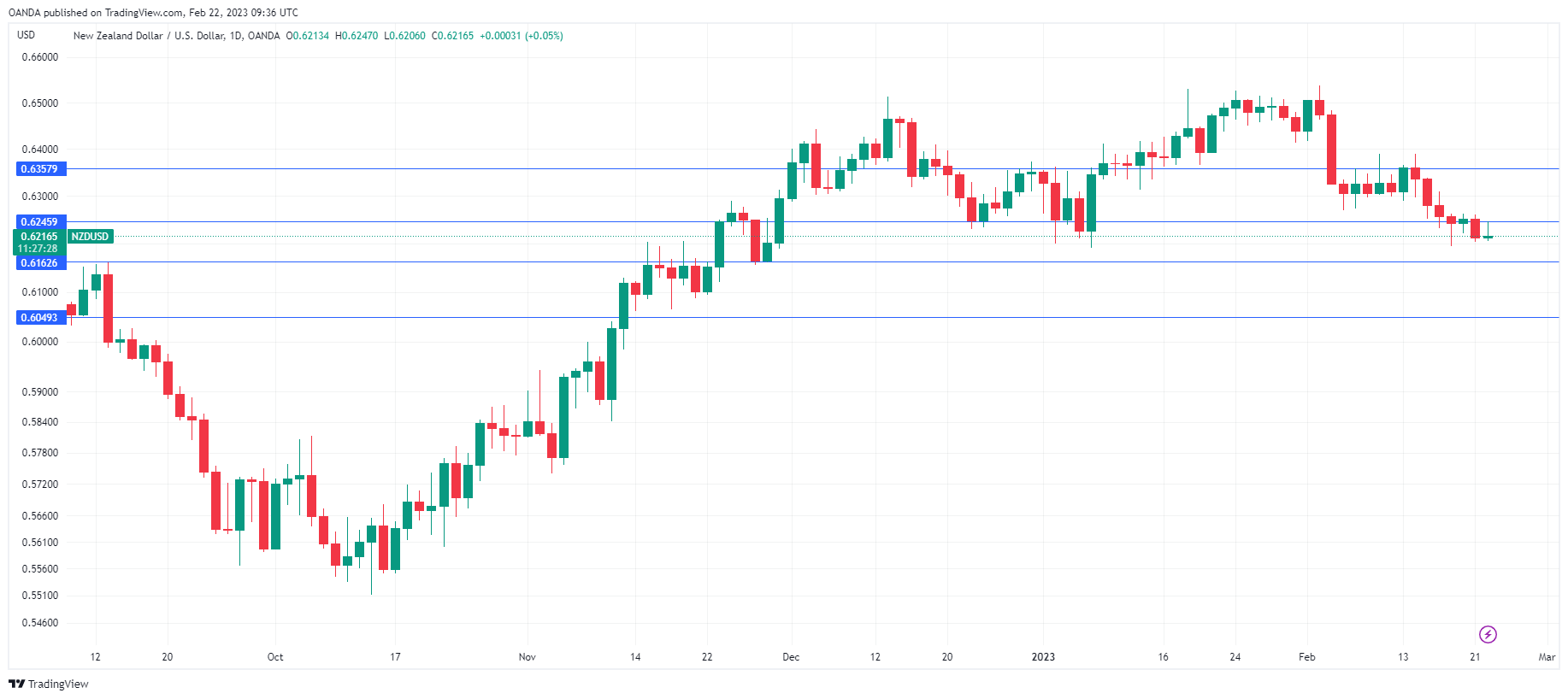

NZD/USD Technical

- There is resistance at 0.6245 and 0.6357

- 0.6162 and 0.6049 are providing support