New York Forex Report: Markets were rocked by sharp volatility over the European morning as reports emerged of terrorist attacks in the Belgian capital of Brussels. News of the attacks, which caused fatalities and casualties at an airport and metro station, saw European equities slide from session highs accompanied by a surge in safe-haven buying, which saw the Japanese yen spiking higher whilst the euro and sterling were sold sharply on the news. Volatility has since subsided with equity and currency markets stabilizing as we head into the US session.

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: EUR slipped 70 pips as news of the Belgian attacks emerged but rate has since stabilized. On the data front Eurozone Services and Composite PMIs both printed above expectations with Manufacturing meeting expectations.

Technical: Expect a further grind higher to test pivotal resistance at 1.1370 en route to the 1.1420 symmetry swing objective, while 1.1210 supports intraday. Only a close below 1.1050 eases immediate bullish pressure

Interbank Flows: Bids 1.1200 stops below. Offers 1.14 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

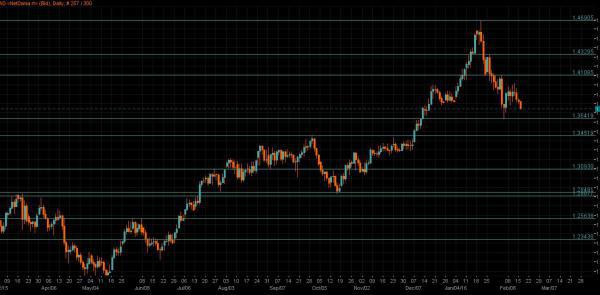

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Sterling was sharply sold over the European morning mapping the decline in European equities. Headline CPI was below expectations at 0.3% vs 0.4% YoY in February. Politics remains the key driver for GBP, with sterling under pressure as cracks appear in the Tory party. The Confederation of British Industry (CBI) said Brexit would cost the economy GBP100bn and about 1 million jobs, although the CBI trends series showed the expected uplift in activity. Fresh European terror attacks strengthen the likelihood of UK citizens voting for an EU exit in June as immigration tensions continue to dominate the debate.

Technical: Close over 1.43 eases immediate downside pressure bulls now target a retest of offers and stops above 1.4668, bulls have the ball while 1.43 supports downside corrections

Interbank Flows: Bids 1.43 stops below. Offers 1.4550 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY strengthened over the European morning on a surge of safe-haven buying in the wake of the European terror attacks. Moves were faded however as traders remain wary of possible BOJ intervention on continued JPY strength.

Technical: Retest of bids sub 111 attracts profit taking, a sustained breach here will leave the psychological 110 exposed, intraday resistance is sited at 112.20 with a close over 113 required to neutralize the immediate downside threat.

Interbank Flows: Bids 110 offers below. Offers 112.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/JPY was heavily sold over the European morning as JPY safe-haven buying weighed on price.

Technical: While 125 acts as support for the current advance expect a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggest false upside break and opens retest of 123.

Interbank Flows: Bids 125 stops below. Offers 127.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: Despite initial weakness as risk-sentiment was rocked in the wake of the Brussels attacks, AUD has regained a firm footing heading into the US open as demand continues to support upside.

Technical: Profit taking pull back should find fresh buyers at .7560/80 for the next upside leg to target .7729 next. Only a failure at.7400 support threatens near term bullish bias

Interbank Flows: Bids .7590 stops below. Offers .7700 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Weakness in oil over the European morning has seen USD/CAD continue to grind higher, though CAD upside is expected to materialize should oil manage to remain above $40. Market focus will also turn to Wednesday’s Canadian Federal Budget. An announcement of a massive growth-supportive fiscal stimulus could provide some upside potential for the Canadian dollar, alongside with a fade in the BoC’s dovish bias.

Technical: AB=CD ultimate downside objective at 1.2966 achieved, while 1.3160 contains profit taking bears target 1.2680 as the next downside objective. Only a close over 1.34 negates immediate bearish bias.

Interbank Flows: Bids 1.3000 stops below. Offers 1.3150 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral