New York Forex Report: Early European trading today was marked by a retreat in risk-appetite following poor data out of China overnight. February exports fell a huge 25.4% whilst Imports slumped by 13.8% with the overall Trade Balance printing well beneath expectations. This data comes just a week after Chinese Manufacturing was shown to have declined for a seventh consecutive month and underscores the deterioration in the world’s second-largest economy. Oil and equities are weaker heading into the New York open, whilst the safe-haven Japanese yen is in demand.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: 4Q EuroZone GDP printed above expectations at 1.6% vs 1.5% exp. Despite this positive data EUR remains under pressure ahead of Thursday’s ECB meeting.

Technical: Only a close over 1.1080/1.11 eases immediate downside pressure. Intraday support is sited at 1.0980/60 while this survives expect a further grind higher to test pivotal resistance at 1.11. Failure at 1.09 opens retest of bids towards 1,08

Interbank Flows: Bids 1.0950 stops below. Offers 1.11 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines

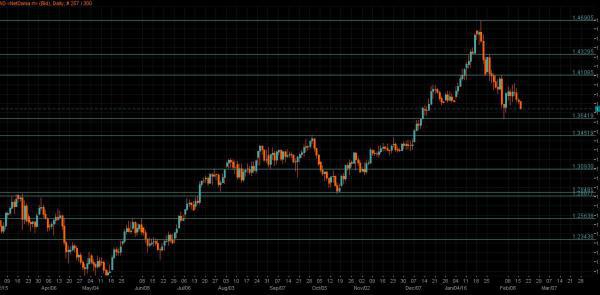

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: A retreat in risk sentiment is weighing on Sterling so far today. Speaking on the UK/EU Referendum BOE Governor Carney said that it is “early days” but there are signs that markets are preparing for a fall in GBP upon a Brexit.

Technical: While 1.4130 acts as intraday support expect a continued grind higher with the next corrective objective at 1.4424. A failure at 1.41 opens base support test at 1.4030

Interbank Flows: Bids 1.41 stops below. Offers 1.43 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Japanese Yen is stronger over early European trading today fuelled by a boost in safe-haven demand and also an upward revision to Japanese 4Q GDP.

Technical: Bulls will be looking for 112.50/113 to continues to support expect a further leg of corrective gains, to retest the broken neckline support at 115/116. Failure at 112.50 open 11 again.

Interbank Flows: Bids 113 offers below. Offers 114.50/70 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/JPY weakened over the European morning with JPY boosted by safe-haven demand and EUR weighed upon ahead of Thursday’s ECB meeting.

Technical: While 123.80 offers intraday support expect a continued grind higher to test pivotal 127. A failure at 123 refocuses bearish sights on the psychological 120 en route to a weekly downside objective at 118/117, only a close over 125.10 eases bearish bias.

Interbank Flows: Bids 123.50 stops below. Offers 125 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD/USD has fallen off recent highs as Chinese data weakness caps the recent surge in risk sentiment taking commodities lower.

Technical: While .7330 supports intraday expect further upside pressure targeting .7530 next. Only a failure at.7150 pivotal support threatens bullish bias.

Interbank Flows: Bids .7350 stops below. Offers .7500 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: A rebound lower in Oil over the European morning has allowed USD/CAD to correct higher. Weak China data has capped the recent surge which sees Crude stalling at the key $38 resistance level ahead of tomorrow’s BOC meeting.

Technical: While USD/CAD trades sub 1.3360 downside pressure remains the driver with bears focusing on a AB=CD ultimate downside objective at 1.2966, the next interim support level to watch is is 1.3176

Interbank Flows: Bids 1.3200 stops below. Offers 1.3460 stops above

Retail Sentiment: Bullish

Trading Take-away: Short