New York Forex Report: Markets managed to hold on to tentative gains over the European session as Crude Oil sustains its recovery, though still capped by the $27.90 area January lows. Heading into the US crossover traders await key US data: January Retail Sales expected to show a slight improvement and University of Michigan Confidence survey (FEB) expected to show an improvement also.

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR softened over the early European session driven by improved risk appetite. EZ GDP oriented in line with expectations and traders now await key US data later today.

Technical: While 1.1150/30 remains intact as support expect rotation through last weeks highs en route to test 1.14 symmetry objective. Below 1.1050 eases immediate upside pressure

Interbank Flows: Bids 1.12 stops below. Offers 1.1350 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

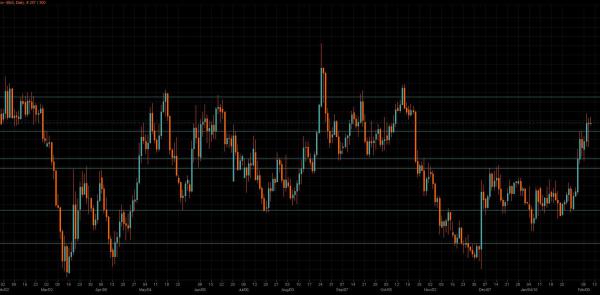

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: A recovery in risk appetite drove Sterling higher over the European morning as traders shrug off recent data weakness.

Technical: Failure at 1.4350 suggests false upside break and resets bearish trend to attack and break 1.40 as the primary downside objective. Over 1.46 re- establishes bullish bias and targets retest of last weeks highs en route to 1.4860

Interbank Flows: Bids 1.4450 stops below. Offers 1.46 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY remained firm over early European trading as Japanese official comment, threatening action if moves continue, stemmed the surging Yen.

Technical: USD/JPY confirms break of major neckline support again overnight. While 114.10/20 caps intraday upside reactions expects a grind lower to test psychological 110 as the next downside objective.

Interbank Flows: Bids 112 offers below. Offers 114 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Recent risk-averse market sentiment has seen EUR/JPY heavily under pressure but yesterday’s heavy JPY selling has stemmed the flow for now extended by a recovery in risk appetite across the European morning.

Technical: While 128.30 caps upside reactions expect a retest of year to date lows, ahead of a test of stops sub 126 only over 130.50 eases immediate downside pressure.

Interbank Flows: Bids 126 stops below. Offers 128.50 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Choppy flows continue in AUD with the neurotic reversals in risk-sentiment and weak USD stifling any directional moves. US data later today will be key driver for AUD/USD short term.

Technical: AUD tests and hold bids ahead of.6950 a failure of support here opens a retest of year to date lows. Only a close over .7150 eases immediate downside pressure..

Interbank Flows: Bids .6950 stops below. Offers .72 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: A recovery in Oil over the European morning has USD/CAD trading weaker as the European session commences. USD strength is keeping directional moves contained however and likely to remain that way until key US data later today.

Technical: Anticipated 1.40 retest from below under way, while this area contains the upside reaction potential for bearish bias to resume, however while 1.38 supports there remains potential fro a broader corrective phase with 1.4160 the next upside pivot.

Interbank Flows: Bids 1.3750 stops below. Offers 1.40 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.