New York Forex Report: Currency markets underwent a quiet session over the European morning today as engagement wanes ahead of the the US employment report tomorrow. We also have US ISM Non-Manufacturing later today, the key data on the session which is expected to decline slightly to 53 from 53.5. Risk sentiment remains supported so far today with Crude Oil and equities remain firm, boosting the commodity currencies which are leading the pack heading into the US crossover. Oil continues to strengthen despite yesterdays bigger-than-expected US crude Oil inventories data. Short squaring on OPEC optimism continues to support upside moves.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR was a little firmer over the European morning as the US Dollar weakened. Flows remain light ahead of key US data.

Technical: While prior support at 1.0950/70 acts as intra day resistance bears target prior range support at 1.08. Only a close over 1.1080 eases immediate downside pressure.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 stops above.

Retail Sentiment: Bullish

Trading Take-away: Sidelines

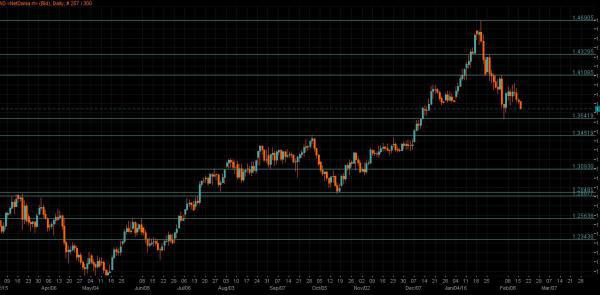

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Sterling was knocked off yesterday’s session highs by weaker-than-expected services PMI data which printed sharply beneath expectations and rounds off a week of poor data with manufacturing, construction & services PMIs all weaker -than-expected.

Technical: While 1.3980 acts as intraday support expect a continued grind higher to test pivotal 1.4235 only a close over 1.4250 eases immediate downside pressure.

Interbank Flows: Bids 1.3950 stops below. Offers 1.4150 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Yesterday’s higher-than-expected US ADP employemnt figure bolsters hopes for a positive non-farm figure tomorrow. JPY a little stronger over early Europe despite firm equities.

Technical: Bulls will be looking for 112.50 to continues to support expect a further leg of corrective gains, to retest the broken neckline support at 115/116. Failure at 112 open 11 again.

Interbank Flows: Bids 112.50 offers below. Offers 114.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Interbank reports suggest exporter supply still dominant in rallies (especially towards 124.50), but dips should also find support ahead of the ECB and BOJ policy decisions in the next couple of weeks. Medium term remains on the downside as the BOJ likely stays on hold in the next meeting.

Technical: While 123 offers intraday support expect a continued grind higher to test offers at 125. A failure at 123 refocuses bearish sights on the psychological 120 en route to a weekly downside objective at 118/117, only a close over 125.10 eases bearish bias.

Interbank Flows: Bids 122 stops below. Offers 125 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD continues to strengthen boosted by strong domestic economic data (4Q GDP beat), weaker US Dollar and stronger Oil.

Technical: Testing range resistance at .7300. While .7250 supports intraday expect further upside pressure targeting .7385 next. Only a failure at.7100 pivotal support threatens bullish bias.

Interbank Flows: Bids .7250 stops below. Offers .7350 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Canadian Dollar continues to be supported by further gains in Oil as short position squaring and OPEC deal optimism keep Oil moving higher.

Technical: While USDCAD trades sub 1.3510 downside pressure remains the driver with bears focusing on a AB=CD ultimate downside objective at 1.2966, the next interim support level to watch is is 1.3350.

Interbank Flows: Bids 1.3350 stops below. Offers 1.3550 stops above

Retail Sentiment: Bullish

Trading Take-away: Short