New York Forex Report: GBP trades with an offered tone weighed by concerns regarding the outcome of the EU summit, which will conclude in late US trade. The correlation between risk sentiment and the EUR seems to be fading with the EUR setting up for its sixth consecutive negative close. Traders attention is turning towards next weeks G20 summit where the wires will likely be alive with comments regarding China, Crude prices and US FED policy topics, which will likely do little to buoy to steady nervous markets.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR not reaping benefits of risk-off markets as in past, probably as positioning data indicates fewer shorts in the market. There is some resistance at 1.1120/30, which was a decent support previously. key focus for remainder of today in Europe will be the outcome of the EU Leaders’ Summit.

Technical: Initial test toward pivotal support at 1.1050/30 attract profit taking bounce. While 1.1220 caps upside sellers have the ball targeting stops sub 1.10. A breach of 1.1250 suggests consolidation and potential return to test offers over 1.13 ahead of 1.1376 highs.

Interbank Flows: Bids 1.1050 stops below. Offers 1.1250 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

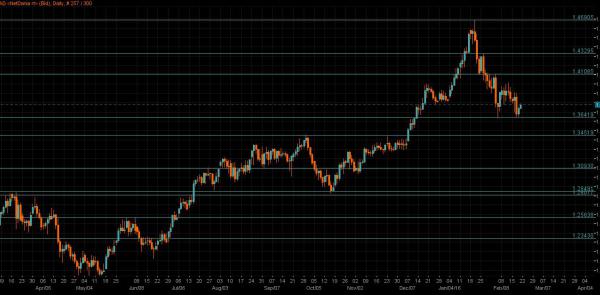

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The UK-EU talks continue in Brussels and it looks like we will have to wait until the weekend before we get something meaningful out of the summit. Irish times report BoE MPC Weale reported as saying would be surprised if BoE took as long to hike rates as market expected, markets may well turn out to be right though. UK retail sales rose 2.3% mm in Jan, much faster than even most optimistic forecast in Reuters poll where median was 0.8%.

Technical: Intraday failure at 1.43 suggest false upside break and bears back in control to target 1.42 bids next. A breach of 1.44 eases bearish bias

Interbank Flows: Bids 1.4230 stops below. Offers 1.44 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: According to Nikkei reporting, Japanese corporate earnings and profit growth seen slowing on stronger JPY. Finance Minster Aso commented that recent market moves were extremely rough and that rapid Forex moves are undesirable.

Technical: While 112.90/70 supports downside rotations expect a grind higher to retest the broken neckline resistance at 115.80/116 where fresh selling interest should emerge. Failure at 112.50 opens retest of 111 bids.

Interbank Flows: Bids 113.40 offers below. Offers 116 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Risk off sentiment and down beat domestic Japanese trade data continues to weigh on the cross. Traders appear reluctant to load up on risk ahead of the weekend and into the G20 summit next week.

Technical: While 126.50 caps upside reactions expect further fresh two and a half year lows for a move down to 124 as the next downside objective. A close over 128.20 would ease immediate downside pressure.

Interbank Flows: Bids 125 stops below. Offers 126.50 stops above.

Retail Sentiment: Bearish

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: According to a Dow Jones report Royal Bank of Australia member Edwards revives fears over AUD strength, suggesting .6500 was a more comfortable level for the AUD/USD. The combination of Edwards comments and the general risk off tone to markets leaves the Aussie trading in a contracting range ahead of the weekend

Technical: While AUD continues to trade above the pivotal .7100/.7070 expect a retest of offers above .7240 en-route to .7310. Another failure at .7050 would suggest further weakness to retest year to date lows at .6820’s

Interbank Flows: Bids .6950 stops below. Offers .7250 stops above.

Retail Sentiment: Bullish

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/CAD has followed the fortunes of crude for most of the week and won’t break from that connection anytime soon. Today however brings with it some activity and price data (retail sales and CPI) for the market to key off.

Technical: While USD/CAD trades sub 1.38 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3630 stops below. Offers 1.40 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral