New York Forex Report: In the wake of yesterday’s ECB meeting the euro traded broadly weaker over the European morning falling against the majority of its major trading counterparts. Leaving rates unchanged as expected, ECB President Draghi notes the banks view that rates would stay at present levels or lower for an extended period of time with the inflation environment expected to remain low and possibly turn negative again also. EUR was knocked lower as Draghi noted that the bank were willing to act as warranted to combat low inflation using all tools in their mandate, with market expectations growing for further easing to come, though Draghi did state that the ECB are not targeting euro exchange rate

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: ECB finished its rate decision meeting yesterday. As widely expected by the markets, ECB held the rates at rock bottom. The ECB chairman Draghi said the ECB’s expansionary monetary policy and keeping low borrowing cost have been working, also adding that interest rate would stay at record low for a long time. EUR was lower over the European morning as a raft of EZ PMI data sets each printed below expectations.

Technical: The second sub 1.13 close suggests a retest of bids at 1.1220. Only over 1.14 negates near term bearishness

Interbank Flows: Bids 1.1220 stops below. Offers 1.14 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines

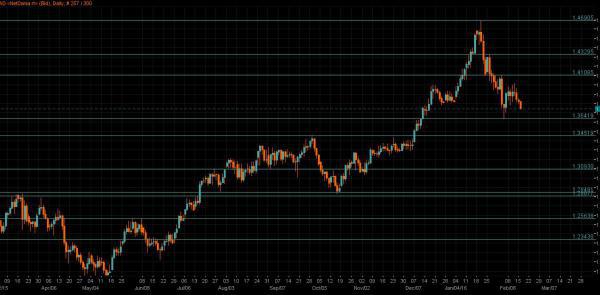

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: UK retail sales dropped 1.3% MoM in March, driven by the drop in sales of household goods and clothing and footwear. In Feb, sales fell 0.5% MoM. In a separate release, public sector debt rose £4.8 billion last month (Feb: £6.9 billion), overshooting official forecast for the latest fiscal year (£74 billion vs forecast: £72.2 billion). Net debt as a share of GDP rose 0.2ppt to 83.5%, raising the stakes for George Osborne of returning public finances to surplus by 2020. Slowing consumption and rising debt may put a brake on growth, aggravating downside risks from mounting Brexit concerns.

Technical: Initial test of offers over 1.4450 as expected stalls the advance. While 1.43 supports bulls target a broader symmetry swing objective at 1.4670. Failure at 1.43 opens a near term base test at 1.4240 next.

Interbank Flows: Bids 1.43 stops below. Offers 1.4450 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: BOJ Officials Said to Eye Possible Negative Rate on Loan Program, according to Bloomberg, Having adopted a negative interest rate on some excess reserves to penalize financial institutions for leaving money idle, the Bank of Japan may consider helping them lend by offering a negative rate on some loans, according to people familiar with talks at the BOJ. Any discussion could happen in conjunction with any decision to make a deeper cut to the current negative rate on reserves, said the people, who asked not to be named as the matter is private BOJ’s Stimulating Bank Lending Facility, which now offers loans at zero percent interest, would be the most likely vehicle for this option, they said

Technical: Trend resistance is sited at symmetry and structure confluence at 110.70 which should attract fresh selling for renewed weakness. A close over 1.11 opens 1.1380 as the next upside objective.

Interbank Flows: Bids 107.50 offers below. Offers 110.70 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Volatile trade in the cross as ECB and BoJ wire updates create shot term erratic moves. The cross is steady to stronger in the current trading session as traders await interest rate policy review by the BoJ next week

Technical: Bears now target weekly symmetry objective at 120.60, resistance is sited at 125. Only a close over 126.80 eases immediate downside pressure.

Interbank Flows: Bids 123.300 stops below. Offers 125 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD dropped from 11-month highs yesterday as surging prices for oil and iron ore started to retreat. The AUD/USD climbed to an 11-month peak of 0.7835 yesterday and gained more than 2 cents this week before it pulled back. Driving the gains was a rousing recovery in iron ore, Australia’s single biggest export earner which hit 10-month highs amid a jump in steel prices in China

Technical: While .7680 supports the advance bulls target .7880 as the next upside objective.

Interbank Flows: Bids .7600 stops below. Offers .7800 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Canadian dollar weakened over the European morning as oil prices fell back following the ending of the Kuwaiti oil strike. Traders await the release of the latest Canadian CPI data at 1330GMT1

Technical: While prior support at 1.2740/60 acts as resistance expect a test of bids at 1.2560 as the next downside objective

Interbank Flows: Bids 1.26 stops below. Offers 1.28 stops above

Retail Sentiment: Bullish

Trading Take-away: Short