New York Forex Report: A continuation of recent Oil strength over the European morning today has seen equities trading firmer alongside the US Dollar, which has also recovered so far today, having weakened in the wake of yesterday’s Dovish FOMC minutes release. Attention now turns to the ECB meeting minutes release at1230GMT though little is expected in the way of new information.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: A recovery in risk sentiment, alongside a firmer US Dollar, is weighing on EUR/USD. Easing expectations are growing ahead of the ECB meeting next week with some players expecting a move deeper into negative rates. ECB Jan minutes release is key data focus today.

Technical: While 1.1220/40 rejects intra-day upside reactions expect a test of pivotal support at 1.1050/30 as the next downside objective. A breach of 1.1260 opens 1.1350 offers.

Interbank Flows: Bids 1.11 stops below. Offers 1.1250 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

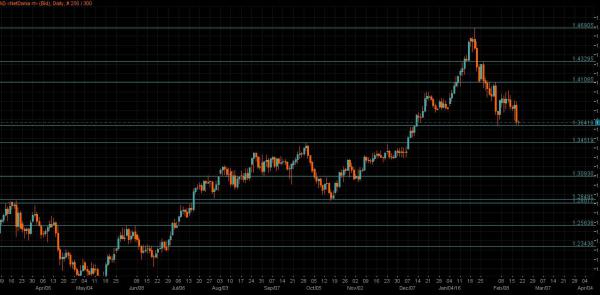

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP ripped higher over the European morning, benefiting from a recovery in risk appetite and heavy EUR/GBP selling.Outlook is still clouded by investor concerns regarding a possible “Brexit”, as a two-day summit commences today at which UK PM Cameron will attempt to secure better terms of the UK’s EU membership.

Technical: While 1.4410 caps the upside expect a retest of bids towards 1.4230 en route to 1.4149 lows as the next downside objective. A breach of 1.4450 eases immediate downside pressure.

Interbank Flows: Bids 1.4230 stops below. Offers 1.44 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY remains very much range-bound despite USD strength and JPY weakness over the European session. BOJ Chief Kuroda has called for co-ordinated action by central banks to stabilise global markets ahead of the G20 meeting later this month.

Technical: While 112.90/70 supports downside rotations expect a grind higher to retest the broken neckline resistance at 115.80/116 where fresh selling interest should emerge

Interbank Flows: Bids 113.40 offers below. Offers 116 stops above

Retail Sentiment: Bearish

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/JPY was sharply lower acorss the European morning as EUR weakness dominated the first half of the day. The OECD slashed EuroZone 2016 growth from 1.8% to 1.4%.

Technical: While 129 caps upside reactions expect a retest of year to date lows 125.77 a breach of this support opens a move down to 124 as the next downside objective. A close over 129.74 would ease immediate downside pressure and open a rotation higher yo test 132.30

Interbank Flows: Bids 126 stops below. Offers 128.50 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD/USD remains supoorted by a recovery in risk appetite despite weak Australin unemployment figures overnight. Australian unemployment rate climbed up by 0.2ppt to 6.0% in Jan, the highest level in four months. Last month, 7.9k employees lost their jobs compared to 0.8k in Dec adding to signs of labour market softness, but on a brighter note, labour force participation rate remained at 65.2%.

Technical: While AUD continues to trade above the pivotal .7100 expect a retest of offers above .7200 en-route to .7310. Another failure at .7100 would suggest further weakness to retest year to date lows at .6820’s

Interbank Flows: : Bids .6950 stops below. Offers .7250 stops above

Retail Sentiment: Bearish

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: The continued recovery in Oil prices has further supported the Canadian Dollar over early European trading today following an 8 percent surge overnight to reach $35 after Iran welcomed a cap on oil production in order to stabilize the market.

Technical: While USD/CAD trades sub 1.3830 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3650 stops below. Offers 1.40 stops above

Retail Sentiment: Bullish

Trading Take-away: Short