New York Forex Report: Month and Quarter End Flows

New York Forex Report: Markets have shifted back into a “risk-on” phase as US equities rebounded strongly yesterday, benefiting JPY crosses, while the broader USD remains under pressure. One of the most notable moves is the Chinese yuan making new highs versus the USD, now at levels not seen since 2015. Month- and quarter-end flow is likely to cause further volatility in a low liquidity Easter environment. It’s a very quiet day on the data front. In the US, the Conference Board’s consumer confidence report and the Richmond Fed survey will attract some attention. In general, consumer and business surveys continue to paint a solid picture of the US economy, even if some of ‘hard’ numbers point to the potential for some softening of Q1 GDP growth. The Fed’s Bostic will speak later today.

NORTH AMERICA The Chicago Fed national index shows that the overall US economic activities are expanding at a faster pace as it registered a positive reading of 0.88 in Feb-18 (Jan: 0.02 revised). 63 of the 85 indicators made positive contributions. The figure coincides with other pleasant readings released earlier in the month which indicates strength in industrial activities and a robust labor market. Meanwhile in a separate release, manufacturing outlook in Texas dampened as the Dallas Fed survey indicates that activities are likely to slow down in the manufacturing sector in Mar-18 due to a broad base decline. The survey recorded a softer than expected reading of 21.4 in Mar-18 (Feb: 37.2).

EUROPE ECB policymaker Jens Weidmann said market expectations for mid-2019 rate hike are "not completely unrealistic." At the same time, he stressed the goal of the ECB is to avoid adding volatility as it exits from quantitative easing by "communicating in a reliable and orderly way." Sterling has been on a tear for much of March. There have been no data releases, rather markets are taking their cue from the apparent progress made on Brexit last week, with hopes for a “soft” Brexit strengthened. Former PM Blair continues to push for a second referendum on the issue, which may be adding some support to the pound at the margin but this remains a low-risk probability at this point.

ASIA In Japan, producer prices in the services sector came in slightly below expectation to increase 0.6% YoY in Feb-18 (Jan: +0.7%). This added to signs of still benign inflation in the Japanese system that would reinforce the case for BOJ to stay pat for longer.

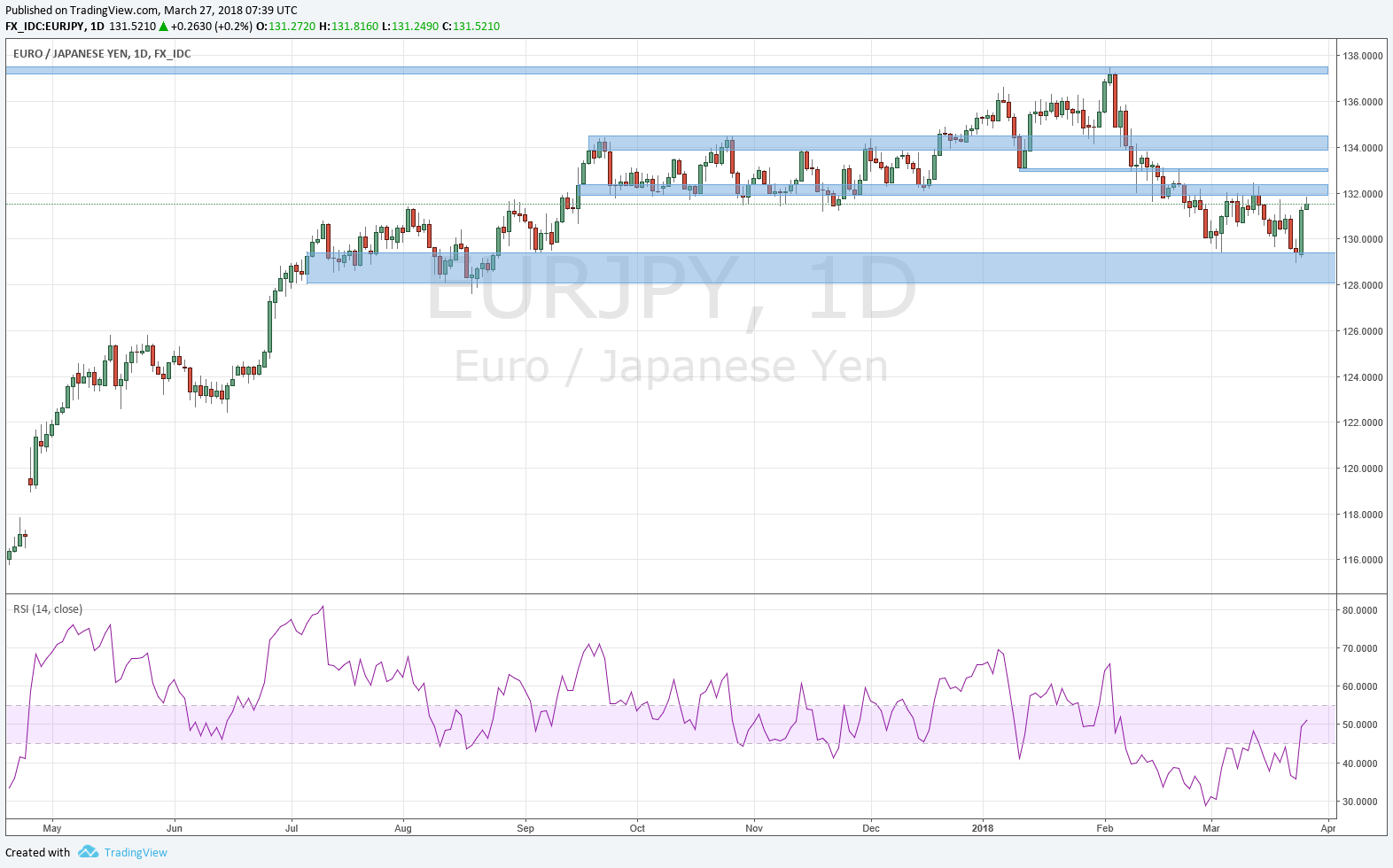

EUR/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Technical: 1-3 Day View – As 1.24 now acts as support expect a test of 1.2530, a close below 1.24 opens a retest of 1.2330 and return to range.

1-3 Week View – As 1.2130 now acts as support expect a test of 1.2635 as the next upside objective. Weekly close below 1.19 neutralises bullish objectives opening a test of 1.14.

Retail Sentiment: Bearish

Trading Take-away: Long

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Technical: 1-3 Day View – As 1.4160 supports 1.4340 is the next upside objective. Only a close below 1.40 concerns near term bullish bias

1-3 Week View – As 1.3650 supports 1.45 becomes the next upside objective, only a close back below 1.34 would jeopardise the bullish advance.

Retail Sentiment: Bearish

Trading Take-away: Long

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – As 108.44 acts as resistance 103.22 is the next downside objective, near term resistance is sited at 105.50

1-3 Week View – The close below 108 negates the broader bullish theme and opens the psychological 100 magnet as the next downside objective, only a close above 108.50 stabilises the pair, opening 112.50

Retail Sentiment: Bullish

Trading Take-away: Short

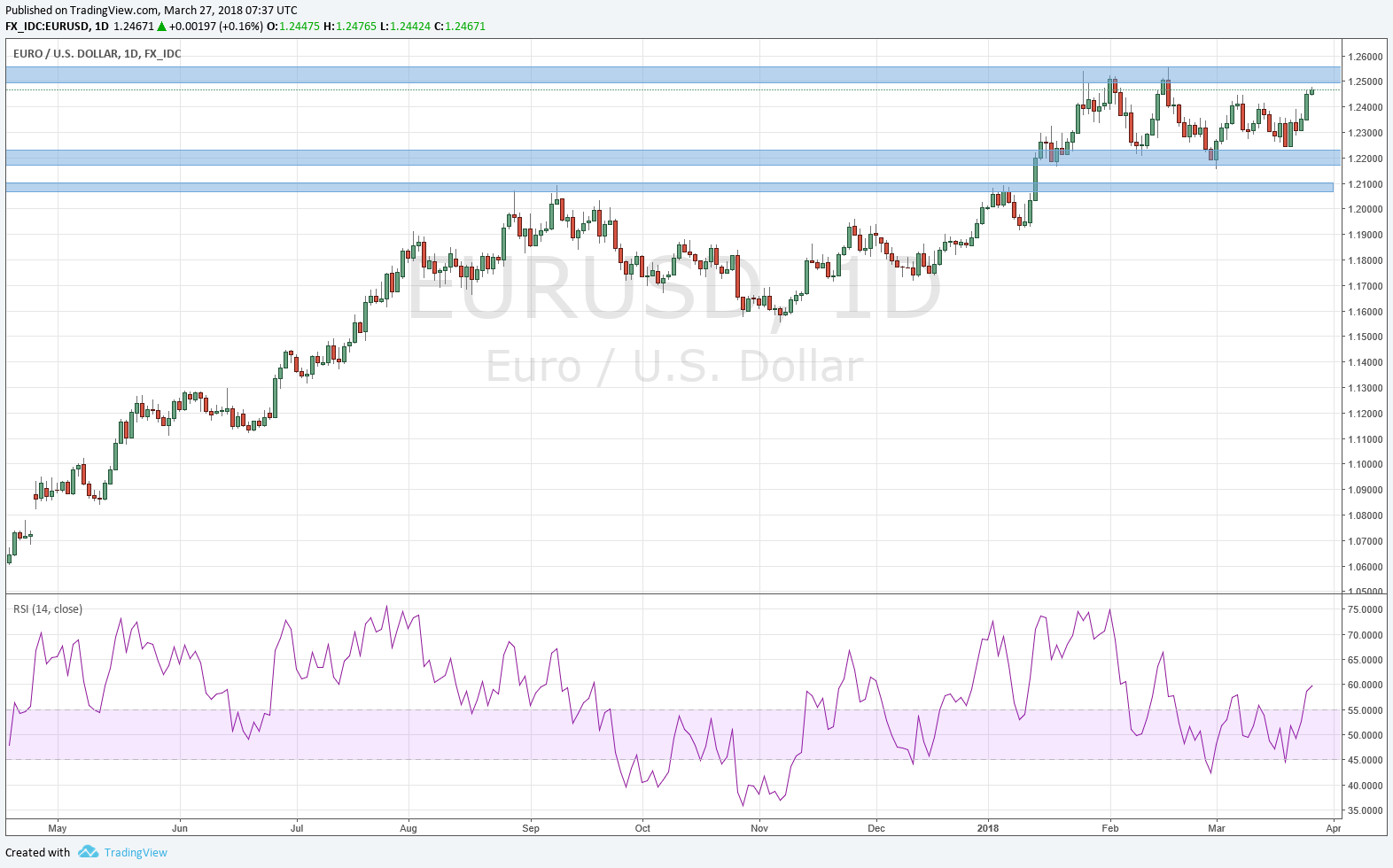

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – Breach of 131 sets a top to target 128.25 as 131 acts as resistance. A close over 132.30 stabilises the pair opening a retest of 135

1-3 Week View – The closing breach of 131 concerns the bullish consolidation bias opening a test of 128.50 while this area supports there is a window to retest and breach cycle highs above 137

Retail Sentiment: Bullish

Trading Take-away: Short