New York Forex Report: Markets remain in a holding pattern broadly, awaiting fundamental developments that will drive a stronger sense of direction for traders.

The USD is again narrowly mixed against its G10 peers. The JPY remains well-supported amid safe-haven demand related to trade war concerns but there is also a sense that perceptions of JPY risks are shifting bullishly amid rising pressure on PM Shinzo Abe. The CHF is flat, with the SNB leaving policy unchanged (as expected) while the NZD and AUD are relative under performers on the session.

Developed market bonds are narrowly mixed. US data reports today include the NY and Philly Fed surveys, import prices, weekly claims and the NAHB housing market index; import prices may tick a little higher but other data – the regional surveys and housing, especially – risk perhaps looking flat or disappointing somewhat relative to expectations. US growth momentum for Q1 appears to be sliding after a robust start. The Atlanta Fed’s GDP tracking data reflects sub-2% growth as of yesterday, down significantly from the 5.5% clip registered at the end of Jan. Traders are being confronted with political risks on multiple fronts – the US/Russia investigation, the UK’s stand-off with Russia and Brexit negotiations, the Italian election, Japan’s political scandal – which may dampen trader appetite for risk-taking for a little longer.

NORTH AMERICA

Unexpected 0.1% MoM decline in retail sales in February (Jan: -0.1% revised), dragged by a broad based decline in most sectors including auto and gasoline raises concerns that US consumers are turning more cautious with their spending. Retail sales have been declining in the last three months. Producer prices eased to 0.2% MoM in Feb-18 (Jan: +0.4%), which brings PPI growth to 2.8% YoY (Jan: +2.7%) matching expectations. This is consistent with a tepid wage growth and headline inflation in Feb-18, signifying that inflation remained contained without major acceleration as worried by investors previously. Mortgage applications sustained a 0.9% WoW increase in the week ended 9-Mar, compared to the 0.3% gain in the preceding week.

EUROPE

Eurozone industrial production fell 1.0% MoM in January (Dec: +0.4%), the biggest fall in more than a year. Markets have been expecting a milder drop of -0.5%. Energy production dwindled by 6.6% MoM whereas both durable consumer goods and intermediate goods abated as well. Annual production growth was also lower at 2.7% YoY (Dec: +5.3%).

ASIA

China retail sales disappointed but industrial production and fixed asset investment outperformed. February data shows that the Chinese economy remained resilient although it is worth noting that the figures are on the upside due to seasonal distortion as Lunar New Year was celebrated week long in Feb-18. Overall the economy is still expected to moderate for the remaining of the year

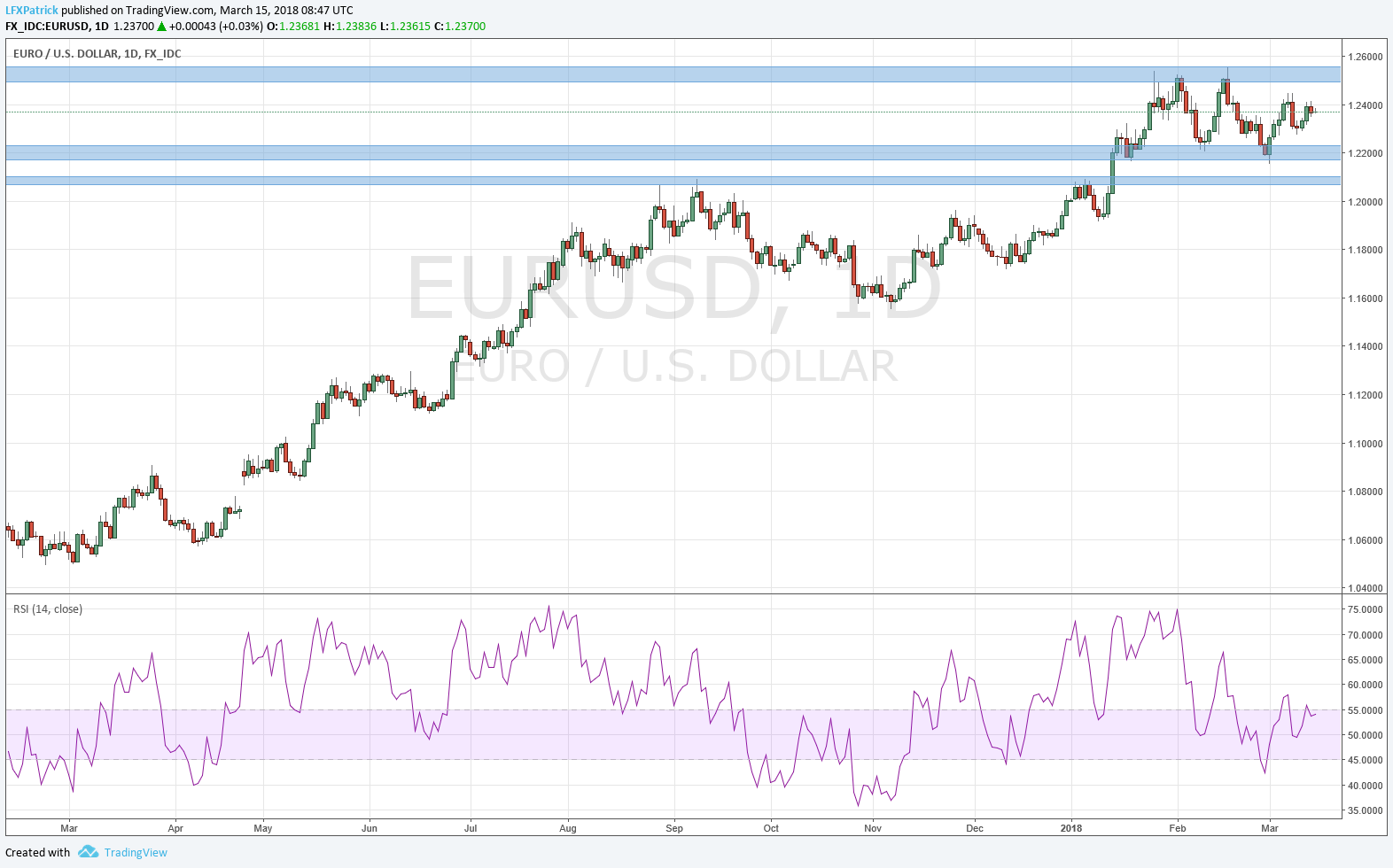

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Technical: 1-3 Day View – Offers ahead of 1.24 contain for now, a close above here opens 1.2630 again, range is contracting a close below 1.23 opens 1.2140.

1-3 Week View – As 1.2130 now acts as support expect a test of 1.2635 as the next upside objective. Weekly close below 1.19 neutralises bullish objectives opening a test of 1.14.

Retail Sentiment: Neutral

Trading Take-away: Neutral

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Technical: 1-3 Day View – The daily close over 1.3925 opens 1.4093, however a close today below 1.3920 suggests a false break and another retest of 1.37 bids

1-3 Week View – As 1.3650 supports 1.45 becomes the next upside objective, only a close back below 1.34 would jeopardise the bullish advance.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – As 108.44 acts as resistance 103.22 is the next downside objective, return to trend confirmed on a daily close below 106.50, near term resistance is sited at 107, with near term support sited at 106.04

1-3 Week View – The close below 108 negates the broader bullish theme and opens the psychological 100 magnet as the next downside objective, only a close above 108.50 stabilises the pair, opening 112.50

Retail Sentiment: Bullish

Trading Take-away: Short

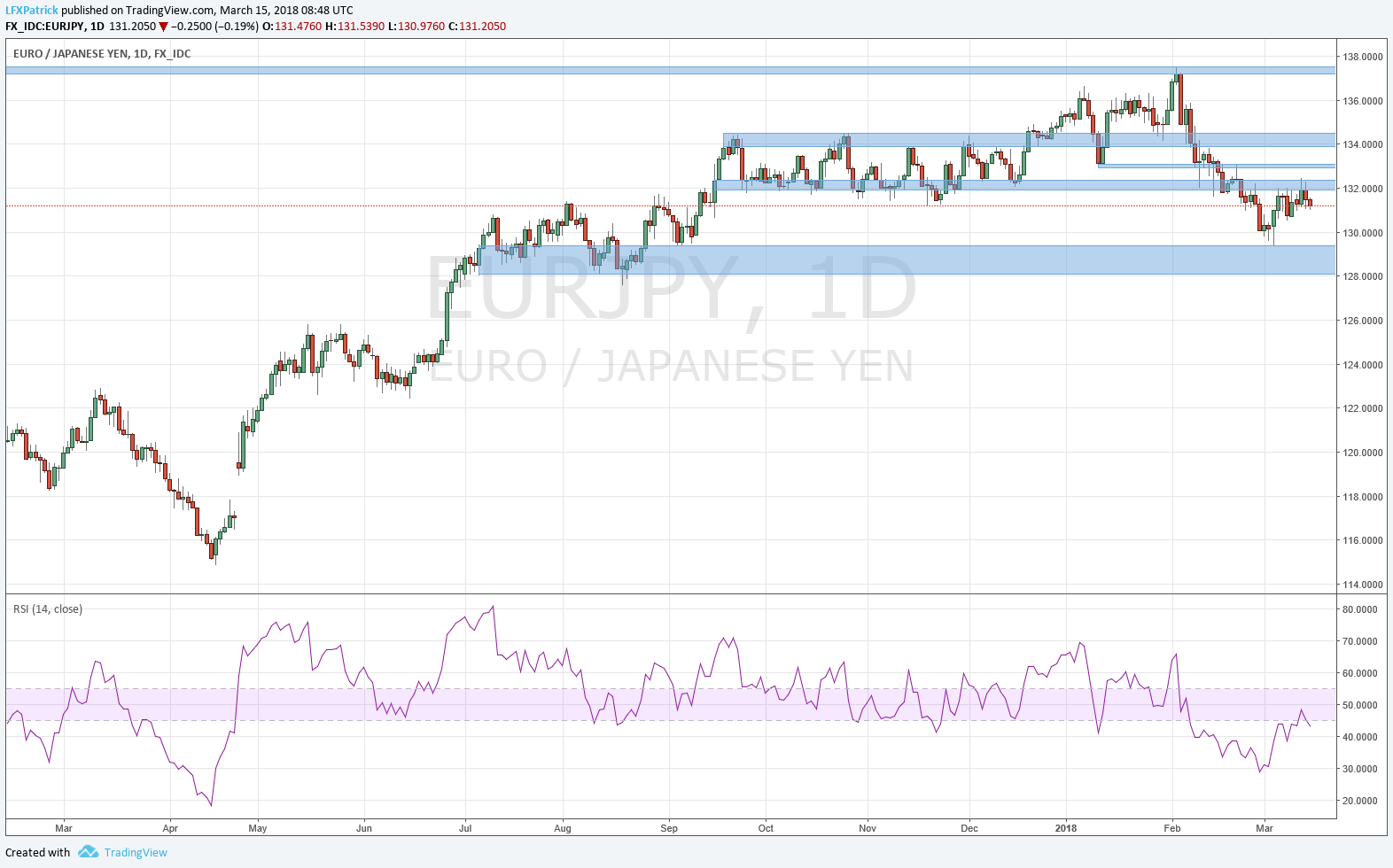

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – Breach of 131 sets a top to target 128.50 as 132 caps corrections. A close over 133 stabilises the pair opening a retest of 135

1-3 Week View – The closing breach of 131 concerns the bullish consolidation bias opening a test of 128.50 while this area supports there is a window to retest and breach cycle highs above 137

Retail Sentiment: Bullish

Trading Take-away: Short