Investing.com’s stocks of the week

Once again we start the week after a relatively quiet weekend in a broad positive mind set. Most of this momentum seems to still be as a result of the ECB press conference on Thursday, which ensured that the market now believes that interest rates have found a bottom at the current level of 0.75%. That, combined with the emphasis that Mario Draghi placed on the “normalisation” of financial conditions seen in the Eurozone, has allowed investors to once again get interested in the riskier side of things with equity markets hitting multi-year highs as a result.

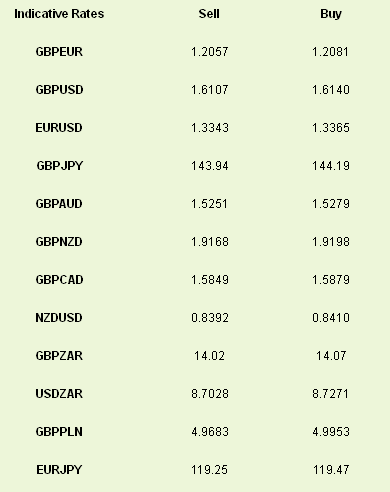

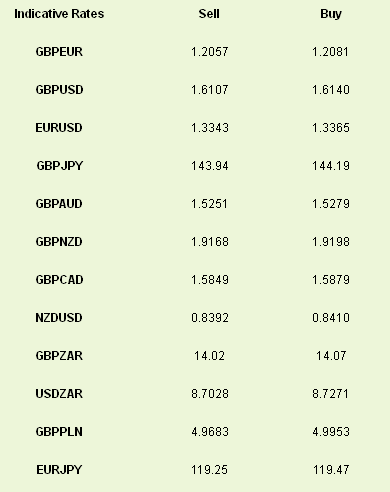

The euro, alongside the typical carry trade currencies of the AUD and NZD, have benefited the most from this atmosphere with GBPEUR heading towards 1.20 at a seemingly unstoppable rate. Sterling has benefited somewhat from the move, with gains against the USD and JPY but lagging behind pretty much everything else. The focus today will now switch to a speech by Fed Chair Ben Bernanke, his first since the release of the Fed meeting minutes which gave the market cause to worry that the latest QE plan would be wound up sooner rather than later in the US. He speaks at 9pm GMT.

That will overshadow trading today with a lack of data from the world economy and low liquidity as a result of a Japanese bank holiday. While this rally does seem sustainable at the moment we have to emphasise that the fundamentals behind it are still very weak, especially in the Eurozone. The ECB’s comments on Thursday do seem to suggest that its paranoid anti-inflation hat is well and truly back on, but rising unemployment and dwindling aggregate demand remains a real challenge for the region.

The retail sector is in focus this week with retail sales and inflation due from China, US and Europe throughout the week. Earnings season will also heat up this week following a strong start with banks set to continue their recent good run of late.

The euro, alongside the typical carry trade currencies of the AUD and NZD, have benefited the most from this atmosphere with GBPEUR heading towards 1.20 at a seemingly unstoppable rate. Sterling has benefited somewhat from the move, with gains against the USD and JPY but lagging behind pretty much everything else. The focus today will now switch to a speech by Fed Chair Ben Bernanke, his first since the release of the Fed meeting minutes which gave the market cause to worry that the latest QE plan would be wound up sooner rather than later in the US. He speaks at 9pm GMT.

That will overshadow trading today with a lack of data from the world economy and low liquidity as a result of a Japanese bank holiday. While this rally does seem sustainable at the moment we have to emphasise that the fundamentals behind it are still very weak, especially in the Eurozone. The ECB’s comments on Thursday do seem to suggest that its paranoid anti-inflation hat is well and truly back on, but rising unemployment and dwindling aggregate demand remains a real challenge for the region.

The retail sector is in focus this week with retail sales and inflation due from China, US and Europe throughout the week. Earnings season will also heat up this week following a strong start with banks set to continue their recent good run of late.