According to the just-released annual Wells Fargo & Company Middle Class Retirement Study, about 60% of middle-class Americans say that getting monthly bills paid is their top concern. This number stood at 52% in the 2012 study. (Source: Wells Fargo & Company, October 23, 2013.)

But there are more depressing results of the survey…

34% of middle-class Americans say that they will work until they are 80 years old, because they will not have enough money saved up for retirement! In 2012, the number of respondents with a similar opinion stood at 30%; and in 2011, this number was at 25%. While the U.S. economy is supposed to be in recovery mode, the trend shows more Americans will need to work after retirement.

Based on the results of the study, the Wells Fargo Institutional Retirement and Trust issued a statement saying, “We do this survey every year and for the past three years, the struggle to pay bills is a growing concern and the prospect of saving for retirement looks dim, particularly for those in their prime saving years.” (Source: Ibid.) No kidding.

While the stock market has more than doubled since 2009, while real estate prices are rising again, while Washington and the mainstream are telling us the U.S. economy is improving, Americans are becoming more “doom-and-gloomish.” According to the results of the CNN/ORC International poll released late last week, only 29% of Americans say that economic conditions are good right now—the lowest level of the year. (Source: CNN Breaking News Text, October 22, 2013.)

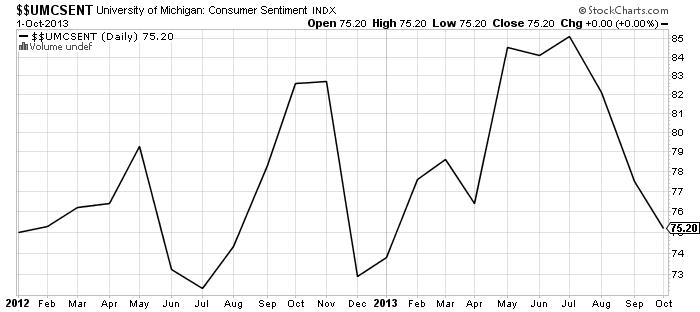

The chart below of the University of Michigan Consumer Sentiment Index is very important. This is a key indicator of consumer confidence in the U.S. economy.

Since July of this year, consumer confidence has been plunging, having now fallen to the same level it was at in early 2012! Weak consumer confidence has always been a signal that consumer spending in the U.S. economy will pull back.

But looking at the retail stocks, it’s like they don’t care how consumers are feeling in the U.S. economy. The Dow Jones U.S. General Retailers Index just hit a record high! What does that tell me? It tells me the same thing I have been telling you, dear reader, for months now. This stock market is rising on easy monetary policy, not fundamentals—and that’s dangerous.

Michael’s Personal Notes:

Even amateur economists will agree with me on this: when supply declines and demand remains the same, prices increase. Well, it wasn’t too long ago when I said that if gold bullion prices remain suppressed for long, we will see the supply decline. This phenomenon has started to happen.

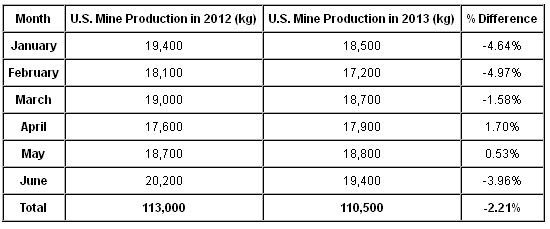

According to the U.S. Geological Survey (USGS), in June of 2013, the total production of gold bullion from mines in the U.S. was 19,400 kilograms (kg)—about four percent lower than the same period a year ago. (Source: U.S. Geological Survey, Mineral Industry Survey, September 2012 and October 2013.)

The table below compares U.S. mine production in the first six months of 2012 to the first six months of 2013.

But as the supply of gold bullion falls, we see consumer demand for gold bullion increase.

In India (the biggest consumer of the precious metal), demand continues to rise in spite of the efforts of the Indian government and the Indian central bank to curb demand for the yellow metal. The director of the All India Gem and Jewellery Trade Federation, Bachraj Bamalwa, recently noted, “Demand is picking up and supplies have dried up.” (Source: “Gold premiums near record levels on lack of supply,” Reuters, October 22, 2013.)

In China (the second-biggest gold bullion consumer), we are seeing something very similar. According to the Hong Kong Census and Statistics Department, in August, 110.5 metric tons (Mt) of gold bullion was imported from Hong Kong into China. It marked the fourth straight month that imports of the precious metal exceeded 100 Mt. (Source: Reuters, October 8, 2013.) Why is this so important to even mention? China keeps the country’s gold bullion production for internal use; importing from Hong Kong shows how much more is needed to fulfill the demand.

Other than the consumer demand for the precious metal, we are still seeing buying for gold bullion from central banks, especially in Russia and Turkey.

After hitting a bottom in June, gold bullion prices haven’t declined to that level again. In fact, they have been trending higher since. This trend can continue, but you have to keep in mind that we are in a market where irrationality prevails. Time will draw a better picture, but as it stands, I see many opportunities in the mining sector.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

New Trend: AThird Of Americans Need to Work Until 80

Published 10/30/2013, 12:52 AM

Updated 07/09/2023, 06:31 AM

New Trend: AThird Of Americans Need to Work Until 80

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.