Market Analysis

The Emini broke to a new all-time high yesterday. Furthermore, all higher time frame charts are in strong bull trends. In addition, the bulls want to rally up to the 2,500 big round number.

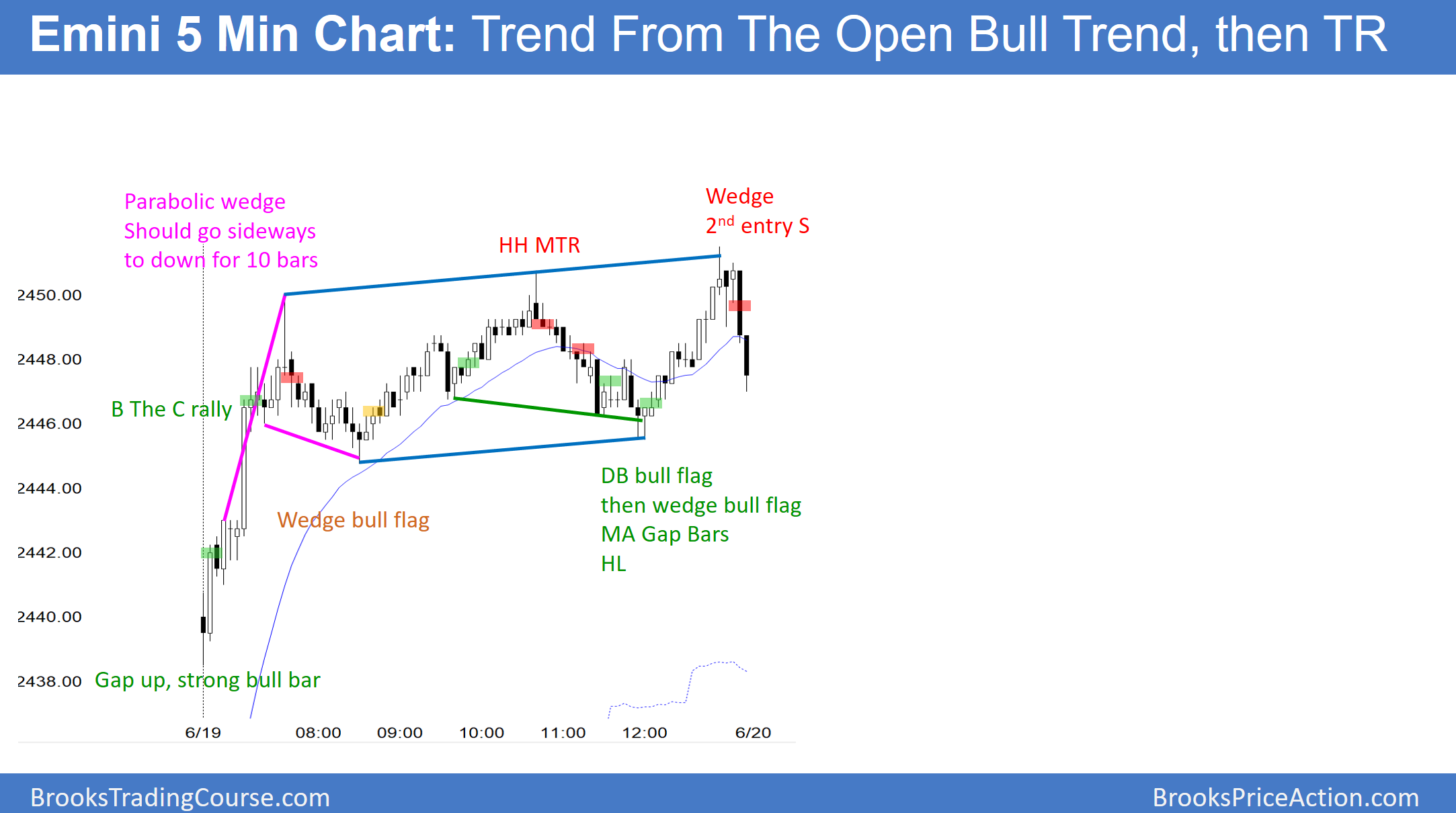

Yet, it was a weak bull trend day. In addition, the odds are against a big breakout above the old high because of the extreme buy climax on the weekly chart.

The Emini tends to rally from June 26 to July 5. That means that it tends to be sideways to down for the week or so before June 26. While calendar trades are unreliable, even when they have a theoretically high probability, this slightly reduces the chances of a strong rally over the next week.

Because most breakouts fail, this further lessens the chances of a strong rally from here. Finally, the daily chart is trying to form a wedge higher high major trend reversal. The odds favor a 100 point pullback to the March 27 low at some point over the next few months.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex market. If it opens here, it will test the bottom of yesterday’s trading range. Furthermore, the daily chart has been in a tight trading range for 3 weeks. Therefore, bear scalpers will sell breakouts above the trading range high. In addition, because the weekly chart is so extremely overbought, bear swing traders will buy puts and put spreads at new highs.

Since yesterday was a trading range and most days over the past month have been trading ranges, the odds again favor another mostly trading range day.

Furthermore, yesterday was a bull trend bar that broke above the range. Because traders usually are disappointed when there is a trading range breakout, the odds favor either a doji bar or a bear bar on the daily chart today. If the bulls get a bull bar today, that would be follow-through buying. However, the odds would then favor a disappointment bar tomorrow.

Here are several reasonable stop entry setups from yesterday.