New Residential Investment Corp. (NYSE:NRZ) is scheduled to report fourth-quarter and 2018 results on Feb 12, before market open. The company’s results will likely display year-over-year decline in its earnings per share (EPS) and NII.

In the last reported quarter, this New York-based mortgage real estate investment trust (REIT), which primarily focuses on residential real estate investments, posted core earnings of 63 cents per share, comfortably surpassing the Zacks Consensus Estimate by 12.5%. However, NII of nearly $262 million declined 3.6% year over year.

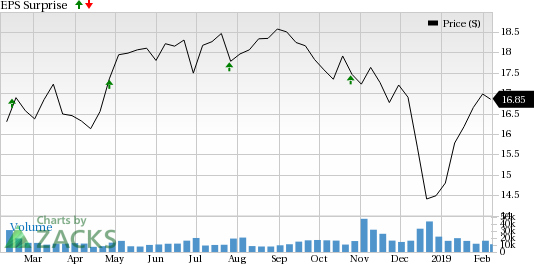

Over the trailing four quarters, the company surpassed the Zacks Consensus Estimate in all occasions. It delivered average positive surprise of 9.58% during this period. The graph below depicts this surprise history:

New Residential Investment Corp. Price and EPS Surprise

Let’s see how things are shaping up prior to this announcement.

Factors at Play

In November, New Residential raised fresh capital by issuing 25 million shares of common stock in a public offering. The proceeds were used for strategic investments and general corporate purposes. In fact, as a preeminent capital provider to the U.S. mortgage industry, the company is expected to have benefited from its access to sound financial resources in the Dec-end quarter.

Further, the company has an impressive pool of mortgage service rights (MSRs) that represent majority of its investments. The company receives fee income as long as the mortgage stays active. As interest rates and mortgage rates rose in the fourth quarter, we believe the company to have witnessed lower pre-payment volumes. This will likely translate into higher market value for MSRs held by the company.

However, higher interest rates are also expected to have negatively impacted the company’s quarterly performance. Since New Residential depends on debt to fund its asset purchases, higher financing cost is expected to have curbed its investment activity.

In addition, flaring up volatility in the market and higher mortgage rates have likely led to a decline in mortgage origination volumes. This is anticipated to affect the company’s residential mortgage loan portfolio.

Moreover, the Zacks Consensus Estimate for fourth-quarter NII of $210.4 million reflects a year-over-year decline of 10.6%.

Additionally, there is lack of any solid catalyst prior to the fourth-quarter earnings release. As such, the Zacks Consensus Estimate of EPS for the to-be-reported quarter remained unchanged at 55 cents, over the past month. The figure also reflects a year-over-year decline of 9.8%.

Earnings Whispers

Our proven model does not conclusively show that New Residential is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. That is not the case here, as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earning ESP: New Residential’s Earnings ESP is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank of 3, which increases the predictive power of ESP. However, we also need a positive ESP to be confident of the earnings beat.

Stocks That Warrant a Look

While the other players in this space are lined up to report financial results, below are three stocks, poised to beat on earnings per the proven Zacks model. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hersha Hospitality Trust (NYSE:HT) , slated to report fourth-quarter results on Feb 25, has an Earnings ESP of +3.81% and holds a Zacks Rank of 2.

American Tower Corporation (NYSE:AMT) , set to release earnings on Feb 27, has an Earnings ESP of +0.29% and carries a Zacks Rank of 3.

CyrusOne Inc. (NASDAQ:CONE) , scheduled to report quarterly numbers on Feb 20, has an Earnings ESP of +3.07 and carries a Zacks Rank of 3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

American Tower Corporation (REIT) (AMT): Get Free Report

New Residential Investment Corp. (NRZ): Get Free Report

CyrusOne Inc (CONE): Get Free Report

Hersha Hospitality Trust (HT): Get Free Report

Original post

Zacks Investment Research