New research from The Real Asset Company shows that when it comes to gold, everyone’s been looking at the wrong data. Rather than looking at the price of gold, which has climbed for the last 12 years, we should be looking at the value of the currencies we’re buying it in.

Gold Investment When The Price Is High

We see the most interest in gold investment when the price is climbing. A majority of people investing see the price rise and quickly rush to buy before it moves any higher because they believe that the price increase reflects an increase in value.

But it’s not, the currency you’re buying in is just becoming more worthless -- you need more of it to buy the same ounce of gold, which you could have bought for a few hundred dollars a couple of years ago.

In contrast, gold's value remains the same, regardless of when you spend it.

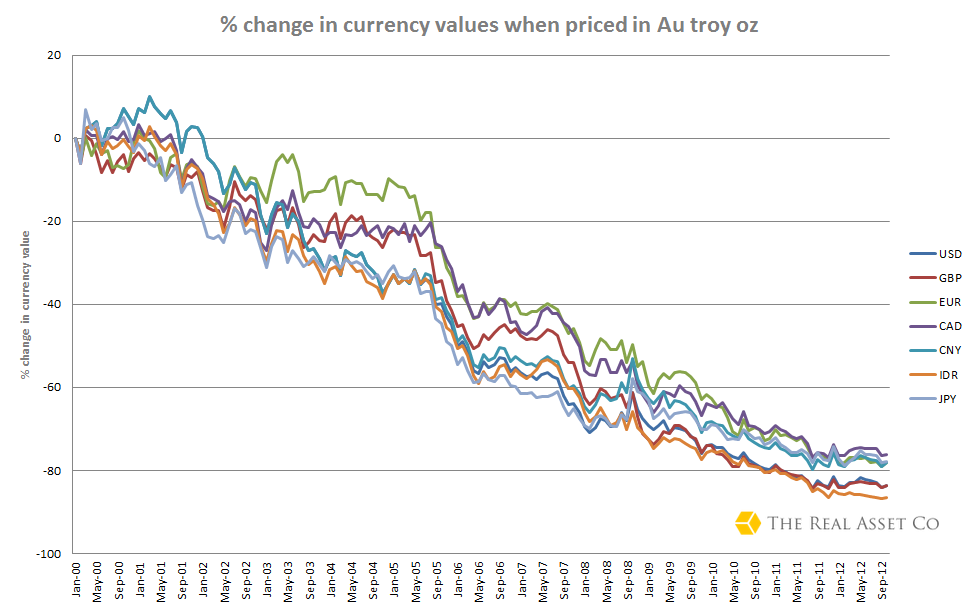

Rather than look at the usual graph of the gold price increasing, the graph we should all be looking at is the one below.

The graph shows a clear fall in the value of currencies when priced in one gold (troy) ounce. For the purpose of this research we have taken the last 12 years as an example. If, however, if you take it back to 1971, then the devaluation of our currencies is far worse.

To reiterate, the British Pound, U.S. Dollar etc. are the currencies you earn and save. If you have been saving for the last twelve years, your money is now worth 80-90% less than it was in 2000.

Had you been paid, or saved, in gold you would still have the exact same amount you received in 2000. Not less, as you find with currencies.

While to some it may seem scary that I’ve just told you gold’s price isn’t what you see, you should look at it another way -- gold is the one constant.

More Money Moves To Gold

The correlation between gold's price and the amount of currency in circulation is one that is often referred to as evidence of gold’s continued price escalation. We are all aware of central banks expanding their monetary bases: first covertly before the financial crisis and now quite openly as they are encouraged by governments to do so through quantitative easing.

As we all know from basic economics, the more there is of something the less it’s worth; its value decreases. And when government-led currencies are priced in true money -- gold -- then it is clear how much value it is losing.

Why Price It In Gold?

Gold has been valued for 6,000 years and its price has been rising ever since. But its value remains the same. Throughout history we have used gold and silver as money, returning to it after financial crises set in.

As more countries prepare to repatriate their gold from foreign custodians and as increasing numbers of non-Western nations trade in gold, memories of the precious metal as money are being refreshed.

Increasingly people and central banks are looking to hold their wealth in gold, not currencies.

We usually price gold in a number of currencies -- most often the U.S. dollar, but at The Real Asset Co. we sell gold in Sterling and Euros as well.

All three are in financial difficulties; all three are using some kind of monetary policy measures to manipulate their way out of the crisis, and to erode the stability and strength of the currency.

Elsewhere the Chinese are accused of being currency manipulators, Japan continues to print to oblivion, Canada is admired because of its impressive economy and India complains about the high price of gold.

But all of them, no matter their policies or global views, are seeing their currencies become hugely devalued against the international, faceless currency that is gold.

Will They Recover?

Those of us interested in gold are big fans of referring to the fundamentals that drive gold. The main fundamental here is what we refer to as the ‘race to debase’ i.e. moves by central banks to implement policies that devalue currencies just as quantitative easing does.

Unless you can find evidence that central banks plan to stop further expansion of the money supply, gold’s price will keep rising and the value of currencies will continue to fall.

The ‘race-to-debase’ is clearly alive and well among the world's currency managers and central bankers.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

New Outlook On Gold: Ignore The Price

Published 11/29/2012, 10:03 AM

Updated 05/14/2017, 06:45 AM

New Outlook On Gold: Ignore The Price

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.