discoverIE (previously called Acal) reported strong interims, proving that its strategy to grow the design and manufacturing (D&M) side of the business is bearing fruit. Organic revenue growth of 9% drove improved operating margins and EPS, while growth in orders and design wins position discoverIE for sustained growth. Management continues to seek out suitable acquisitions to accelerate growth of D&M – based on a similar profile to previous deals, we estimate that using existing credit facilities to make £50m worth of acquisitions could add 20-25% to FY19e EPS.

H118 results reflect strong trading environment

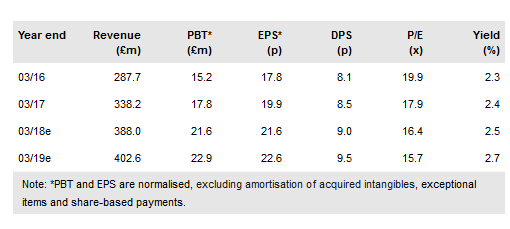

The company generated strong organic revenue growth in H118, resulting in underlying operating profit growth of 34% y-o-y (+23% CER) and margin expansion of 0.6 percentage points to 6.2%. Underlying EPS increased 24% y-o-y and the interim dividend was 8% higher than a year ago. Strong order intake during H1 provides support to our forecasts – we make minor changes to reflect H1 results, with normalised EPS up 0.8% in FY18e and up 0.1% in FY19e.

To read the entire report Please click on the pdf File Below: