People have been asking forever for a diversified way to play growth and momentum. Someone has licensed the IBD 50 list and turned it into an ETF – Innovator IBD 50 Fund (NYSEArca:FFTY). The expense ratio is expected to be between 0.8% and 1.2%.

Here’s some info from the ETF’s prospectus:

The “IBD® ” mark has been licensed to the Adviser by IBD for use in connection with the Fund under certain circumstances. The Adviser, in turn, has sublicensed to the Fund its rights to use the mark pursuant to a Sublicense Agreement. The Fund is not sponsored, endorsed or sold by IBD. IBD makes no representation regarding the advisability of investing in the Fund.

The IBD® 50 Index is a computer-generated stock index published by Investor’s Business Daily (“IBD”). IBD uses proprietary fundamental and technical ratings to compile what IBD considers the 50 leading growth companies that trade on U.S. securities markets. Companies included in the IBD® 50 Index must meet minimum earnings, sales, profit margin, volume and technical requirements. Companies meeting these requirements are included in the IBD® 50 Index on a price-weighted basis. This means that stocks with higher prices receive a greater weight in the Index. The IBD® 50 Index is rebalanced on the last day of each trading week after the U.S. stock market closes and is published by IBD on its website, www.investors.com, and in its Monday print edition.

Unlike the IBD® 50 Index’s price-weighted basis, the Fund will invest in the companies included in the Index on a conviction basis. This means that the Fund’s portfolio manager will overweight the higher ranked companies in the IBD® 50 Index and underweight the lower ranked companies. The Fund’s portfolio manager anticipates that these higher ranked companies may each represent as much as approximately 3.5% of the portfolio at the time of investment while the lower ranked companies may each represent as little as approximately 0.5% of the portfolio at the time of investment.

Although market conditions and other factors may cause deviations, the portfolio manager typically aims to maintain a portfolio with the following attributes: • Fully invested diversified portfolio consisting of U.S.-listed, exchange-traded securities. • Long-only positions, no derivatives, no leverage.

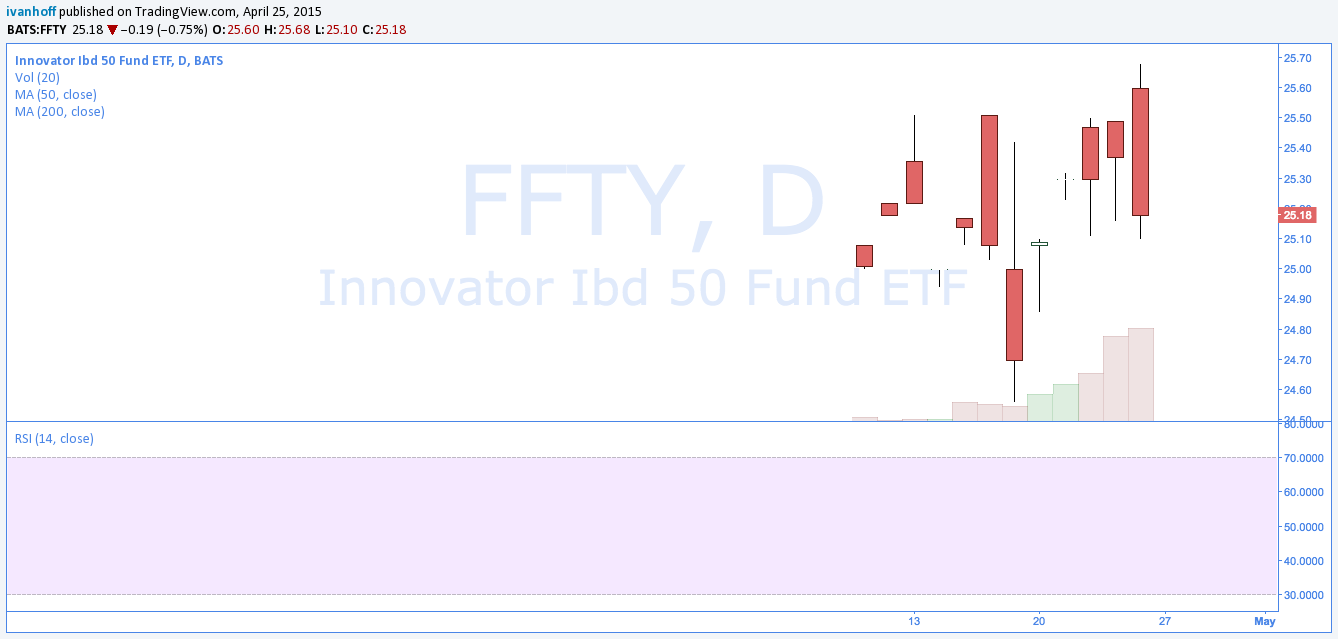

It’ll be interesting to see how it will actually perform. 3 weeks after its inception, it is already trading over 100k shares per day. Current assets are $10mm, which means that the fund sponsor is losing money. I think it has a potential to become popular. Good news for momentum investors in general. Such an ETF could exacerbate upside moves and offer a way to hedge individual momentum holdings.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.