Some analysts claim that the housing bubble is back. Are they right? And what are the consequences for the gold market?

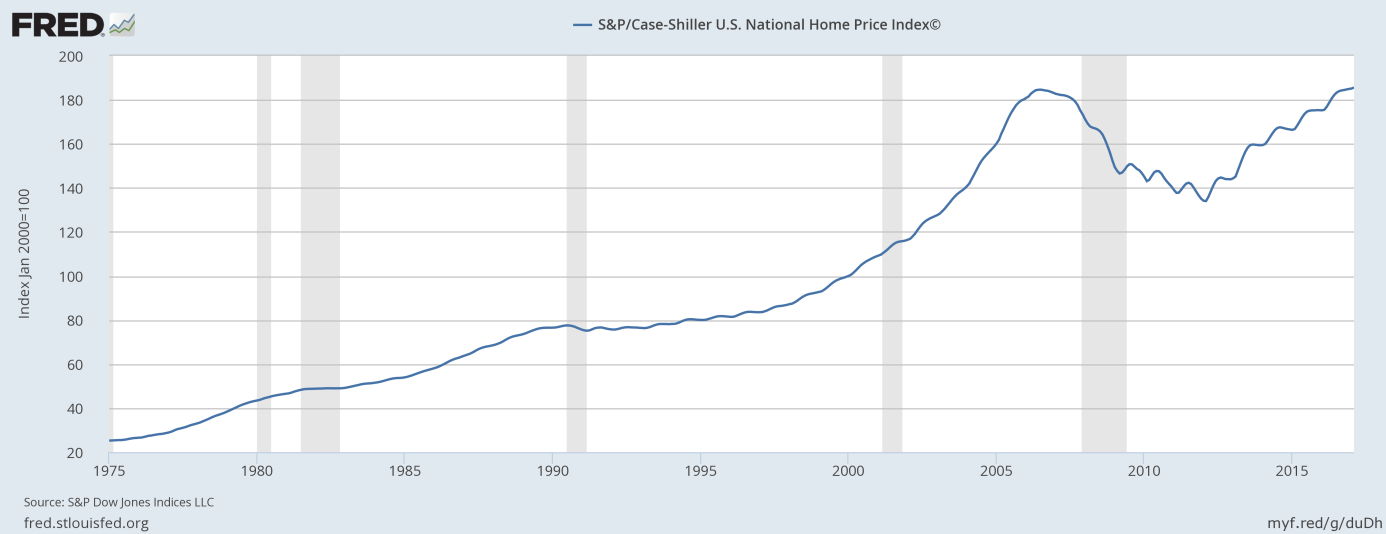

As the chart below shows, the Case-Shiller U.S. National Price Index exceeded in February its previous peak from July 2006. Actually, some regional indices (e.g. for Portland or Seattle) are even more worrying. It seems that the Fed and the government managed to reflate the crushed housing prices.

Chart 1: Case-Shiller U.S. National Price Index from January 1975 to February 2017.

Although home prices have hit record highs, the U.S. housing market is nowhere near as bad as it was a decade ago. This is because the number of second homes has been continually declining. It signals lack of intense speculation, as people buy homes to live in, not to resell at higher prices. Actually, the fundamental drivers of higher prices are higher demand and limited supply. In several places, there is a significant lack of supply of homes for sale, while low mortgage rates boost demand. In other words, we do not see a country-wide bubble, but rather regional imbalances due to structural factors.

Moreover, lending standards are tighter than in the 2000s, while the growth of real estate loans has been slowing down since October 2016.

Surely, some of the recovery in real estate is not sustainable, given lagging incomes. Hence, prices in particular locations could stop to increase or even start to decline at some point in the future. However, investors who buy gold because they expect the replay of the last housing crisis may be disappointed.

We do not say that the U.S. economy does not face any problems, but we do not see a country-wide housing bubble similar to that from the 2000s. There are many reasons to invest in gold, but gloomy predictions of a burst of another alleged housing bubble are simply not among them.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.