A year end series taking a longer perspective in many market indexes, macro related commodities, currency and bonds. Over the next three weeks these reviews are intended to help create a high level road map for the the next twelve months and beyond. We continue with Crude Oil.

Crude Oil is used by many as an economic indicator as much as a trading commodity on the world stage. High crude prices lead to high gasoline prices and hurt consumer spending. And high crude demand is perceived to show increased economic activity, productivity. Crude Oil can also be used as a fear gauge, with premiums added in times of conflict world wide. What is most important to the stock market though is that Crude Oil can move the market, in both directions, when it moves sharply.

Fortunately Crude Oil has traded in a narrowing band for the last 3 years. We may be in a new era of stablizing Crude Oil prices or, it might be the calm before the storm.

The monthly chart has two technical patterns that suggest the latter. The first is the AB=CD pattern that has been running since November 2001. This pattern not only suggests a target price but timing to get there, and in this case looks to a move to $163 around August 2015. This is a long way from where it is now at just $97, and far from a certainty. But if you also look at the symmetrical triangle forming, it would target a $40 move when Crude oil breaks the pattern. The triangle can break either way, but a move to the upside would target $159 if it happened in the next month or so. The momentum indicators at the top and bottom of the chart support a move higher as well. The Relative Strength Index (RSI) is in bullish territory and has been since late 2009, and the MACD is positive.

There is another interesting aspect of this monthly chart. The move out of the triangle is thought o be its most powerful about 2/3 of the way through the triangle. This would be around February 2015. So maybe we get another year of stability before the firestorm. But it pays to look at the shorter timescale to see if there are shorter term catalysts.

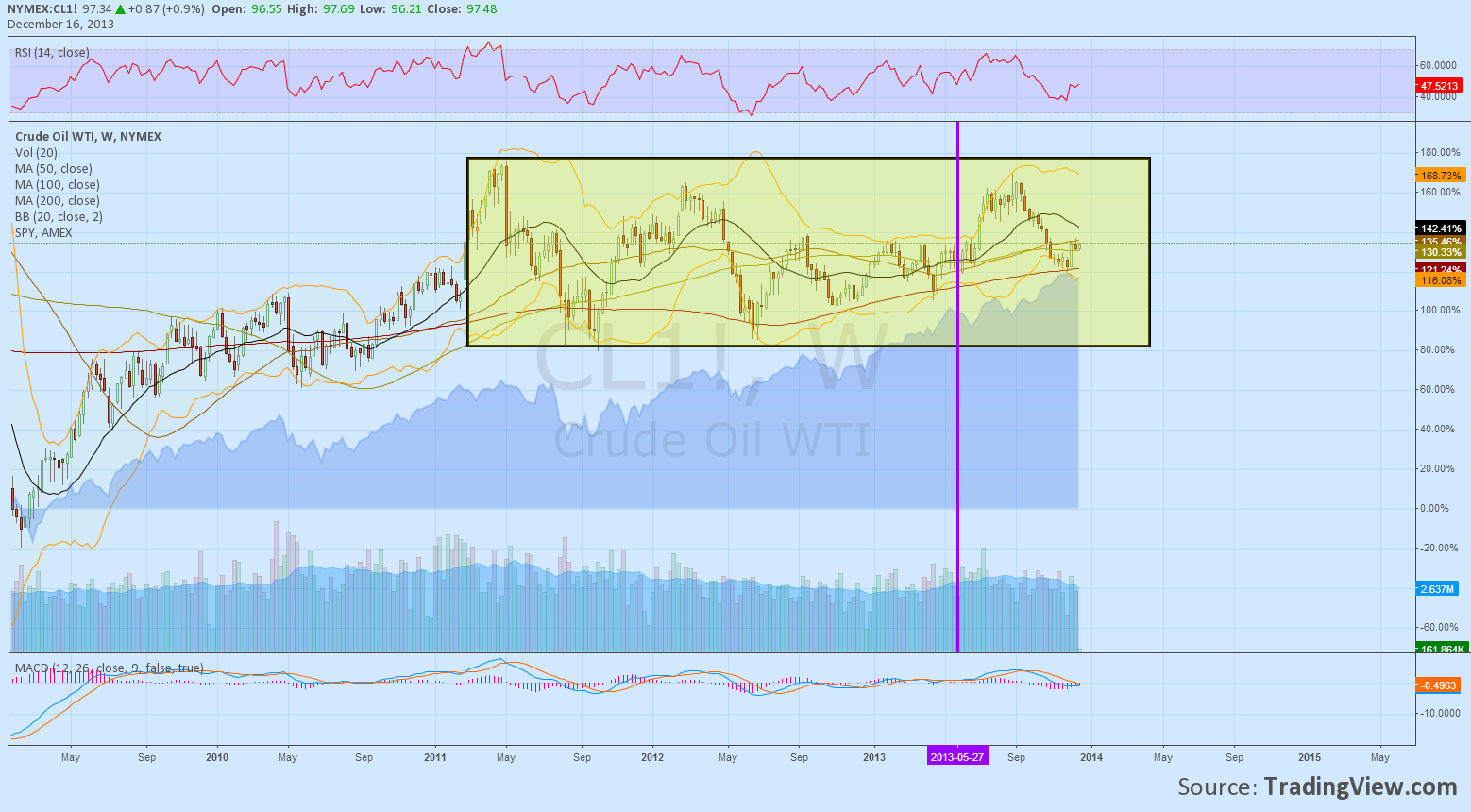

The weekly chart below does not give any particular insight not already discussed in the price action on the monthly chart. But it does give an interesting perspective, dispelling the notion that Crude Oil is detrimental to the stock market. The price of Crude oil and the S&P 500 were highly correlated from the March 2009 low until May of 2013. Four years of rising Crude and rising stocks before they uncoupled and inverted.

This happens to be at the same time the Federal Reserve started to float the notion of tapering its stimulus. Look at this as an inflection point for the relation ship between stocks and Crude Oil.

The daily chart shows a bounce off of a support zone and consolidation in a bull flag formation that could lead to the 104 area. It would still take another move above that to break the triangle range from the monthly chart though. So it seems that the short term bias is higher but there is a lot more movement that has to take place before the 85-107 range is threatened. This suggests that the intermediate term will see continued relative stability in Crude Oil with an upward bias and if it does accelerate then the upside targets can move higher very quickly to new all -time highs.

Back tomorrow with Gold.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post