After the 4Q15 release and conference call, Netflix (O:NFLX) ($107.89/share) remains in the Danger Zone and we are sticking with our 'Dangerous' rating. We consider the focus on international subscriber growth as a purposeful distraction from a failing business and dangerously overvalued stock.

Per our 4Q15 Preview Report, four major challenges to Netflix’s business model remain unanswered.

The trend, since 2010, of content cost growth exceeding revenue growth remains intact. In 2015, streaming content obligations rose 15%, slower than revenues at 23%. However, since 2010, when Netflix began significantly ramping up its content library, obligations have grown by 43% compounded annually while revenues have only grown by 25% compounded annually. Long term, the amount Netflix owes on its content is outpacing the revenue the company derives from said content.

International contribution margins continue to deteriorate and are not likely to get positive in the near future. The international margin in 2015 was -17.1% compared to -12.2% in 2014. The company’s focus on growth in unprofitable markets is a red flag. Management guided investors to expect profits from the international segment in 2017. Some analysts predict it will take more like five or six years. Either way, it is a long way off and we are not sure it will ever materialize

Domestic subscriber growth is hitting a wall. Netflix added 1.56 million U.S. subscribers in 4Q15, below expectations of 1.62 million and well below the 4Q14 additions of 1.9 million. Netflix management stated “Our high penetration in the US seems to be making net additions harder than in the past.”

Netflix continues to burn cash at a high rate and will have to raise capital in 2016 or early 2017. We first highlighted this problem in October 2015, but noted that as long as investment banks can profit from a capital raise, analyst ratings will remain positive on Netflix.

The stark reality is that Netflix is expanding into unprofitable areas, facing significant competition at home and abroad, burning through cash, and resorting to accounting tricks to prop up reported earnings. While the house of cards continues to stand another day, when it comes crashing down it could do so violently.

Just How Overvalued Are Shares?

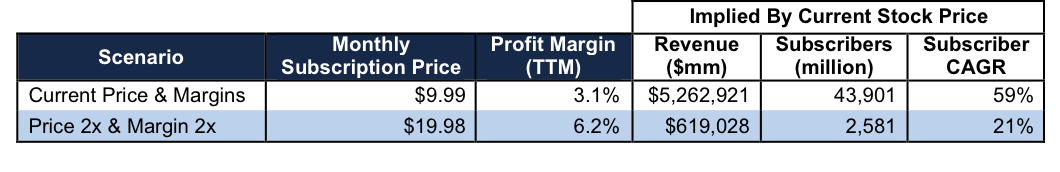

We’ve previously pointed out just how overvalued Netflix is by quantifying how many subscribers the company would need to justify its current valuation. To best illustrate the expectations baked into NFLX, we looked at two scenarios, as seen in Figure 1.

Subscriber Growth Expectations

Sources: New Constructs, LLC and company filings

Scenario 1: If we assume Netflix can maintain its current pricing structure and its current margins, the company must grow NOPAT by 28% compounded annually for 24 years to justify its current price of $108/share. In this scenario, Netflix would generate over $5 trillion in profit, which at current subscription prices implies the company’s user base will be 43.9 billion.

Scenario 2: Even if we assume Netflix can double its subscription price and double its current profit margin, the company must grow profits by 28% compounded annually for the next 18 years to justify its current share price. In this scenario Netflix would be generating $619 billion in revenue in 18 years. With double its current subscription price, this scenario implies Netflix will grow its subscriber base to nearly 2.6 billion, or 21% compounded annually over the next 18 years.

No matter how you measure it, one thing is clear; NFLX is beyond overvalued.

EPS Not As Good As They Appear – Artificial Boost From Tax Reserve

At first glance, the EPS beat would look impressive and it certainly helped push shares upwards of 10% in after-hours trading. However, this EPS beat was artificially boosted by the release of $13 million, or $0.03/share, in benefits from tax accruals. This $13 million is counted in net income despite being a non-core source of profits.

Netflix used a similar trick in 4Q14, when it included $39 million, or $0.10/share in net income from the same release in benefit from tax accruals. Using such reserves allows companies to “create income” when fundamentals are unable to support the growth story any longer.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, sector, or theme.