Stellar Run

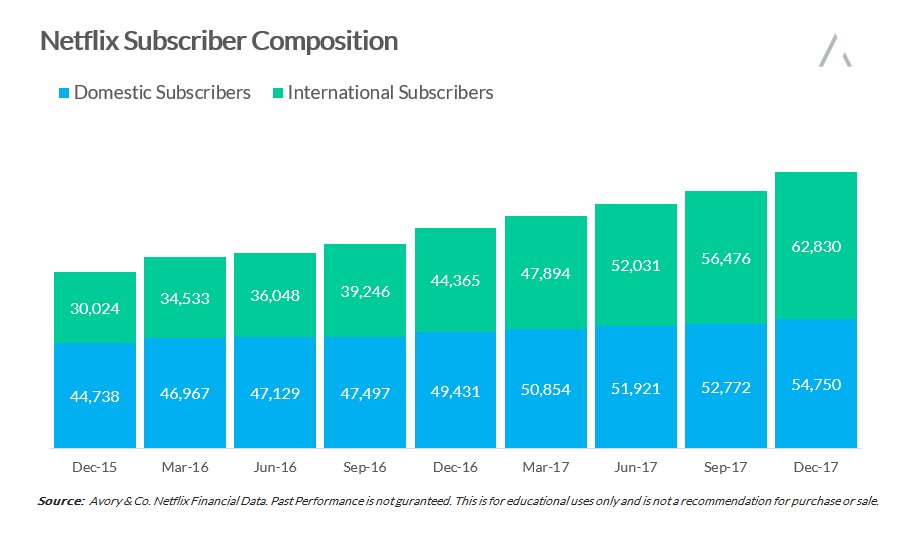

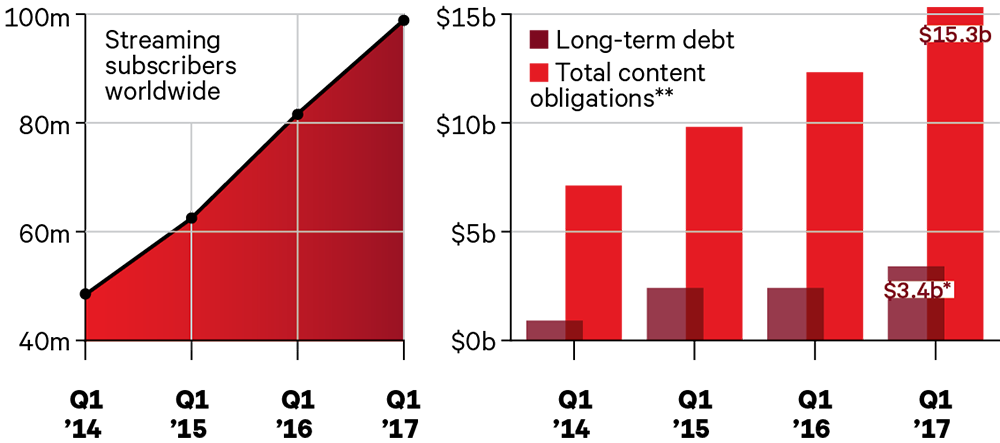

Netflix (NASDAQ:NFLX) has been on a tear over the last 12 months as investors continue to focus on the rampant rise of subscriber growth especially in the international market. From the image below you can see that domestic growth has been steadily rising in the US, however the real star has been international growth as Netflix has been introducing its content into several new countries.

Even more surprising has been the record surge in the stock from the start of this year now having risen 30% year to date.

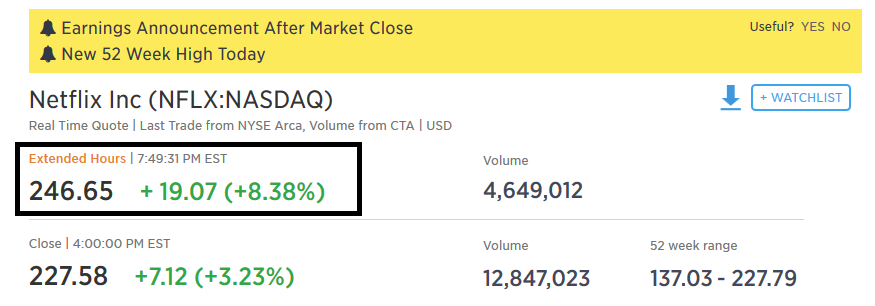

Netflix stock jumped higher today in the futures market after the stock closed for trading as the market digested the earnings report. I have added the latest jump taken from CNBC.com where the stock has moved a further 8% after a strong day leading up to the earnings release. It seems the company cant do no wrong.

What Investors Are Ignoring

One of the key reasons why Netflix subscriber growth has been so spectacular has been due to the fact that Netflix pricing for its streaming services is extremely low. This is even more evident when you compare it to traditional cable / pay TV companies.

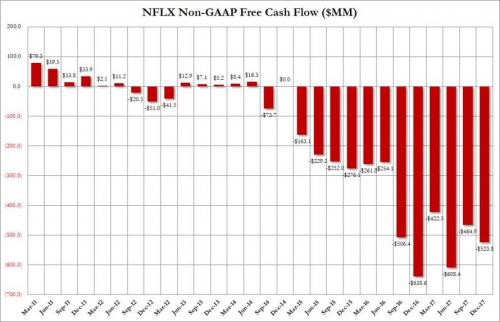

By keeping the pricing low its placed a huge strain on its cash flows, as the company has been spending record amounts of its cash as its business model clearly inst sustainable even though company is growing so quickly. With the chart below you can see its latest cash burn was staggering at $523 million for the most recent quarter.

Whats even more worrying is the company is forecasting to burn through a total of $4 Billion in 2018.

Original Content Is Its Achilles Heel

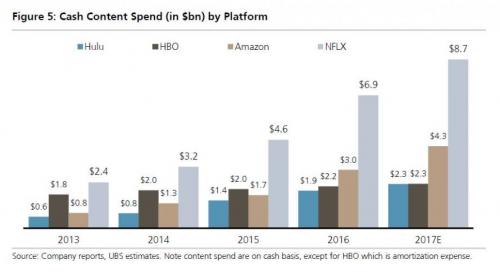

The other key reason for the massive cash burn for Netflix is its huge budgets spent on generating its own original content. Not only has it been rising every year for the last five years, but its expected to hit $7.5 + Billion based on forecasts. (See Below)

The company's historical content spending is as follows:

2018: $7.5-$8 billion (forecast)

2017: $6 billion

2016: $5 billion

2015: $4 billion

2014: $3 billion

2013: $2 billion

Netflix content also outpaces its competitors own content budgets by a significant amount with a spend of approximately double its closest competitors content budget.

The end result of Netflix business model is the company is knowingly placing huge strains on its balance sheet with the loss of billions in cash each year and rising debt which is sitting around $20 Billion to fund its yearly cash burn.

For the moment none of this matters as stock investors cheer the company on by bidding it higher and higher rewarding the company for such reckless spending that it clearly cannot sustain.

Why Low Rates Are Important?

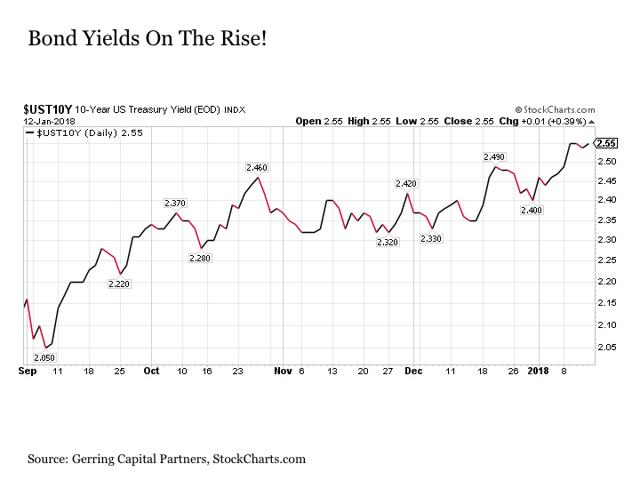

Netflix like many companies listed in the US are more reliant than ever on low interest rates to fund their business model. If US Government 10 year bond yields continue to move higher it will spell disaster for Netflix and other companies who continue to accelerate their debt levels to fund their losses.

If yields move beyond 3% it will mean significantly higher interest payments and accelerate already high cash burn levels which could ultimately lead to bankruptcy under their large debt levels. However until that day its celebrations all round for investors as the fundamentals don't matter at all.

Thanks for reading this post.

Disclaimer: This post is for educational purposes only, and all the information contained within this post is not to be considered as advice or a recommendation of any kind. If you require advice or assistance please seek a licensed professional who can provide these services.