After a remarkable run this past fall, shares of video-streaming giant Netflix (NASDAQ:NFLX) are now showing weakness, underperforming other technology companies in the current risk-averse environment.

The Los Gatos, California-based entertainment behemoth has seen its stock drop more than 12% in the past one month, losses that were almost double those of Alphabet (NASDAQ:GOOGL) or Meta Platforms (NASDAQ:FB) for example. Since reaching a record high of $700.99 on Nov. 17, the stock, which closed on Monday at $593.74, has fallen about 15%.

This year-end slump coincides with investors’ diminished appetite for high-growth technology names as the Federal Reserve begins to unwind some of its monetary stimulus with the intention to raise interest rates as early as next year.

This weakness—which could continue into 2022—offers a good entry point, in our view, for investors interested in buying the best streaming entertainment stock available, at a cheaper price. Behind our optimism we see clear evidence that Netflix is performing much better than other top media companies in the ongoing streaming war.

Despite the current share sell-off, Netflix's market capitalization is almost the same as century-old Walt Disney Company (NYSE:DIS). The House of Mouse, which is considered NFLX's closest rival, and owns a massive entertainment empire that includes theme parks, cruise lines and its newly launched streaming Disney+ service, has a market cap of $264 billion after its shares shed 20% of their value this year versus Netfix's $263B valuation.

Clear Lead On A Variety Of Metrics

What gives Netflix a clear lead over other streaming services is the company’s growing slate of original content. Netflix is on track to spend about $17 billion on original content this year, a 40% jump from the last year.

Even as its original content spending has swelled, the company has managed to expand its operating margins. Margins have grown from 7.2% in 2017 to 18.3% in 2020. As of its third quarter ended September, margins improved again to nearly 23%.

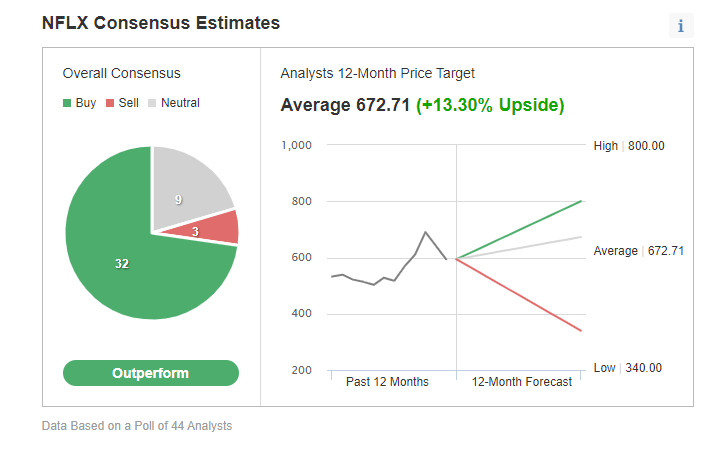

The company’s expanding margins and its foray into new markets, such as video games, are some factors keeping the analyst community excited about NFLX shares. Among 44 analysts polled by Investing.com, the majority gave Netflix an “Outperform” rating.

Chart: Investing.com

Average consensus estimates are targeting a 14% upside potential on the stock from the current price.

JPMorgan analyst Doug Anmuth, who has a $750 price target on the shares, sees more upside for the stock as the company’s global reach continues to expand. His note added:

“We remain positive on shares based on continued strengthening of the 4Q content slate, greater distance from pandemic pull-forward, improving seasonality, & potential for greater traction in APAC, where NFLX has low penetration.”

Morgan Stanley, which this month reiterated its overweight rating on the streaming giant, said in a recent note:

“Our OW rating on NFLX is based on the view that it will scale a large, global, and highly profitable streaming business. This thesis manifests itself in an expectation of roughly 30% EPS CAGR from ’21E through ’25E, and even more rapid FCF growth.”

Netflix added 4.4 million global paid subscribers in its third quarter and expects 8.5 million more in the three months ended December. The company has a total 214 million paying subscribers worldwide.

Another positive development that long-term investors should take into account is that Netflix isn't dependent on debt to fuel its growth. After years of borrowing to fund production, Netflix has said it no longer needs to raise outside financing to support day-to-day operations. The company plans to reduce debt and will buy back up to $5 billion worth of shares.

Bottom Line

Netflix stock has emerged much stronger from the unique environment seen this past year, solidifying its cash and market positions. These factors, including its superior content slate, make its stock a good buy during, or even after, the current bearish spell.