Netflix (NASDAQ:NFLX) just released its fourth-quarter 2017 financial results, posting earnings of $0.41 per share and revenues of $3.29 billion. Currently, Netflix is a Zacks Rank #3 (Hold), and is up nearly 8% to $227.79 per share in after-hours trading shortly after its earnings report was released.

NFLX:

Matched earnings estimates. The company posted earnings of $0.41 per share, matching the Zacks Consensus Estimate of $0.41 per share.

Beat revenue estimates. The company saw revenue figures of $3.29 billion, just topping our consensus estimate of $3.28 billion.

The company’s Q4 sales climbed 32.6% year-over-year. On top of that, Netflix’s quarterly earnings jumped from $0.15 per share in the year ago period.

Yet, what has investors so excited is the fact that the streaming powerhouse, which has been able to grow its subscriber base more quickly than anticipated, once again blew away quarterly subscriber estimates. Netflix added 8.3 million new subscribers in Q4, which marked a 15% jump from the year-ago period and also represented the biggest quarter in the company’s history.

Netflix originally predicted it would add a total of 6.3 million new subscribers in the fourth-quarter. The company added 6.36 million new international memberships alone. This massive growth will help the company as it fights for streaming supremacy over the likes of Amazon (NASDAQ:AMZN) and Hulu.

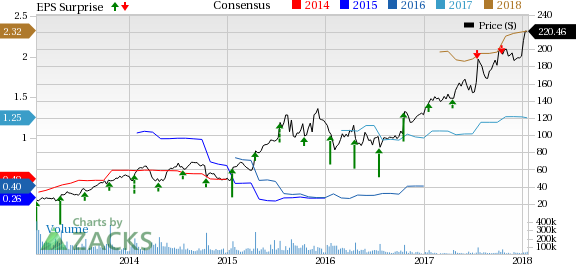

Here’s a graph that looks at NFLX’s Price, Consensus and EPS Surprise history:

Netflix is the world's leading Internet television network with millions of subscribers in nearly 50 countries who have access to an ever-expanding library of TV shows and movies, including original programming, documentaries and feature films. The company offers the ability to watch as subscribers want, anytime, anywhere, on nearly any Internet-connected screen.

Check back later for our full analysis on NFLX’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Netflix, Inc. (NFLX): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Original post

Zacks Investment Research