Netflix (NASDAQ:NFLX) has signed a five-year deal worth around $300 million with Ryan Murphy, the name behind popular series’ like American Horror Story and Glee. Reportedly, Murphy is ending his tenure with Twenty-First Century Fox (NASDAQ:FOXA) where he has been working since 2003 to join Netflix in July.

Earlier in September, Netflix collaborated with Murphy to bring a two-season 18 episode series, Ratched, that traces the origin of Nurse Ratched of One Flew Over the Cuckoo’s Nest. A comedy series named The Politician produced by Murphy is also in the making.

The addition of Murphy will definitely provide an impetus to Netflix’s original content expansion strategy. Last year, the streaming giant signed a contract with Shonda Rhimes, a long-time Walt Disney (NYSE:DIS) associate, to produce original content exclusively for Netflix.

We believe these additions will help Netflix to maintain its dominant market share going forward. Walt Disney is set to enter the streaming market in 2019 and its recent deal with Twenty-First Century Fox is expected to be a major catalyst to growth. However, Netflix doesn’t see this as a threat.

Talking about the Disney-Fox merger, recently, Netflix’s chief content officer Ted Sarandos was quoted saying, “one of the reasons we entered into original programming was that if we got to the place where networks didn't want to sell us their content in second windows, that we would be replacing that with our own -- by creating our own original programming.”

Focus on Original Content

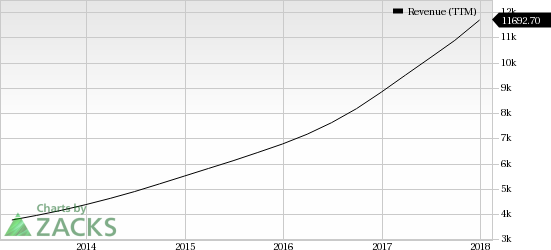

Netflix’s continued focus on producing quality original content is driving its top line. The company’s strong programming slate is helping it attract and retain subscribers.

In the last reported quarter, Netflix added 8.33 million subscribers (highest in its history), of which 6.36 million came from the International streaming business. The figure is impressive, considering that Netflix hiked prices in Europe and the United States by almost 10%.

In January, Netflix released a new sci-fi series Altered Carbon and a six-episode chat show, My Next Guest Needs No Introduction with David Letterman. The guest list of the talk show includes influential personalities like Barack Obama, George Clooney, Malala Yousafzai, Jay-Z, Tina Fey and Howard Stern.

A new coming-of-age high school comedy series set in the 1990s called Everything Sucks is also set for a Feb 16 release.

The company also mentioned its upcoming projects on the last earnings call. The second seasons of Marseille, Jessica Jones, Santa Clarita Diet and Lemony Snicket are due this quarter.

Notably, Netflix plans to release 30 international original series this year, including programs from France, Poland, India, Korea and Japan. The company intends to produce/acquire 80 films throughout the year.

Netflix has set a budget of $7.5-$8 billion for production/acquisition of original content in 2018. Management expects this figure to increase in 2019 and 2020.

Zacks Rank and Stock to Consider

Netflix has a Zacks Rank #3 (Hold).

A better-ranked stock in the broader technology sector is Micron Technology (NASDAQ:MU) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Micron is projected to be 10%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research