Contrary to conventional wisdom, Netflix (NASDAQ:NFLX), Inc. actually stands to benefit greatly from the AT&T Inc (NYSE:T)-Time Warner Inc (NYSE:TWX) merger. Here’s why.

Largely unknown to most investors, mega mergers with antitrust implications often require the approval not just of regulators, but of competitors across the industry landscape as well. Put simply, if AT&T and Time Warner’s biggest competitors give their OK, then regulators are much more likely to allow a deal to pass.

Those testimonials from the competition don’t come cheaply, however. Companies will often ask for big favors in exchange for their support of large mergers. And that’s great news for Netflix. In Bloomberg, Craig Moffett, an analyst at MoffettNathanson LLC, said,

The part you never see is what the various players demand behind the scenes in order to support the deal in Washington...You’ll have all kinds of programmers essentially demanding a pound of flesh. It’s a gravy train for everybody.

Netflix, for better or worse, will end up speaking on behalf of an entire class of would-be competitors...That gives them tremendous negotiating leverage for their support of the deal.

The company’s influence can be huge. Netflix opposed Comcast’s proposal to buy Time Warner Cable in 2014, and regulators wound up blocking the deal. Later, TWC was purchased by Charter Communications instead, a deal that Netflix supported — likely in exchange for some form of preferential treatment.

Early indications are that Netflix will support the AT&T-Time Warner merger, as Netflix CEO Reed Hastings said at a conference last month,

We want to make sure it doesn’t give an unfair advantage to HBO...If it’s open competition, we love that.

It remains to be seen what the company could receive in return for its blessing, but investors should expect some form of benefits coming Netflix’s way soon.

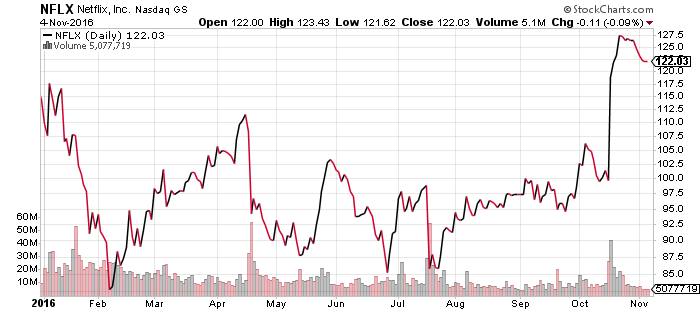

Netflix shares rose $1.87 (+1.53%) to $123.90 in premarket trading Monday. Year-to-date, NFLX has gained 6.69%.