Netflix Inc. (NASDAQ:NFLX) was downgraded by Vetr from a "strong-buy" rating to a "buy" rating in a research report issued on Wednesday, MarketBeat.com reports. They presently have a $125.96 target price on the Internet television network's stock. Vetr's target price suggests a potential upside of 10.89% from the stock's current price.

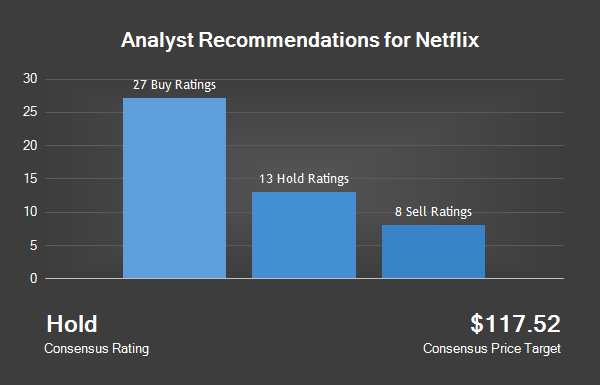

Several other equities research analysts have also recently issued reports on NFLX. Credit Suisse reiterated a "neutral" rating and issued a $122.00 price target (up from $119.00) on shares of Netflix in a research note on Tuesday, July 19th. FBR & Co upped their target price on Netflix from $90.00 to $104.00 and gave the stock a "mkt perform" rating in a research note on Tuesday, July 19th.

Goldman Sachs restated a "buy" rating and set a $115.00 target price (down from $120.00) on shares of Netflix in a research note on Tuesday, July 19th. JPMorgan) restated an "overweight" rating and set a $116.00 target price (down from $125.00) on shares of Netflix in a research note on Tuesday, July 19th.

Finally, Mizuho upped their target price on Netflix from $90.00 to $109.00 and gave the stock a "neutral" rating in a research note on Tuesday, July 19th. Eight analysts have rated the stock with a sell rating, fourteen have given a hold rating and twenty-eight have assigned a buy rating to the stock. The stock currently has an average rating of "Hold" and a consensus target price of $117.47.

Shares of Netflix opened at 113.59 on Wednesday, MarketBeat.com reports. The company's 50 day moving average price is $113.45 and its 200-day moving average price is $99.53. Netflix has a 52 week low of $79.95 and a 52 week high of $133.27. The firm has a market capitalization of $48.75 billion, a PE ratio of 307.00 and a beta of 1.81.

Netflix last issued its quarterly earnings results on Monday, October 17th. The Internet television network reported $0.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.06 by $0.06. The business earned $2.29 billion during the quarter, compared to analysts' expectations of $2.28 billion. Netflix had a return on equity of 6.31% and a net margin of 1.99%.

The firm's revenue for the quarter was up 31.7% compared to the same quarter last year. During the same period in the previous year, the company posted $0.07 earnings per share. On average, equities research analysts expect that Netflix will post $0.40 EPS for the current fiscal year.

In other news, CEO Reed Hastings sold 102,340 shares of the stock in a transaction on Monday, August 22nd. The shares were sold at an average price of $95.21, for a total value of $9,743,791.40. Following the completion of the sale, the chief executive officer now directly owns 102,340 shares of the company's stock, valued at $9,743,791.40. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website.

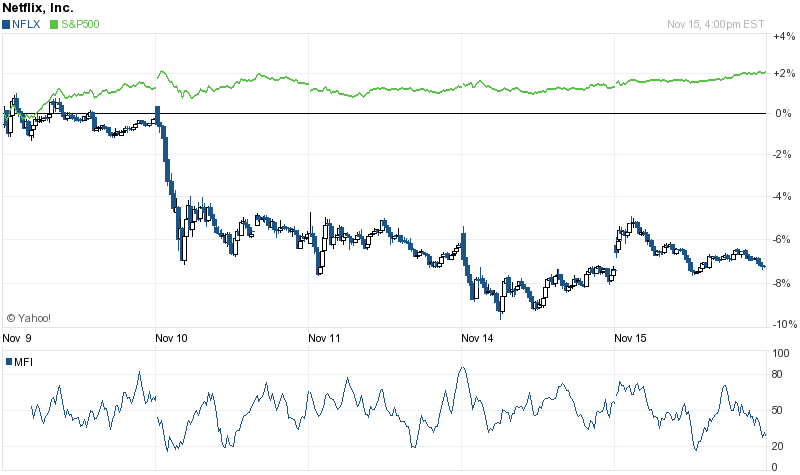

Also, CFO David B. Wells sold 500 shares of the stock in a transaction on Wednesday, November 9th. The stock was sold at an average price of $122.83, for a total transaction of $61,415.00. Following the completion of the sale, the chief financial officer now directly owns 500 shares of the company's stock, valued at $61,415. The disclosure for this sale can be found here. 4.90% of the stock is currently owned by company insiders.

Hedge funds have recently made changes to their positions in the company. Cornerstone Advisors Inc. boosted its stake in shares of Netflix by 25.6% in the second quarter. Cornerstone Advisors Inc. now owns 1,118 shares of the Internet television network's stock worth $102,000 after buying an additional 228 shares during the period.

Signature Estate & Investment Advisors LLC purchased a new stake in shares of Netflix during the second quarter worth about $124,000. Quadrant Capital Group LLC boosted its stake in shares of Netflix by 15.1% in the second quarter. Quadrant Capital Group LLC now owns 1,475 shares of the Internet television network's stock worth $126,000 after buying an additional 194 shares during the period.

Coconut Grove Bank boosted its stake in shares of Netflix by 1.7% in the second quarter. Coconut Grove Bank now owns 1,526 shares of the Internet television network's stock worth $140,000 after buying an additional 26 shares during the period.

Finally, Harel Insurance Investments & Financial Services Ltd. boosted its stake in shares of Netflix by 15.3% in the second quarter. Harel Insurance Investments & Financial Services Ltd. now owns 1,690 shares of the Internet television network's stock worth $155,000 after buying an additional 224 shares during the period. 77.56% of the stock is owned by hedge funds and other institutional investors.

About Netflix

Netflix is a provider of Internet television network. The Company's members can watch original series, documentaries and feature films in Internet-connected screen. The Company has three operating segments: Domestic streaming, International streaming and Domestic DVD. The Domestic and International streaming segments derive revenues from monthly membership fees for services consisting of streaming content.