- Market expectations are high for Netflix's quarterly results today.

- Ads continue to drive the company's revenue.

- Technically, the stock has rebounded from the $700 area.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Netflix (NASDAQ:NFLX) stock has been riding a wave of growth, with the price climbing steadily for over two years. This momentum has been fueled by a surge in new subscriptions and a strong push into advertising revenue.

Since launching its $6.99 ad-supported tier in 2022, the streaming giant has seen a noticeable boost in profits. With today's Q3 2024 earnings report looming, investors are eager to see if the global streaming giant can maintain its upward trajectory.

The company is expected to post record revenue, supported by a flurry of upward revisions. However, the stock has recently pulled back, hovering around the critical $700 support level.

Netflix’s Strategy: Expanding Content and Monetizing Ads

As competition in the streaming space intensifies, Netflix has leaned into sports broadcasting and live events, including NFL games, to broaden its content offerings.

The highly anticipated second season of Squid Game is also set to draw in viewers. But the real story for investors is Netflix's push into advertising.

In Q2, ad-supported subscriptions jumped 34% year-over-year, underscoring the company's ability to tap into a new revenue stream.

The upcoming elimination of the $6.99 plan will further nudge subscribers toward the $15.99 ad-supported tier, boosting margins.

Investor Focus: Will It Pay Off?

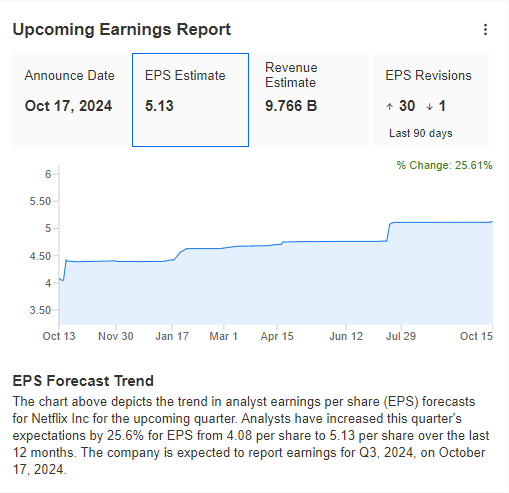

Wall Street expects Netflix to show strong revenue and earnings growth, reflected in 30 upward revisions ahead of today's report.

Source: InvestingPro

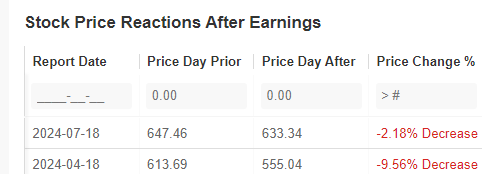

But recent history suggests that even beating estimates may not guarantee a stock price surge, as past earnings surprises have sometimes led to sell-offs.

Source: InvestingPro

Investors will be paying close attention to forward guidance and subscriber growth, with analysts expecting a 4.5 million increase in new users.

Technical Outlook: Key Support at $700 Ahead of Results

Netflix's stock has rebounded over the past week, testing the $700 support level. A break below this could trigger further downside toward September’s lows.

However, a positive earnings report could reignite the uptrend, with $750 and $800 as the next targets for bulls.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.