Netflix Inc. (NASDAQ:NFLX) is set to launch a sequel to its highly popular production, Bright starring Will Smith and Joel Edgerton. The sequel is expected to feature director David Ayer, according to Variety.

Following the announcement, share price of the company rallied to a new 52-week high of $206.21, eventually closing a tad lower at $205.05 on Jan 3.

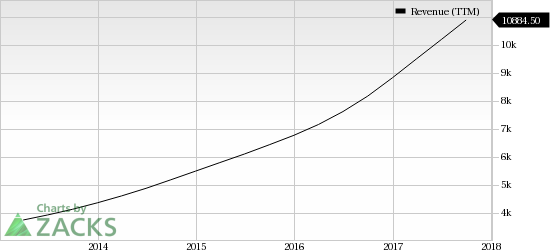

Notably, shares have gained 58.4% in the past year, substantially outperforming the industry’s 13.6% rally.

Content Strength Drives Growth

Netflix – the online giant of original content – is poised to have a superb time this year with a whopping budget of $8 billion for producing original content. The company plans to release 80 original movies this year.

Netflix has been drawing strength from its growing portfolio of original content. Per Nielsen data, which was quoted by Bloomberg, the movie Bright with a budget of $90 million attracted 11 million views between Dec 22 and 24, 2017.

TechCrunch adds that the movie received positive reviews from 28% of the movie critics on Rotten Tomatoes and 88% positive reviews from viewers.

Netflix claimed that it garnered highest number of views on the platform in the launch week and is supposedly one of the biggest originals it has ever produced.

The company also mentioned Bright to have more international viewers than domestic ones. This bodes well for Netflix as it looks to expand its international presence as the domestic market approaches saturation.

We note that at the end of the last reported quarter, Netflix's paid streaming members across the globe increased 24.9% year over year to approximately 104 million. This was driven by 10.5% and 43.2% year-over-year increase in paid members in the Domestic and International Streaming Segment, respectively. The company has more than 109 million total subscribers, globally.

Zacks Rank & Stocks to Consider

Netflix carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are NVIDIA Corp (NASDAQ:NVDA) , NetApp Inc (NASDAQ:NTAP) and Micron Technology Inc (NASDAQ:MU) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for NVIDIA, NetApp and Micron is projected to be 10.3%, 11.3% and 10%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

NetApp, Inc. (NTAP): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research