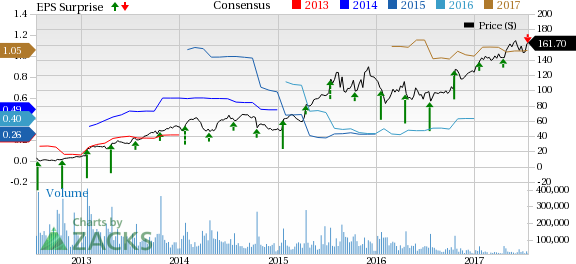

Netflix, Inc. (NASDAQ:NFLX) reported second-quarter 2017 earnings of 15 cents per share, which missed the Zacks Consensus Estimate of 16 cents. However, revenues of $2.786 billion crushed the consensus estimate of $2.761 billion.

Nonetheless, earnings grew 66.7% while revenues increased 32.3% on a year-over-year basis. Moreover, the company added over 5.2 million subscribers, much more than the expected 3.2 million.

Netflix’s focus on international expansion and original regional content has paid off, with 4.14 million net new additions overseas in the quarter. The company remains confident of adding more and more subscribers as the trend of binge viewing catches up fast. Netflix now has 104 million subscribers globally. Consequently, shares jumped 11% in the aftermarket trading session.

In the company’s letter to shareholders, CEO, Reed Hastings said that the increase in subscribers was “due to our amazing content.” The second quarter had a strong programming slate, with popular shows like House of Cards and Orange is the New Black returning for new seasons. Its new original series, Glow – about female wrestling – also garnered mostly positive reviews.

Segment Revenues

International Streaming revenues (41.8% of total revenue) soared 53.7% year over year to $1.165 billion driven by an increase in paid members.

Meanwhile, Domestic Streaming revenues (54% of total revenue) improved 24.6% from the year-ago quarter to about $1.505 billion.

However, the DVD business continues to be in trouble, with revenues (4.2% of total revenue) declining 17.3% year over year to $114.7 million.

Subscriber Base

At the end of the quarter, Netflix's paid streaming members across the globe were approximately 99.04 million, up from 79.90 million in the prior-year quarter.

In the Domestic Streaming segment, Netflix’s subscriber base totaled 51.92 million, up from 47.13 million in the year-ago quarter. Paid members increased to 50.32 million from 46 million in the same period.

In the International Streaming segment, the company recorded 52.03 million members compared with 36.05 million in the prior-year quarter. Paid members were approximately 48.71 million, up from 33.89 million in the year-ago quarter.

Margins

Consolidated contribution profit margin (revenues minus the cost of revenues and marketing cost) was 21.9% compared with 19.8% in the year-ago quarter.

Consolidated operating income grew 81.6% year over year to $127.8 million. Consolidated operating margin increased 130 basis points (bps) to 4.6%.

Balance Sheet

Netflix had $2.165 billion in cash and cash equivalents (and short-term investments) as of Jun 30, 2017 compared with $1.734 billion as of Dec 31, 2016.

Cash used in operations in the quarter was $534.5 million compared with $226.3 million used in operations in the prior-year quarter. The company reported free cash outflow of $608.4 million.

Outlook

For the third quarter of 2017, management forecasts earnings of 32 cents per share.

Domestic and international streaming revenues are expected to be $1.553 billion and $1.306 billion, respectively. Total streaming revenues are expected to be $2.859 billion while total revenue, including DVD business, is anticipated to be $2.969 billion.

Management expects to add 0.75 million subscribers in the domestic streaming segment and 3.65 million subscribers in the international segment. Domestic streaming contribution profit is likely to be $576 million while International streaming segment is anticipated to earn $30 million. Netflix estimates the U.S. contribution margin to be around 37.1% in the quarter.

The company forecasts total operating income of $204 million for the quarter.

Our Take

Netflix has been drawing strength from its growing portfolio of original content. We believe growth will actually come from international markets as the domestic market approaches saturation.

Netflix shows have been very popular and recently, the streaming giant has earned 93 Emmy nominations for its 27 shows like Stranger Things, The Crown and Master of None, per media reports.

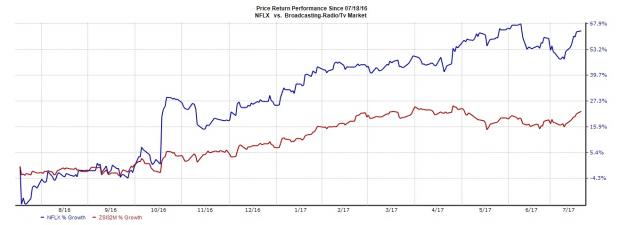

Over the past one year, shares have gained 63.5% compared with the Zacks categorized Broadcasting-Radio and Television industry’s gain of 22.6%.

However, investors need to watch out for astronomically high costs that come with rapid international expansion and the addition of relevant content. The company will spend $6 billion in 2017 on content and another $1 billion on marketing. These aside, stiff competition from bellwethers like Amazon.com (NASDAQ:AMZN) , Hulu and Time Warner’s HBO is a concern. Also, Facebook (NASDAQ:FB) and Snap Inc. (NYSE:SNAP) are making efforts to improve video viewing, which remains a cause of concern.

At present, Netflix carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.See these buy recommendations now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Original post

Zacks Investment Research