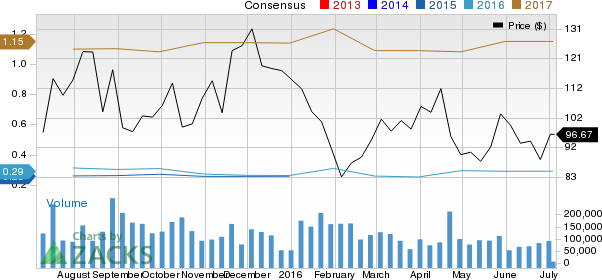

Netflix, Inc. (NASDAQ:NFLX) shares are on an uptrend again. Shares were up nearly 6% this Friday to close at $96.67. The upside was driven by a bullish note from a Canaccord Genuity analyst. In addition, the prospect of the company entering the China market soon added to the positive sentiments.

We believe that the stock may cross the $100 mark, sooner than you think.

We note that the stock hasn’t performed that well in the first half of this year (losing almost 20% of its value).Then what would it take to bring it back on the growth trajectory.

Let’s go through the concerns first to understand the story of the first half.

The company rapidly expanded to over 190 countries at the beginning of this year, which has naturally escalated content costs. The uncertainties stemming from Brexit are another concern. Furthermore, the un-grandfathering of prices beginning this month can also affect demand.

Despite these, the stock has enough steam to move ahead.

Netflix’s growing subscriber base is the primary factor that helps it generate significant revenues. In addition, the company’s paid streaming membership, as a percentage of total subscription, has grown considerably. International expansion bodes well for the company as the domestic market is more or less saturated. In addition, Netflix is now focusing on producing more quality original content than ever to add as well as broadly diversify its subscriber base. The company had earlier declared that in 2016 it will be launching as many as 31 original series (including both new and sequels), about 8 original feature films and 12 documentaries, 35 original kids series and 9 stand-up comedy shows.

We believe that such initiatives might enable it to secure its subscriber base even after the price hike. The demand for its original programs would likely attract users even if some of them have to shift from HD to a lower-priced SD plan, in our opinion. Furthermore, there are talks that the company will soon be giving updates about its plan to expand in China, which would open up new avenues for growth.

Even the Canaccord analyst assumes that despite muted growth in the next few months, Netflix should get back on the growth track from the fourth quarter onward. The analyst initiated the coverage with a price target of $120 stating "Our analysis suggests a long runway for international subscriber growth in Q4 and beyond, and we believe this is the key metric for the stock through next year at least"

However, there can be some headwinds as competition is rife with players like Time Warner Inc.’s (NYSE:TWX) HBO, Hulu, Amazon.com Inc. (NASDAQ:AMZN) and Alphabet’s (NASDAQ:GOOGL) YouTube.

Netflix carries a Zacks Rank #2 (Buy).

TIME WARNER INC (TWX): Free Stock Analysis Report

AMAZON.COM INC (AMZN): Free Stock Analysis Report

NETFLIX INC (NFLX): Free Stock Analysis Report

ALPHABET INC-A (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research