Summary

- NetEase (NASDAQ:NTES) is one of China’s largest diversified online gaming companies with strong fundamentals, but has recently suffered a correction due to missing Wall Street’s lofty second-quarter earnings expectations.

- Given that the Chinese gaming market continues to exhibit strong growth prospects going forward, NetEase would likely continue to be a major beneficiary of this trend.

- After its ~15% correction, valuations have become attractive at 20x FY2016 P/E, especially when compared to its direct competitor Tencent. We think this provides a good entry point to gain exposure to the rapidly growing Chinese gaming market.

Q2 missed expectations, but fundamentals remain intact

NetEase (NTES) is one of China’s top online gaming companies, with a focus on producing massively online role-playing games (MMORPG). Its game titles include ‘Overwatch’ and ‘Diablo III’ which are collaborations with Blizzard (NASDAQ:ATVI), and original titles such as ‘Fantasy Westward Journey II’ and the new ‘Onmyoji’.

The company did recently report weaker-than-expected Q2FY2017earnings, with earnings per share coming in at RMB 22.41,lower than consensus estimates of RMB 25.65, according to Reuters. As a result, shares were punished, falling approximately 15% since its earnings release on 9th August.

However, investors should remember that although the bottom line missed expectations, it was still 8.7% higher than the same figure last year. And revenues came in at RMB 13.4 billion, which did not miss estimates of RMB 12.8 billion, and was 49.4% higher than the same period last year.

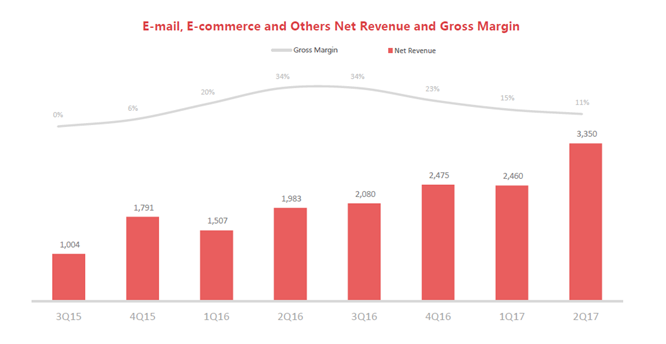

The main reason why earnings did not grow as fast as expected was due to NetEase’s promotional spending on their e-commerce business ‘Yanxuan’, which grew volumes at the expense of e-commerce margins (compressed from 34% to 11%). However, we think that such initial promotional spending to drive up volumes is justifiable, as the company pushes hard to capture market share in the fast-growing e-commerce space in China.

Regardless, the company’s financial health and cash generative abilities remain solid, generating a 31.5% return on invested capital, 6.2% free-cash flow yield and holding a net cash position as of FY2016.

Beneficiary of Chinese games market expansion

In terms of future growth, the main driver for NetEase would have to be the general expansion of the Chinese mobile games market. According to Newzoo’s report, China’s overall games market has grown steadily from $13.8 billion in 2013 to $27.5 billion in 2017, and would likely continue its upward trajectory towards $33.7 billion in 2020 – giving a compounded annual growth rate of 13.6% (2013-2020). And considering thatNetEase, together with Tencent (OTC:TCEHY), holds dominant positions within the mobile games segment (~80% market share combined), sales at NetEase should see continued growth as China’s rapidly urbanized population turns to online games for entertainment.

Attractive valuations after correction

After its ~15% correction from early August, valuations have corrected to attractive levels. Consensus estimates now project NetEase’s FY2017 earnings per share to be at RMB 107.12, which gives the company an earnings growth rate of 21.9% (in constant currency terms). Based on such growth prospects, current valuations of 20x FY2016 P/E isn’t demanding, especially when compared to Tencent’s current valuation of 67.5x FY2016 P/E.

Disclosure: We have no positions in any stock mentioned above.