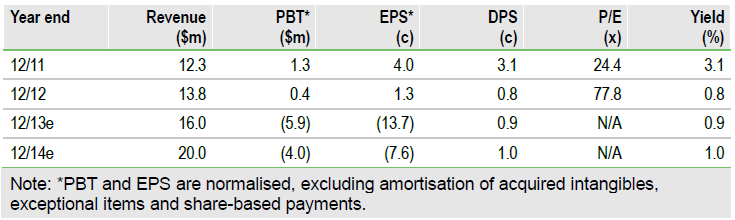

NetDimensions (NETDY) is firmly on track to meet our forecasts, having produced 11% growth in H1 revenues, including 25% growth from the group’s global hosted secure SaaS platform. The group has been hiring at pace, in line with the new business plan announced in May, which aims to achieve $50m revenues within five years. The hiring includes five senior managers in the year to date, along with an expanded sales force, which we expect will begin to have an impact from Q4. We see significant upside potential in the shares if the growth strategy is successful, as US peers trade on very steep valuation multiples.

Stock is in a major growth phase

In May NetDimensions announced a new three-year business plan, supported by a $6.1m fund-raising, which has a goal of attaining $50m revenues along with growing, sustainable profits in five years. The strategy is supported by the group’s strong track record of revenue growth (29% pa from 2004-12), profitability and cash generation. The industry dynamics are attractive, with the global Talent Management Software sector recording 17% annualised growth over 2009 to 2012, according to specialist research firm Bersin by Deloitte, which also projects that the market will grow by 21% in 2013 to $4.8bn. Customers typically operate in highly regulated industries and the group has blue-chip clients that include the BBC, Cathay Pacific, ING and Progress Software, which provide strong references.

Interim results: Broadly in line, forecasts maintained

Revenues jumped 11% to $6.5m, with the priority growth areas of Hosting services and Professional services recording growth of 25% and 44% respectively. The adjusted loss before tax expanded to $2.9m, in line with the business plan, and the group ended the period with $10.2m of cash along with negligible lease debt and $1.0m in acquisition-related liabilities. As the financials are in line with management’s plan, we are maintaining all our forecasts.

Valuation: High-growth sector

Clearly, there are risks in the new strategy. However, if management can execute effectively on the growth plans, we think there is significant upside for investors, as the shares trade on a modest 1.4x our FY14e revenues, compared to the group’s larger US peers (its key competitors), which typically trade at 5.5-9.5x FY14e revenues. While the group’s US peers are pure SaaS businesses, we note NETD is focused on the lucrative highly regulated, high-consequence end of the market.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NetDimensions (Holdings): In A Major Growth Phase

Growth plans are on track

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.