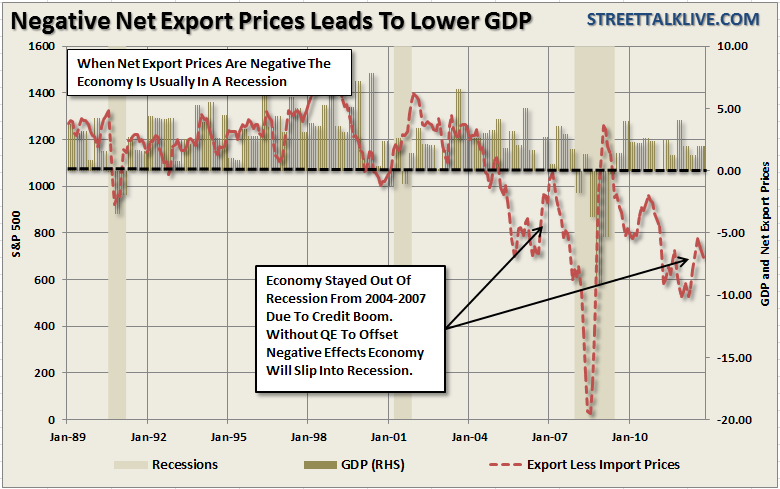

I discussed the potential economic ramifications of declining exports on domestic businesses and employment earlier. The recent releases of import and export prices, along with wholesale trade data, add further confirmation that the economy is struggling.

In the last update on these import/export prices I said: "The bounce in net export prices came from a strengthening of the US Dollar in August which has now faded. However, it is important to notice that just before the last recession negative net exports improved sharply just prior to. This increase in export prices is being driven by the drought in the Midwest which pushed agricultural products higher by 5.1 percent in August following July's 6.3 percent surge. The concerns over shortages is driving prices of the foods/feeds/beverages component up 4.8 percent and 6.8 percent in the last 2 readings. This, however, is a temporary anomaly which will subside as we move into the winter months." As expected - that spike is now over.

Despite the recent strength in the dollar, following the pre-QE3 announcement plunge, strength in the dollar, import prices are moving higher. In October import prices rose a sizable 0.5 percent in October following very sharp fuel-driven gains of 1.1 percent and 1.2 percent in the two prior months. The problem, of course, is that these price increases are going to be difficult to pass along to consumers and will further impact corporate profit margins going into the end of the year.

The ongoing recession in the Eurozone is pulling foreign demand down which is being exacerbated by the recent strength in the dollar. This is also a negative for U.S. companies where with profits already under attack there is little pricing power for US exports. Overall, like the majority of the other economic related reports as of late, the current trend of the data is not supportive of a rapidly strengthening economy or a recovery in corporate profit margins going into the end of the year.

Wholesale Trade

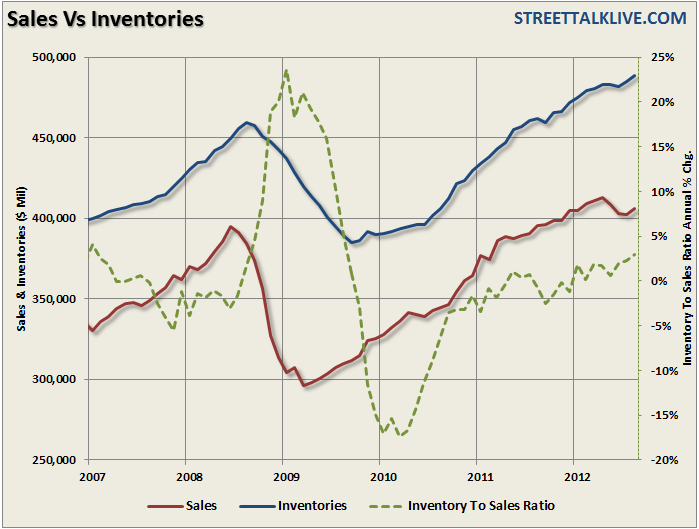

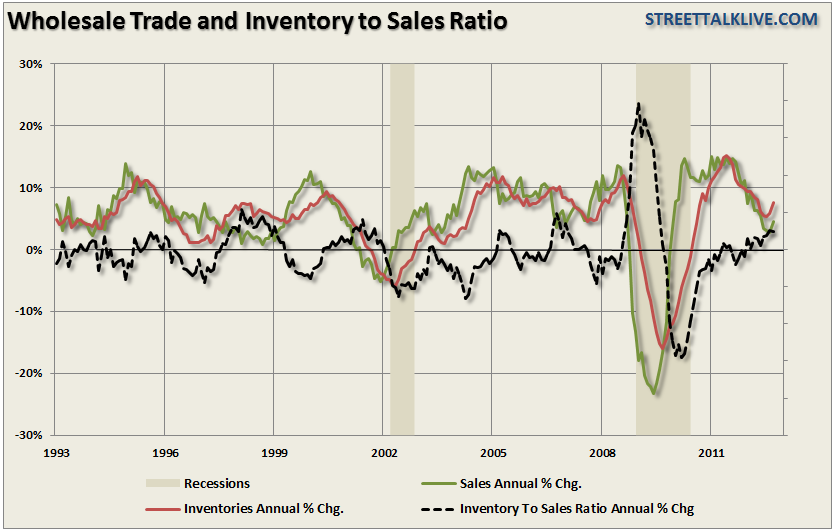

The wholesale trade data, as well as the inventory to sales ratio, improved marginally in the most recent month but not materially enough to offset a trend of weakness on the consumption side of the economic equation. For the latest month wholesale inventories rose a steep 1.1 percent in September which is consistent with the recent trend of weakness of new orders and new export orders in many of the regional economic reports. This build in inventories is likely unwanted as product remains stagnant. However, sales did rise by 2.0% at the wholesale level which was the first uptick in the annual rate change since the beginning of the year. The good news is that the jump in sales reduced the inventory to sales ratio from 1.2 to 1.19 in the last month.

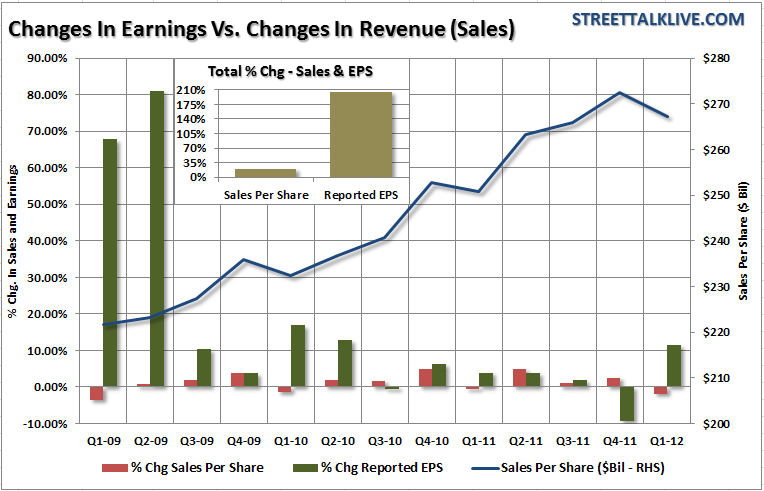

This data clearly lines up with the trends that we have seen in earnings and revenue for corporations. Our argument for quite some time has been that the profit margin expansions we have witnessed since the last recession are ephemeral as they have been driven by cost cutting and low employment. We discussed this in our article "Corporate Profits Surge At Workers Expense" where in we stated: "'Given the enduring hard times, you might think that corporations have used up their cash since 2009. But real pretax corporate profits have soared, from less than $1.5 trillion in 2009 to $1.9 trillion in 2010 and almost $2 trillion in 2011, data from the federal Bureau of Economic Analysis shows.'

There is a very interesting, albeit disturbing, contradiction in the statement above. The initial assumption would be that if companies are having a hard time putting cash to work, because there is less demand for products and services, this would infer lower revenues. The chart shows the change in reporting earnings and sales (top line revenue) for the S&P 500. Since the beginning of 2009 the total growth in sales per share has been 21% as compared to a 206% increase in reported earnings. This confirms our assumption that lower revenues and demand is behind the historically high levels of corporate 'cash hoarding.' However, if revenue growth is weak then how are real pretax corporate profits soaring? The answer comes down cost controls and productivity."

As we stated during the last update: "The chart shows the annual change in sales, inventories and the inventory to sales ratio. With the inventory to sales ratio rising towards historical peaks (excluding the financial crisis), combined with the sharp slow down in sales, we are likely going to see continued weakness in upcoming manufacturing reports." That weakness has indeed been flowing through many of the recent manufacturing reports as expected.

The Good News

With the uptick in sales in the past month we may see some marginal improvement in the manufacturing reports. However, these reports do not take into account the upcoming impact that we will see from hurricane Sandy which will likely have a negative near term impact. We will need a couple of more months of actual data to assess the real condition of the trade and inventories.

Furthermore, while the evidence is clearly tilted toward economic weakness, we are still not at recessionary levels just yet with respect to wholesale trade (inventories and sales annual change will go below 0%). So, unlike other indicators that are at levels normally associated with the onset of a recession, this data is not yet confirming the same.

The question of whether or not a recession is coming is really a moot point. We will have another recession - it is only a function of time. However, the underlying economic data remains too weak to muster anything more than modest growth at best. The problem with modest growth is that there is no "margin of safety" against economic shocks the sharply curtail demand. The "fiscal cliff" issue is now being complicated by a "debt ceiling" debate all coinciding before the end of the year. The last debt ceiling debacle tipped the markets into a nasty 10% plunge over just a few short weeks. While hopes are high that the Republicans are going to be more conciliatory towards the Democratically controlled Senate and the President - historically precedent suggests that this is not likely to be the case. In otherwords, risks of further contraction, both in the economy and the markets, are high.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Net Export Prices And Wholesale Trade

Published 11/11/2012, 02:15 AM

Updated 02/15/2024, 03:10 AM

Net Export Prices And Wholesale Trade

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.