Nestle SA (OTC:NSRGY). is one of the largest companies in the world and the biggest food and drink producer by revenue. The company is headquartered in Switzerland and went public in 2001. The stock’s all-time low was reached in March 2003, when it fell to CHF 23.32 a share.

Seventeen years later now, Nestle stock is hovering around CHF 105, following an all-time high of CHF 113.20 in September 2019. The two major disruptions to Nestle’s uptrend occurred during the 2007-2009 Financial crisis and, of course, the COVID-19 crisis.

Nestle is a company investors are often comfortable holding no matter what. On the other hand, no trend lasts forever. In order to see what is left of its post-2003 rally, let’s examine it through the prism of the Elliott Wave principle.

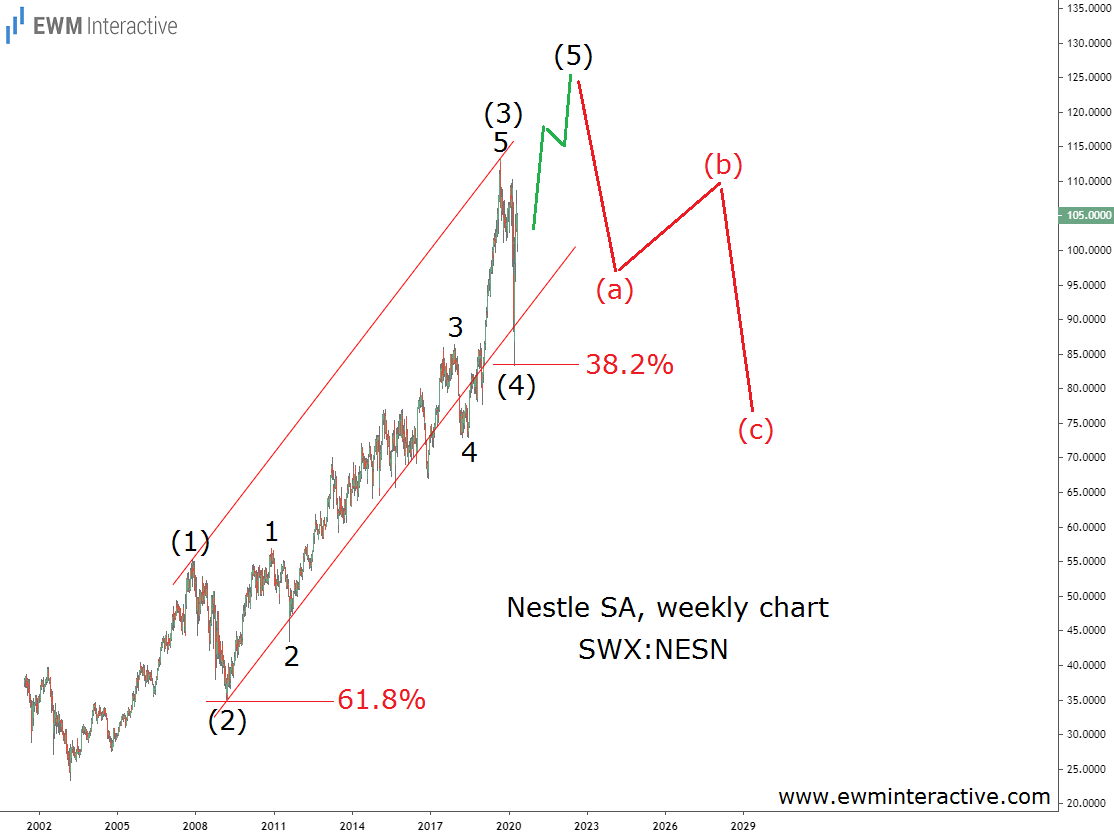

It turns out Nestle’s uptrend is an almost complete five-wave impulse. Almost, because the fifth wave appears to be still in progress. Waves (1) through (4) are already in place. The two corrections in (2) and (4) have retraced precisely 61.8% and 38.2% of waves (1) and (3), respectively.

If this count is correct, wave (5) should lift the price to a new record from here. Targets near CHF 130 seem plausible. Once there, however, the theory states that a three-wave correction in the opposite direction can be expected. Corrections usually erase the entire fifth wave. For Nestle, this translates into a decline to roughly CHF 80 a share. From CHF 130, this would be a ~38% drop. We’d rather observe it from a safe distance.