Roche’s decision not to develop rontalizumab, its IFNα monoclonal antibody, any further after completing Phase II trials in systemic lupus erythematosus (SLE) removes a key competitor for Neovacs', (ALNEV) IFNα-Kinoid. Roche achieved clinical proof of concept with its IFNα targeted approach, but the compound did not meet economic criteria and thus is removed from the competitive space. Meanwhile, Neovacs has initiated a Phase IIb trial with its lead product TNFα-Kinoid in rheumatoid arthritis (RA) while it seeks a partner. The ability to partner this drug, which has also been in Phase II for Crohn’s disease, is central to Neovacs’s investment case.

Less competition for IFNα-Kinoid

Roche has disclosed that rontalizumab, its humanised monoclonal antibody (mAb) to interferon-alpha (IFNα), would not be taken into Phase III trials, although it may be out-licensed. This was the first anti-IFNα mAb to reach Phase III, and helped to validate the IFNα targeting approach for lupus, including Neovacs’s IFNα-Kinoid. The removal of rontalizumab from the competitive space may make IFNα-Kinoid a more attractive asset to a potential partner.

Phase IIb trial in rheumatoid arthritis initiated

Neovacs has initiated a Phase IIb study of TNFα-Kinoid in 140 RA patients with inadequate response to methotrexate but who are anti-TNF naïve. This is designed to maintain the programme’s momentum while Neovacs seeks a partner. There are potentially significant commercial advantages to the Kinoid approach in this large, highly competitive therapeutic area, but it may be challenging to secure a partner. There are many novel biologicals in the space and the first anti-TNF biogeneric (infliximab) has just been launched, which may paradoxically help to emphasise the Kinoid’s low cost of goods advantage. Nevertheless, a large pharma licensing deal for TNFα-Kinoid would be a significant event and could prompt a share re-rating.

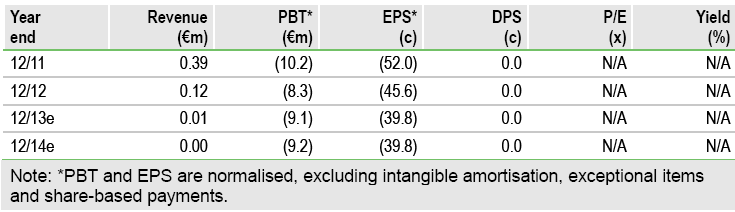

Financials: Funded to H114

Neovacs had cash of €8.3m at 30 June 2013, which should provide a sufficient runway to complete the Phase IIb RA trial.

Valuation: Risk-adjusted NPV of €101m

We maintain our risk-adjusted NPV of €101m, based on prudent assumptions of its two lead products’ probability of success in each indication, launch date, pricing and market penetration. Neovacs has a current market cap of c €33m and cash of €8.3m, resulting in an EV of €25m.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Neovacs: Ronta Exit Spells Good News

Published 10/17/2013, 06:25 AM

Updated 07/09/2023, 06:31 AM

Neovacs: Ronta Exit Spells Good News

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.