Neos Therapeutics, Inc. (NASDAQ:NEOS) announced that the FDA has approved its third attention deficit hyperactivity disorder ("ADHD") drug, Adzenys ER extended-release oral suspension in patients six years and older. The drug is approved as a once-daily treatment.

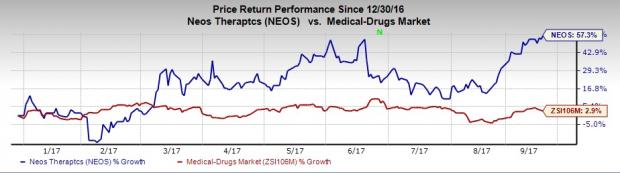

The company’s shares were up 2.2% on Friday after the announcement of the news. The stock has outperformed the industry so far this year. Neos Therapeutics’ shares have risen 57.3% whereas the industry rose 2.9% in the same period.

The FDA approval will give ADHD patients an option of different dosage form. The other products in the ADHD portfolio include Adzenys XR-ODT (Orally Disintegrating Tablets) and Cotempla XR-ODT.

Both Adzenys XR-ODT and Adzenys ER are prescription drugs, which stimulate the central nervous system ("CNS") for treating ADHD in patients six years and older. Cotempla XR-ODT is also a CNS stimulant, which treats ADHS in pediatric patients (6-17 years).

The company said that Adzenys XR-ODT, which was approved in January 2016, is the fastest growing alternative dosage form product for the treatment of ADHD.

The company expects to launch the drug in the first half of 2018.

We note that both dosage forms of Adzenys are a bioequivalent form of Shire plc’s (NASDAQ:SHPG) Adderall XR. We remind investors that Shire is a market leader in the ADHD segment and received approval for its new ADHD drug, Mydayis in June.

Adzenys XR-ODT recorded sales of $7.3 million in the first half of 2017, registering sequential growth of 35.5% in the second quarter of 2017.

The ADHD space is one of the largest and fastest growing segments of the market. There are many drugs available for the indication including Johnson & Johnson’s (NYSE:JNJ) Concerta and Pfizer Inc.’s (NYSE:PFE) Quillivant.

Neos Therapeutics has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Pfizer, Inc. (PFE): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Shire PLC (SHPG): Free Stock Analysis Report

Neos Therapeutics, Inc. (NEOS): Free Stock Analysis Report

Original post

Zacks Investment Research