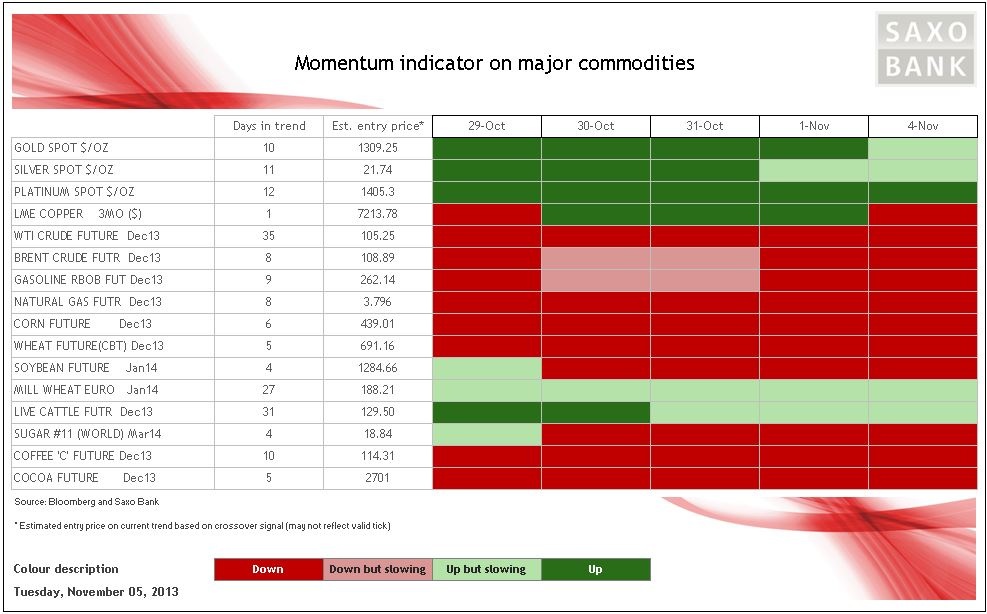

Commodities in general continue to find little to cheer about at the moment and this is reflected in our momentum indicator with just three out of 16 commodities holding onto positive momentum. Seasonal slow demand for oil, increased supply of agricultural commodities at a time of tepid growth are some of the current negative drivers. In addition, some renewed dollar strength means that even the metal sector has succumbed to profit taking while we await news from the European Central Bank on Thursday and the US job market on Friday.

The metal sector was supported up until last week by speculation that tapering in the US would be further delayed together with the weakening US dollar. Both of these supports have since then been removed, meaning that copper turned negative and silver may follow suit today. Overall, the sector remains range bound with the range in December copper in particular continuing to narrow with support currently at cents 324.5 per pound being threatened.

The energy sector is a sea of red with WTI crude having shown negative momentum for 35 days since it broke USD 105.25/barrel. Brent crude has seen a significant amount of speculative long liquidation during October which leaves it better positioned to react to price friendly news such as continued supply disruptions in Libya. While supply disruptions remain, the area below USD 106 should provide enough support to retain the price between within its established range which currently offer resistance at USD 110/barrel.

Natural gas is suffering from the outlook for mild November weather which may limit the demand for heating and at the same time increase inventories which are currently above the five-year average. After the gap down in price yesterday and the subsequent move lower the price for December delivery has now move into oversold territory which may halt the slide. The current price of 3.4 is the lowest seasonal price for this time of year since 2008 reflecting the continued strong rise in production together with seasonally higher temperatures.

All three softs — cocoa, coffee and sugar — have been under some selling pressure the past couple of weeks. Coffee has seen selling accelerate with double digit losses seen this past month. The price has dropped to the lowest since 2008 on speculation that Brazil, the worlds largest producer, will see a strong rise in production into 2014 leading to a substantial global surplus. Cocoa and sugar meanwhile have both run into profit taking after a recent strong surge. The bullish story for cocoa remains intact while sugar has to deal with a speculative run up in net-longs which in just two months reached a near record on October 22. Since then the price has dropped by six percent as fundamental news from China (importer) and Brazil (exporter) has become less supportive.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Negative Momentum Taking Hold In Key Commodities

Published 11/05/2013, 07:03 AM

Updated 03/19/2019, 04:00 AM

Negative Momentum Taking Hold In Key Commodities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.