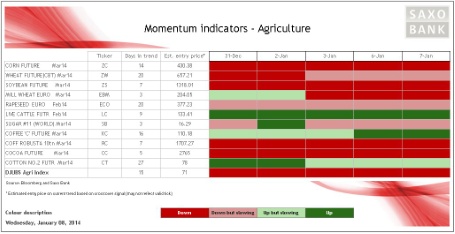

The agriculture sector begins 2014 as the most unwanted of the three major commodity sectors. Using our short-term indicators we currently see negative momentum engulfing the majority of those tracked in this update following a year where focus switched to ample supply from worries about shrinking inventories.

The grain sector is currently the least wanted with hedge funds holding net-short positions in this sector primarily driven by bearish positioning in CBOT Corn and Wheat while soybeans, although much reduced in recent weeks, still hang onto a sizable net-long position. The USDA will release its estimates for global grain supply and demand on Friday together with its final estimates for US crop production for the current 2013/14 season.

The soft sector is also predominantly showing negative momentum, not least sugar which is now once again trading at a 36-month low after a failed upside attempt during the last couple of weeks in December. Coffee and cotton are two of the few positive stories at the moment. Cotton has been supported by continued buying from the China National Cotton Reserves Corporation which now holds around 60 percent of global stocks, according to Reuters. Against this, US farmers are expected to increase planting this spring, not least as a result of current high prices compared with other crops.

CBOT Corn has spent the past couple of months stabilising in an ever-decreasing range between 417 and 432 cents per bushel. Currently the momentum remains negative, but could begin to slow as the cold weather across the US stalls grain movement and increases demand for livestock feed. Index rebalancing and short-covering from hedge funds may lend some support ahead of the USDA report on Friday. A break above the 432 cents level may, at least short term, signal some additional upside.

CBOT Wheat has shown negative momentum for the past 20 trading days but just like corn it has received some support from the US winter which has raised the risk of winter-kill damage to the crops across the US Midwest. The mild winter in Europe and the Black Sea area have countered this fear as the winter crop there is currently in a good condition. A technical bounce from the 600 cents per bushel area could be on the cards but sell stops will not be far away should a new low below 596 be reached.

Coffee has kicked off 2014 with a bout of technical short covering with the market jumping by more than 10 cents over the past week thereby adding further support to the positive momentum of the past 16 days. Ample near-term supply is making further gains hard to come by, but further out the industry is contemplating a potential disappointment in terms of production out of Brazil, the world's largest producer. Support has also come from the fact that Hedge Funds were short 8,417 futures contracts on December 31 combined with buying triggered by the annual index re-balancing of both the DJ-UBS and S&P GSCI Indexes.

Live Cattle futures for February delivery has reached overbought territory after catching up with strong price action in the cash market. The driver behind the latest move higher has been the coldest US winter in 20 years which has reduced the potential weight gain for cattle in the fields as they use more energy to stay alive. This has triggered strong demand from buyers who worry that supply will decline into January. Improved weather now carries the risk of a retracement but overall momentum looks pretty solid.