Over the past week the most telling signals came from sentiment and our risk indicators. As the market traded sideways negative sentiment continued to build, but at the same time our risk indicators are showing a total lack of fear. This is the same pattern as we saw from February through April this year where the market continued to move higher, but in a choppy fashion. Thursday and Friday painted back to back +1% days in opposite directions which is a sign of indecision by market participants. If the trend continues into next week it will provide warning of instability.

Mid week our core market health indicators all showed a lot of weakness, however Friday corrected the damage indicating that buyers moved in force on the dip. As a result, we didn’t make any changes to our core portfolios.

Our Twitter Sentiment indicator for the S&P 500 Index (SPX) issued a consolidation warning at the close on Thursday. Smoothed sentiment had been diverging from price since mid October and weakened enough to break the prevailing up trend line and also fell below zero. This warning comes behind signals from both small cap stocks (RUT) and the Nasdaq 100 (NDX) which adds to my concern that this could be the start of a larger correction. If sentiment for RUT and NDX can clear their warnings in the next few days it will be a good sign indicating that the recent weakness was merely some profit taking and rotation instead of the beginnings of an intermediate term down trend.

One thing of note is that Thursday’s decline brought the bears out in force. The volume and intensity of bearish tweets spiked by over 60% while the bullish intensity remained flat. The pattern persisted into Friday even as the market rallied strongly. From 11:00 Eastern until the close the bullish tweets barely outnumbered the bearish ones. This indicates that the bulls aren’t throwing in the towel while the bears are trying to press the market lower. The current battle consists of committed bulls and newly energized bears.

The battle between the bulls and bears is occurring in a tight range. Price is moving between 1740 and 1775 on SPX with the majority of tweets at the same levels. A break from either side of the range will most likely point the next direction for the market. More resistance comes in at 1800 and further support is at 1730 and 1700.

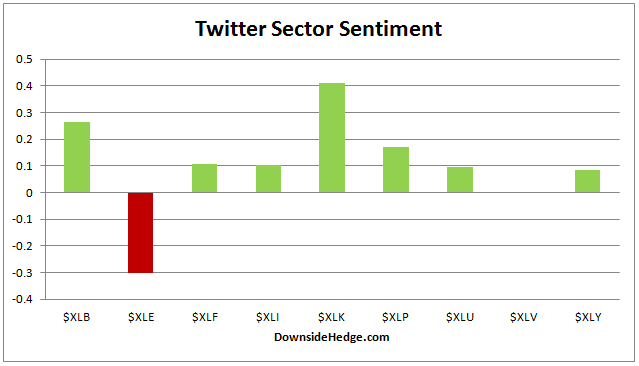

Sector sentiment continues to paint the same pattern indicating rotation to defensive sectors and a likely short term top. However, I did notice that on Friday the pattern reversed sharply. The rally came from financials and other leading sectors. This is our first sign that the market may break higher from here.

From a sentiment perspective the bears have scored a short term victory by pushing RUT, NDX, and SPX into consolidation warnings. However, their efforts on price have only damaged RUT. I’ll need to see price on SPX confirm the move in sentiment to get overly concerned. I’ll be watching the range between 1740 and 1775…and how sentiment reacts to any break.

Conclusion

The bears have come out in force pushing sentiment lower, but the bulls are still committed and showing no fear. Our market health indicators are sitting near inflection points that could resolve in either direction. The bulls and bears are fighting a battle in a tight range. That makes the range the most important factor. A break below 1740 on SPX will most likely drag our health indicators with it resulting in raising more cash and adding hedges. While a break above 1775 could carry higher than anyone expects.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Negative Market Sentiment, Without Fear

Published 11/10/2013, 04:17 AM

Updated 07/09/2023, 06:31 AM

Negative Market Sentiment, Without Fear

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.