Despite headwinds of potential contagion emanating from Europe and the possibility of a slowdown in U.S. economic growth, corporate bond yields and the incremental return over U.S. Treasuries, aka spreads, have compressed and continue to remain low in recent months. This has led to tremendous performance gains for the asset class. These gains have been driven primarily by strong inflows as investors who have grown weary of the uncertainty stemming from the economic and political environment, reach for that last drop of yield.

Having said this, let’s not assume that all is well in corporate bond land. The fact is that second quarter earnings season was quite disappointing for Wall Street analysts. As we talked about before, analyst downgrades and falling optimism can lead to weakness in risk assets which should not bode well for both corporate bonds (from a spread standpoint, that is) and equity prices.

While the weakness in earnings have yet to show up in the fundamental channel of corporate bond valuations due to the overwhelming demand for the asset class, corporate bond fund managers have taken note apparently and have adjusted their positions.

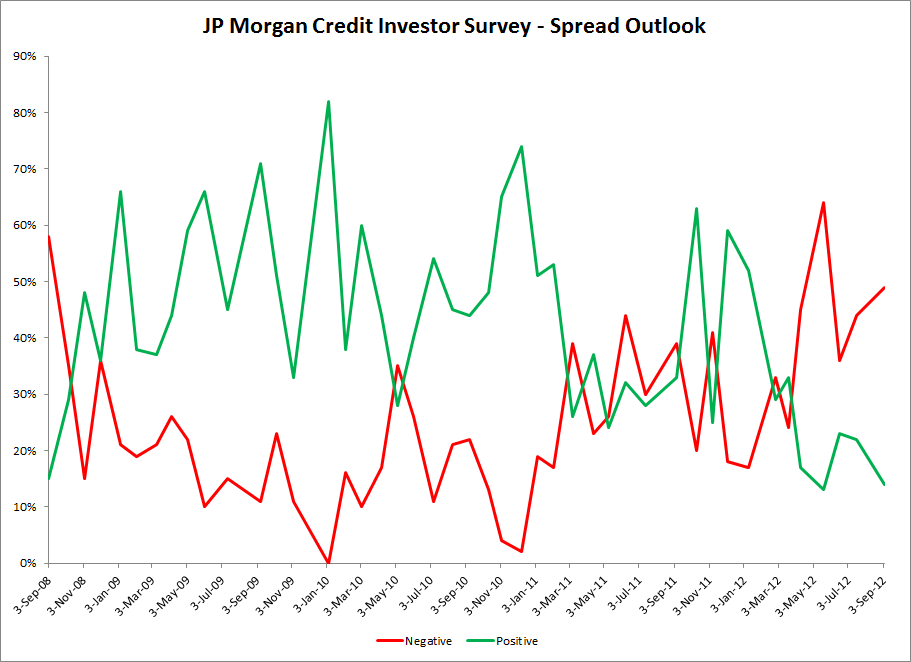

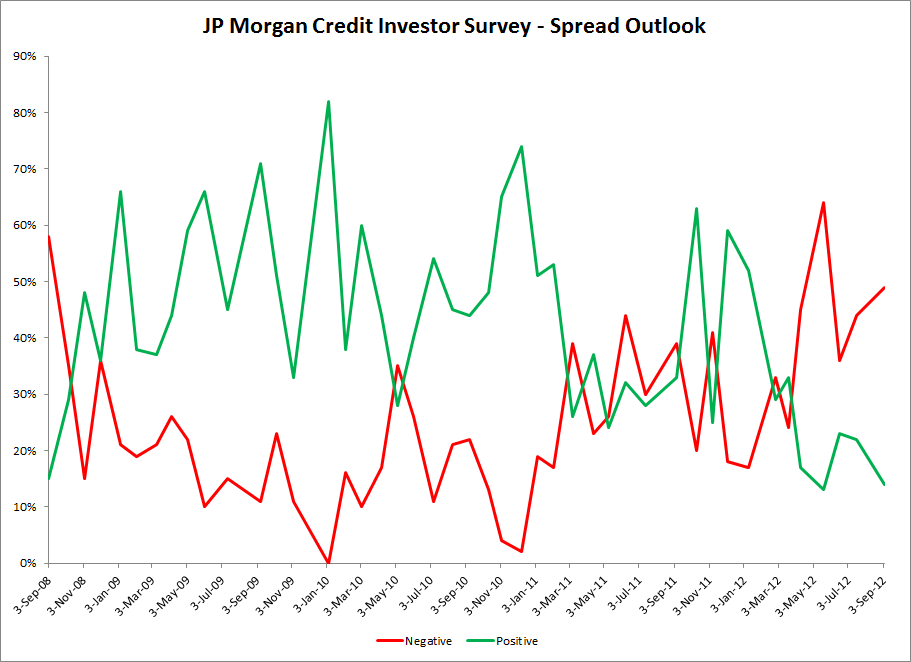

Based off of JP Morgan’s monthly Credit Investor Survey, corporate bond managers have turned more bearish. Of all the corporate investors surveyed, 49% are negative on investment grade spreads. Given the 41% that were bearish on spreads in July, this is quite a turnaround from the recent low set in June when the amount of bears stood at 36%. In addition, the September data is above the one year average of 39% for credit investors in the bearish camp.

As a result of this sentiment, investors have either underweighted their corporate bond holdings or gone neutral in risk exposure, relative to their benchmarks. The number of investors who are underweight stands at 12% in September, up from 5% in July. 77% of investors are neutral, which is an increase by 10% from the previous reported period.

Conversely, only 14% are positive on spreads and believe that they will tighten, down from 22% and 23% in July and June, respectively. Unfortunately, spreads have been tightening all throughout the summer months which have led to credit investors being wrong up to this point.

That said, spreads continue to hover near historical lows which suggests the richness of the asset class. In addition, with profit margins compressing for businesses coupled with event risk and the uncertainty that accompanies it, i.e. the Fiscal Cliff, spreads could widen as we move closer toward the end of the year. If that is indeed the case, corporate investors who are currently underweight with their bearish bias may ultimately be right.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

Having said this, let’s not assume that all is well in corporate bond land. The fact is that second quarter earnings season was quite disappointing for Wall Street analysts. As we talked about before, analyst downgrades and falling optimism can lead to weakness in risk assets which should not bode well for both corporate bonds (from a spread standpoint, that is) and equity prices.

While the weakness in earnings have yet to show up in the fundamental channel of corporate bond valuations due to the overwhelming demand for the asset class, corporate bond fund managers have taken note apparently and have adjusted their positions.

Based off of JP Morgan’s monthly Credit Investor Survey, corporate bond managers have turned more bearish. Of all the corporate investors surveyed, 49% are negative on investment grade spreads. Given the 41% that were bearish on spreads in July, this is quite a turnaround from the recent low set in June when the amount of bears stood at 36%. In addition, the September data is above the one year average of 39% for credit investors in the bearish camp.

As a result of this sentiment, investors have either underweighted their corporate bond holdings or gone neutral in risk exposure, relative to their benchmarks. The number of investors who are underweight stands at 12% in September, up from 5% in July. 77% of investors are neutral, which is an increase by 10% from the previous reported period.

Conversely, only 14% are positive on spreads and believe that they will tighten, down from 22% and 23% in July and June, respectively. Unfortunately, spreads have been tightening all throughout the summer months which have led to credit investors being wrong up to this point.

That said, spreads continue to hover near historical lows which suggests the richness of the asset class. In addition, with profit margins compressing for businesses coupled with event risk and the uncertainty that accompanies it, i.e. the Fiscal Cliff, spreads could widen as we move closer toward the end of the year. If that is indeed the case, corporate investors who are currently underweight with their bearish bias may ultimately be right.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.