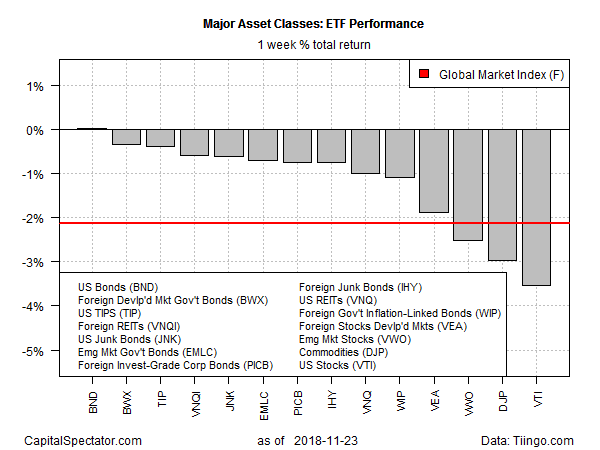

US investment-grade bonds were the exception, courtesy of a flat performance. Otherwise, the rest of the major asset classes fell last week during a wave of selling, based on a set of exchange-traded products.

The outlier: Vanguard Total Bond Market (NYSE:BND), which was essentially flat by the close of trading for the week through Nov. 23. The ETF, which holds a broad set of government and corporate fixed-income securities, has been in a tight trading range since early October.

US stocks posted last week’s biggest setback for the major asset classes. Vanguard Total Stock Market (NYSE:VTI) tumbled 3.5%, marking the fund’s second straight weekly loss.

Investors are looking for some relief in today’s session. US equity futures are up sharply in early trading today, offering a sign that prices may rebound following the worst Thanksgiving trading week since 2011.

“I don’t think the bull run is over but I think we’re close to the end of the cycle,” said Mark Esposito, CEO of Esposito Securities, on Friday. “It feels a bit unsafe,” he commented, citing softer earnings growth, higher market volatility and a downshift in economic output.

Last week’s downside bias weighed on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights tumbled 2.1% — the second straight weekly decline for the index.

Turning to the one-year return, only US stocks are posting a gain at the moment. Vanguard Total Stock Market (VTI) closed on Friday with a modest 2.8% total return for the trailing 12-month period – the only positive comparison for the major asset classes for this time horizon.

The rest of the field is under water for one-year changes. The biggest loss is in emerging market stocks. Vanguard FTSE Emerging Markets (NYSE:VWO)has shed 13.6% over the past year.

GMI.F was also in the red at last week’s close vs. the year-earlier level via a 2.3% loss.

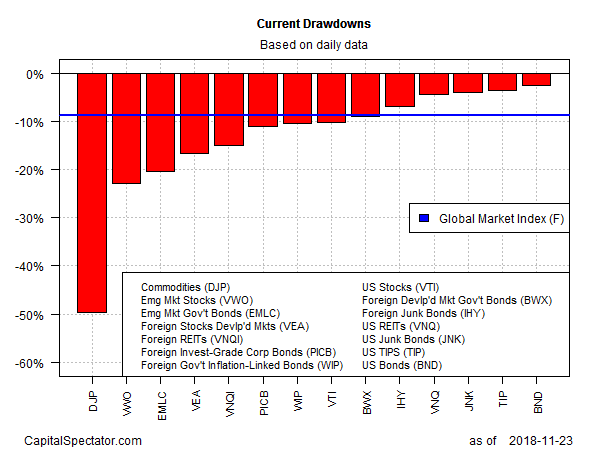

For drawdown, US investment-grade bonds enjoy the distinction of posting the smallest peak-to-trough slide for the major asset classes at the end of trading last week. Vanguard Total Bond Market (BND) is currently 2.5% below its previous peak.

Broadly defined commodities are still posting the steepest slide from the previous peak. The drawdown for the iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) is nearly -50%.

GMI.F’s current drawdown is a relatively moderate -8.8% at the moment.