Key Points:

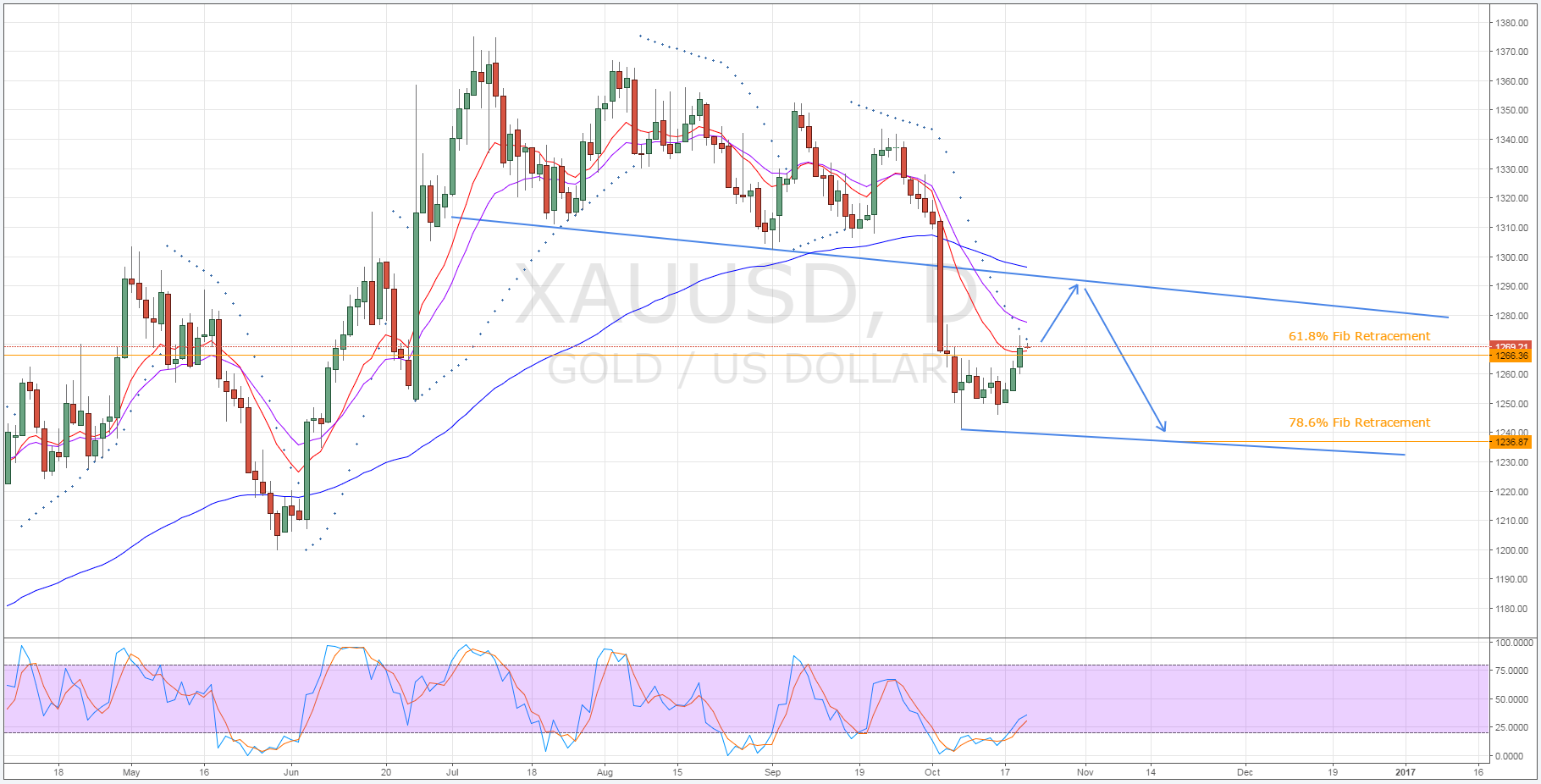

- Gold has recently broken through the 61.8% Fibonacci level.

- Parabolic SAR ready to reverse its bias.

- Long-term bias remains bearish for the metal.

Whilst the medium to long-term bias remains somewhat bearish for gold, the metal could be setting up for a fairly sizable rally in the near-term before resuming its downtrend. Of course, this might seem a bit of a stretch given the relentless bearish EMA activity. However, a closer look at some of the other technicals reveals that the metal could move against the prevailing trend for a short while.

Firstly, as is made clear on the daily chart, gold has moved above the 61.8% Fibonacci retracement which should limit downside risk in the near-term. This price has historically proven itself to be a turning point and, as a result, any attempts to push the metal lower should be thwarted by the strong support around this level.

Additionally, gold is now on the cusp of seeing its parabolic SAR reading swap from bearish to bullish. As a result of this, buying pressure will begin to mount and this could represent the start of a new upswing.

However, whilst we are expecting the metal to begin trending higher over the proceeding sessions, it is currently unlikely that we see gold back above the $1292.72 mark. This is largely a result of the resistance that will be encountered as the commodity comes into conflict with the downside constraint of the old bearish channel. Moreover, as it approaches this level, the 100 day EMA will be supplying some strong dynamic resistance which should spark a reversal and subsequent decline.

After moving into this bearish phase, gold should travel as low as the 78.6% Fibonacci level before the downtrend runs out of momentum. What’s more, if the metal does reverse here, it will confirm the lower boundary of a new bearish channel structure with roughly the same negative gradient as the preceding channel. As a result of this channel, the medium to long-term bias for the metal will remain bearish as it traverses between the upper and lower constraints in a range bound fashion.

Ultimately, fundamentals will have a significant impact on gold prices in the coming days and should not be forgotten. Namely, the US Unemployment Claims, Philadelphia Federal Manufacturing Index, and Existing Home Sales results are all due and weakness in the figures should give a boost to the metal. However, also keep an eye on remarks made by FOMC members as any hints about the probability of a near-term rate hike could also see gold jawboned lower.