The market was positioned for a more dovish Reserve Bank of New Zealand from the looks of things last night, as governor Graeme Wheeler and co hiked rates 25 basis points to 3.25 per cent and maintained its forecasts for the forward rate path, suggesting that the bank will hike another two times this year.

The NZ 2-year bond rate leaped 10 basis points and the NZD pulled sharply higher across the board, smashing the AUD/NZD back down through support and lifting the NZD/USD a full figure higher to its highest level since mid May. Wheeler said that inflation expectations must be contained and that interest rates return to a more neutral level. The rhetoric on the exchange rate in the statement was not particularly alarmist, as the bank expects the exchange rate to moderate with lower commodity prices.

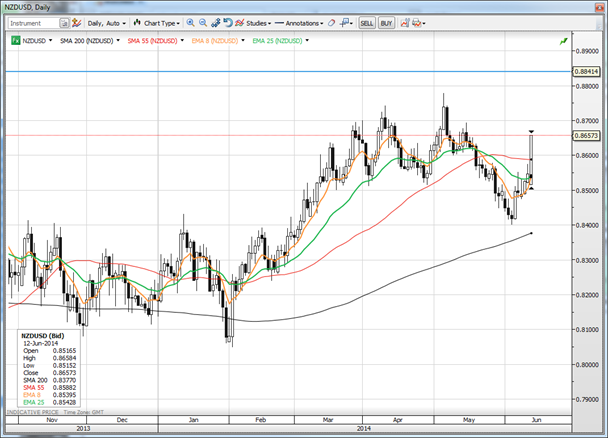

NZD/USD

The NZD roared higher as the RBNZ’s message failed to discourage carry traders and as New Zealand’s rates at the front end of the curve jumped higher in anticipation of more rate hikes in the pipeline. Note the blue line at 0.8841, which is the 2011 high (and 33-year high) for the pair.

Australia’s jobs report was a disappointment, with slightly negative payroll growth relative to the modest growth expected, although the market’s reaction was relatively muted. The glass half-full data was a strong growth in the full time employment number, though the data series for this measure is highly erratic. The unemployment rate remained unchanged. A story from Bloomberg suggests the Bank of Japan (BoJ) will maintain a large balance sheet and roll over expiring securities into new purchases of long-term government bonds for the fore seeable future. This comes ahead of tomorrow’s BoJ policy decision and statement, where no new developments are expected. Yesterday saw JPY crosses pushing lower, though some of that move was consolidated overnight. Their next direction is likely more about the direction in bond yields and asset markets (a sharp drop in the latter with a rally in the former is the most likely scenario to support the JPY). Most are standing aside as JPY crosses have been mostly range-bound for several months. GBP jumped sharply yesterday on the very positive employment data, but the response in the forward rates was rather muted, and the two-year interest rate spread between the UK and the US Is actually near a four-week low, suggesting no support for a rally. Perhaps the market is concerned, like Mark Gilbert, with low wage inflation? Crude oil prices remain very elevated on the developments in Iraq, where the ISIL insurgency has taken over large swaths of the country. This has helped to keep CAD on the bid, and the AUD/CAD is showing signs of rally exhaustion. I prefer that pair much lower in the coming months.

Looking ahead In Europe this morning, SEK traders will be anticipating the final Swedish CPI number ahead of the July 3 Riksbank meeting. The EUR/SEK has been churning between in the 9.00/12 range for two weeks now. Today we have the latest batch of US retail sales data after some wild swings in the numbers of previous months. This, together with next Tuesday’s May CPI and Housing Starts and Building Permits data are the final major data inputs ahead of the Federal Open Markets Committee meeting next Wednesday. Look out for the Bank of Canada’s “Financial System Review” for hints of its attitude on its policy trajectory. I’m wondering longer term - given the leverage in the Canadian economy and potential for a deflation threat once asset prices decline - if the risk is eventually that the Bank of Canada moves toward some form of QE or other non-traditional policy mix. Far too early for this, but let’s see what Stephen Poloz and company have up their collective sleeve, as 45 minutes after the review is published, Poloz will be holding a press conference.

Economic Data Highlights

- New Zealand RBNZ hiked the Official Cash Rate 25 bps to 3.25 per cent as expected

- UK May RICS House Price Balance out at 57 per cent v 52 per cent expected and 55 per cent in April.

- Japan April Machine Orders out at -9.1 per cent month-on-month and 17.6 percent year on year vs. -10.8 per cent/13.3 percent expected, respectively and versus 16.1 percent year-on-year in March.

- Australia May Employment Change out at -4.8k vs. +10k expected and +10.3k in April.

Upcoming Economic Calendar Highlights (all times GMT)

- Sweden May CPI (0730)

- Sweden May Average House Prices (0730)

- Euro Zone ECB Publishes Monthly report (0800)

- Euro Zone Apr. Industrial Production (0900)

- Poland May CPI (1000)

- US Weekly Initial Jobless Claims (1230)

- US May Retail Sales (1230)

- Canada May Teranet/National Bank Home Price Index (1300)

- US Weekly Bloomberg Consumer Comfort Survey (1345)

- US Apr. Business Inventories (1400)

- Canada Bank of Canada publishes Financial System Review (1430)

- Bank of Canada Governor Poloz to hold press conference (1515)

- UK Bank of England’s Carney, Chancellor Osborne to speak (1800)

- New Zealand May Business NZ Manufacturing PMI (2230)

- Japan Bank of Japan announcement (no time given)

- Japan Bank of Japan’s Kuroda to hold press conference (0600)